Product Description

In 2021, the U.S. ventilator market size is projected to reach $811 million, with the sub-acute care ventilators showing the most sustainable growth. Due to COVID19, the U.S. market size is expected to grow over the forecast period to reach over $866 million in 2027.

The overall U.S. ventilator market grew significantly in 2020, due to the increased number of patients requiring respiratory support from COVID-19 complications. The acute care and emergency transport segments saw the most pronounced growth, while home care and neonatal ventilators took small steps backwards in 2020. Due to the abnormally high sales numbers and the influx of ventilators into the market, the market is expected to decrease significantly in 2021 and again in 2022.

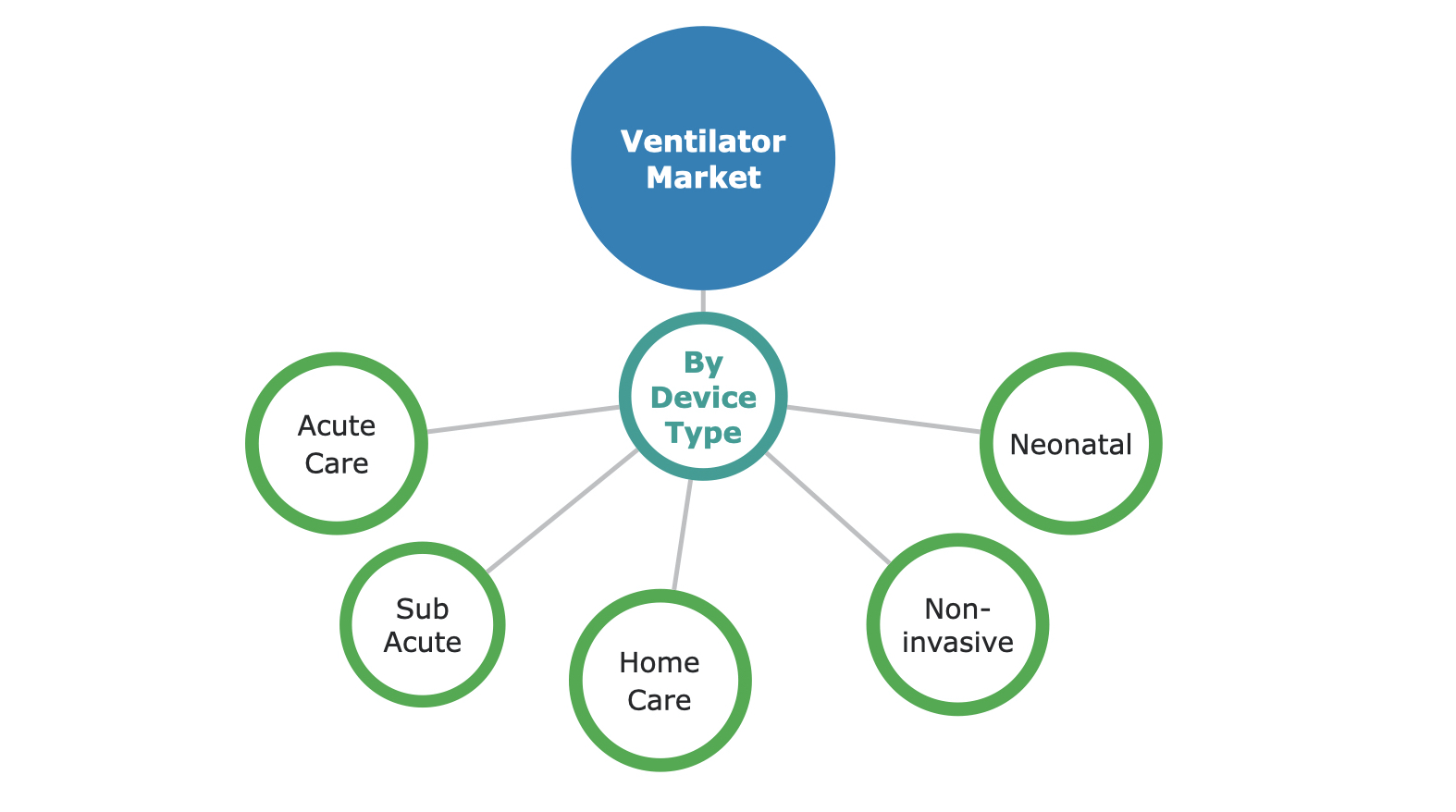

The U.S. ventilator market can be segmented by the device’s level of sophistication and location of use. The six categories are acute care ventilators, sub-acute care ventilators, home care ventilators, neonatal ventilators, non-invasive ventilators, and emergency transport ventilators. These products are tailored to meet the needs of different age groups or individuals with specific physiological limitations.

European Ventilator Market insights

In 2021, the European ventilator market size is projected to reach €168 million, with the majority of the market experiencing steady growth after the surge in demand due to COVID19. The European market size is expected to grow over the forecast period to reach over €174 million in 2027.

2020 was a year of unprecedented growth in the European ventilation market, due entirely to the COVID-19 pandemic. The acute care ventilator segment represented nearly half of the total market. Non-invasive ventilators are expected to become increasingly prevalent in this market space in future years. Similar to the U.S., the EU ventilator market is expected to correct itself in the years following the pandemic, due to the massive over-purchase of supply in 2020.

Top Ventilator Companies in the U.S. & Europe

In the U.S., Philips is a leading competitor within the ventilator market. The company offers sub-acute, home care, and non-invasive ventilators, with particularly strong shares in the home care and non-invasive ventilation segments. Its V60™ ventilator is the company’s gold standard, a hospital dedicated, non-invasive ventilator system.

In Europe, the leading competitor in the ventilator market is Drӓger. The company offers a variety of devices in many of its market segments. Specifically, Dräger’s Evita® is a universal ventilator that incorporates invasive and non-invasive ventilation parameters, offering flexibility for clinicians that increasingly want to move patients to non-invasive ventilation to improve recovery times. These devices have an advanced software suite that allows the user to choose various representations of the appropriate data.

Top Ventilator Companies Analyzed

|

- Aire Liquide

- AirLife

- BOMImed

- Breas

- Bunnell

- Drager

- EMT Medical

- eVent

- Fisher & Paykel

- GE Healthcare

- Getinge

- Hamilton

|

- Hoffrichter GmbH

- Medtronic

- Percussionaire

- Philips

- ResMed

- Sechrist

- SIARE

- SLE Ltd

- Stephan GmbH

- VyAire

- Zoll

|

Research Scope Summary

| Report Attribute |

Details |

| Regions |

United States, Germany, France, U.K., Italy, Spain, Benelux (Belgium, Netherlands, Luxembourg), Scandinavia (Norway, Finland, Sweden, Denmark), Switzerland, Austria, Portugal. |

| Base Year |

2020 |

| Forecast |

2021-2027 |

| Historical Data |

2017-2020 |

| Quantitative Coverage |

Market Size, Market Shares, Market Forecasts, Market Growth Rates, Units Sold, and Average Selling Prices. |

| Qualitative Coverage |

COVID19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios, FDA Recalls, Disruptive Technologies, Disease Overviews. |

| Data Sources |

Primary Interviews with Industry Leaders, Government Physician Data, Regulatory Data, Hospital Private Data, Import & Export Data, iData Research Internal Database. |

Market Segmentation Summary

CONTACT US FOR ADDITIONAL INFORMATION

For full segmentation and any questions regarding research coverage, please contact us for a complimentary demo of the full report.

FREE Sample Report

For a complete Table of Contents, please

Contact iData Research.

UNITED STATES TABLE OF CONTENTS

LIST OF FIGURES XLIST OF CHARTS XIIEXECUTIVE SUMMARY 1U.S. ANESTHESIA, RESPIRATORY AND SLEEP MANAGEMENT DEVICE MARKET OVERVIEW 1COMPETITIVE ANALYSIS 4MARKET TRENDS 7MARKET DEVELOPMENTS 10MARKETS INCLUDED 12KEY REPORT UPDATES 17VERSION HISTORY 17RESEARCH METHODOLOGY 18Step 1: Project Initiation & Team Selection 18Step 2: Prepare Data Systems and Perform Secondary Research 21Step 3: Preparation for Interviews & Questionnaire Design 23Step 4: Performing Primary Research 24Step 5: Research Analysis: Establishing Baseline Estimates 26Step 6: Market Forecast and Analysis 27Step 7: Identify Strategic Opportunities 29Step 8: Final Review and Market Release 30Step 9: Customer Feedback and Market Monitoring 31

DISEASE OVERVIEW

2.1 BASIC ANATOMY 322.1.1 Respiratory System 322.2 DISEASE TREATMENTS & DIAGNOSTICS 332.2.1 Chronic Obstructive Pulmonary Disease 332.2.2 Sleep Apnea 332.2.2.1 OSA 342.3 PATIENT DEMOGRAPHICS 352.3.1 COPD Incidence 352.3.2 OSA Incidence 35

VENTILATOR MARKET

3.1 INTRODUCTION 363.1.1 Acute-Care Ventilators 363.1.2 Sub-Acute Ventilators 363.1.3 Home Care Ventilators 373.1.4 Neonatal Ventilators 373.1.5 Non-Invasive Ventilators 383.2 MARKET OVERVIEW 393.3 MARKET ANALYSIS AND FORECAST 443.3.1 Acute Care Ventilator Market 443.3.2 Sub-Acute Ventilator Market 463.3.3 Home Care Ventilator Market 483.3.4 Neonatal Ventilator Market 503.3.5 Emergency Transport Ventilator Market 54

3.3.6 Non-Invasive Ventilator Market 563.4 DRIVERS AND LIMITERS 583.4.1 Market Drivers 583.4.2 Market Limiters 593.5 COMPETITIVE MARKET SHARE ANALYSIS 61

ABBREVIATIONS

iData’s 9-Step Research Methodology

Our reports follow an in-depth 9-step methodology which focuses on the following research systems:

- Original primary research that consists of the most up-to-date market data

- Strong foundation of quantitative and qualitative research

- Focused on the needs and strategic challenges of the industry participants

Step 1: Project Initiation & Team Selection During this preliminary investigation, all staff members involved in the industry discusses the topic in detail.

Step 2: Prepare Data Systems and Perform Secondary Research The first task of the research team is to prepare for the data collection process: Filing systems and relational databases are developed as needed.

Step 3: Preparation for Interviews & Questionnaire Design The core of all iData research reports is primary market research. Interviews with industry insiders represent the single most reliable way to obtain accurate, current data about market conditions, trends, threats and opportunities.

Step 4: Performing Primary Research At this stage, interviews are performed using contacts and information acquired in the secondary research phase.

Step 5: Research Analysis: Establishing Baseline Estimates Following the completion of the primary research phase, the collected information must be synthesized into an accurate view of the market status. The most important question is the current state of the market.

Step 6: Market Forecast and Analysis iData Research uses a proprietary method to combine statistical data and opinions of industry experts to forecast future market values.

Step 7: Identify Strategic Opportunities iData analysts identify in broad terms why some companies are gaining or losing share within a given market segment.

Step 8: Final Review and Market Release An integral part of the iData research methodology is a built-in philosophy of quality control and continuing improvement is integral to the iData philosophy.

Step 9: Customer Feedback and Market Monitoring iData philosophy of continuous improvement requires that reports and consulting projects be monitored after release for customer feedback and market accuracy.

Click Here to Read More About Our Methodology