Product Description

This Global Report Series represents iData’s entire collection of country-level reports in the Global Dental Bone Graft Substitute market. Each of these reports may be purchased as a stand-alone report, tailoring the data to your needs. The covered countries are listed below, including the report’s publication year:

US Dental Bone Graft Substitutes Market

In 2021, the US dental bone graft substitutes (DBGS) market size is expected to reach $390 million, with the Allograft market showing the fastest growth. Despite COVID19, the US market size is expected to increase over the forecast period to exceed $540 million in 2027. Over 40% of the dental bone graft substitutes market share in the US was dominated by three main competitors – Geistlich, Zimmer Biomet, and ACE Surgical.

Dental bone graft substitutes market growth in the US will be driven by continued technological developments that allow companies to introduce new products with innovations to increase the ease of use and patient comfort. This research takes a closer look at new product launches, specifically in the innovation-rich segments like the barrier membrane market, to understand the impact on the Average Selling Prices (ASPs) and the overall market value.

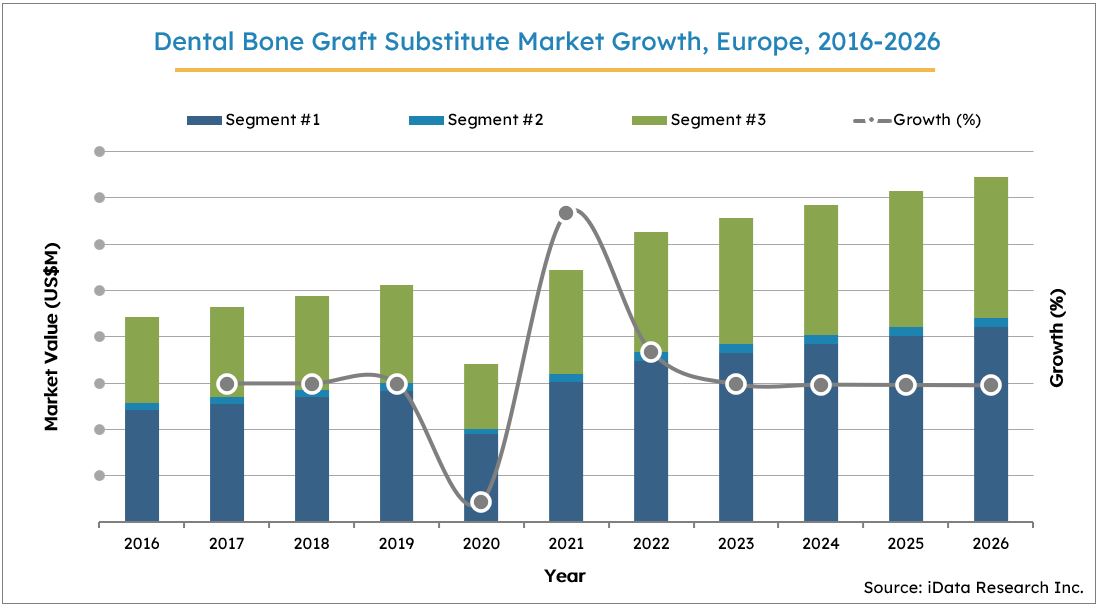

Europe Dental Bone Graft Substitutes Market

In 2021, the EU dental bone graft substitutes market size is projected to reach $272 million, which is a recovery of over 30% when compared to 2020. Despite COVID19, the EU market size is expected to increase over the forecast period to exceed $372 million in 2027. Currently, over 40% of the dental bone graft substitutes market share in Europe is dominated by two main competitors – Geistlich and Botiss Biomaterials.

The growing number of GPs placing implants is driving the European market for dental bone graft substitutes forward by increasing the volume of dental implant procedures. The growing number of GPs placing implants increases the probability that a patient is informed on the importance of having a sufficient level of bone in their jaw before the procedure. Ultimately, this will result in a greater number of patient referrals to specialists for dental regenerative procedures that incorporate dental biomaterials.

Asia Pacific Dental Bone Graft Substitutes Market

In 2021, the Asia Pacific dental bone graft substitutes market size is projected to reach $295 million, which the Chinese market showing the most promising growth. Despite COVID19, the Asia Pacific market size is expected to increase over the forecast period to exceed $667 million in 2027.

An ongoing trend within the South Korean and Indian markets for dental bone graft substitutes is the increasing market share of dental barrier membranes. In these markets, dental barrier membranes have yet to achieve similar market penetration as other developed dental markets, such as the United States. Given the high rate of dental implants placed in South Korea and India, the dental barrier membrane market is poised to experience significant growth over the forecast period.

In the Japan and Australian markets, a major limiter preventing market growth in the dental bone graft substitute and other biomaterials market is the strict regulatory environment. This largely limits competition and the products available to these markets. As a result of limited products, patients may instead opt to travel to other regions of the world to undergo a DBGS procedure.

Latin America Dental Bone Graft Substitutes Market

In 2021, the Latin America dental bone graft substitutes market size is projected to reach $72 million, which the Brazilian market showing the most promising growth. Despite COVID19, the Latin American market size is expected to increase over the forecast period to exceed $161 million in 2027.

The Mexican dental bone graft substitute market growth will be driven by continued technological developments that allow companies to introduce new products with innovations to increase the ease of use and patient comfort. New product launches have the effect of expanding a company’s product mix and capture more of the market while maintaining a steady or growing ASP in innovation-rich segments like the barrier membrane market, leading to a higher market value overall.

In the Argentinian market, dental professionals have made attempts to reduce the risk of contamination and spread of disease in bone grafting procedures. As tissue banks have gained complete control of the allograft market, they have been able to set certain rules and standards regarding these products. In hopes of reducing the spread of disease through implantation treatments, tissue banks have implemented intense laws and regulations in the use of allograft materials that prevent retailers from selling them on the market.

Global Dental Bone Graft Substitutes Market Share Insights

Geistlich is a clear leader in the dental bone graft substitutes market, particularly in Europe, where they command more than one-third of the market share themselves. The U.S. market sees stronger competition from Zimmer Biomet, ACE Surgical, and BioHorizons to compete as leaders in this space. Geistlich’s emerging market share in the overall market is a direct result of their dominance strictly within the xenograft market. The Bio-Oss® bovine xenograft product line in the xenograft realm of DBGS is recognized as the gold standard within the xenograft market. In fact, the product is the clear leader of the xenograft market.

Combining the dental divisions of each company, Zimmer Dental and BIOMET 3i merged in June of 2015, creating an entity that rivals that of Geistlich in the United States. The company continues to maintain a strong presence in the overall DBGS market by providing products in the mineralized allograft, DBM allograft, xenograft, and synthetic sub-segments of the market. In the European market, Zimmer Biomet still trails behind Botiss Biomaterials.

Botiss continues to experience significant growth, largely owing to its distribution deal established with Straumann, a leading dental implant manufacturer. The company is headquartered in Berlin, Germany and has R&D and production sites in Germany, Austria and the United Kingdom. Unlike Geistlich, the leading competitor in the market, Botiss maintains a much more varied product portfolio in the dental biomaterial market. Though the company is most successful in the xenograft segment, Botiss also produces and distributes allograft and synthetic DBGS materials.

Global Dental Bone Graft Substitutes Market Segmentation

While this Global Series contains all global dental bone graft substitutes market data, each of the market segments is also available as a stand-alone report, MedCore. This allows you to get access to only the dental bone graft substitutes market research that you need.

- Dental Bone Grafting Procedure Numbers | US | 2021-2027 | MedPro – Using a number of databases, internal and external, we’re able to provide the volume of dental bone grafting procedures being performed in the US, including dental implant and periodontal procedures performed using bone graft substitutes.

- Dental Bone Graft Substitute Market | US, EU15*, Asia Pacific*, Latin America* | 2021-2027 | MedCore – The market analysis is further broken down into segments, such as Mineralized Allografts, Demineralized Bone Matrix (DBM) Allografts, Xenografts, and Synthetic Bone Grafts.

- Dental Barrier Membrane Market | US, EU15*, Asia Pacific*, Latin America* | 2021-2027 | MedCore – The chapter contains the market analysis which is categorized by:

- Device Type: Resorbable and Non-Resorbable Dental Barrier Membranes;

- Material Type: Xenograft, Synthetic, and Allograft.

- Dental Growth Factor Market | US, EU15*, Latin America | 2021-2027 | MedCore – The market analysis is also further segmented by:

- Device Type: Emdogain®, GEM 21S®, Infuse™, and Osteocel® devices.

*Limited Coverage Available. Please consult the respective reports for more information.

Research Scope Summary

| Report Attribute |

Details |

| Regions |

United States, EU15, Asia Pacific (South Korea, China, India, Japan, Australia), Latin America (Brazil, Mexico, Argentina) |

| Base Year |

2020 – United States, Asia Pacific, Latin America

2019 – Europe |

| Forecast |

2021-2027 – United States, Asia Pacific, Latin America

2019-2025 – Europe |

| Historical Data |

2017-2020 – United States, Asia Pacific, Latin America

2015-2018 – Europe |

| Quantitative Coverage |

Market Size, Market Shares, Market Forecasts, Market Growth Rates, Units Sold, and Average Selling Prices. |

| Qualitative Coverage |

COVID19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios, FDA Recalls, Disruptive Technologies, Disease Overviews. |

| Data Sources |

Primary Interviews with Industry Leaders, Government Physician Data, Regulatory Data, Hospital Private Data, Import & Export Data, iData Research Internal Database. |

FREE Sample Report

For the complete

Table of Contents from any of the Country-Level reports in this Global Series, please navigate to the respective reports:

TABLE OF CONTENTS I

LIST OF FIGURES VII

LIST OF CHARTS XI

EXECUTIVE SUMMARY 1

GLOBAL DENTAL BONE GRAFT SUBSTITUTE AND OTHER BIOMATERIALS MARKET OVERVIEW 1

COMPETITIVE ANALYSIS 4

MARKET TRENDS 6

MARKET DEVELOPMENTS 7

MARKETS INCLUDED 8

REGIONS INCLUDED 9

VERSION HISTORY 10

RESEARCH METHODOLOGY 11

Step 1: Project Initiation & Team Selection 11

Step 2: Prepare Data Systems and Perform Secondary Research 14

Step 3: Preparation for Interviews & Questionnaire Design 16

Step 4: Performing Primary Research 17

Step 5: Research Analysis: Establishing Baseline Estimates 19

Step 6: Market Forecast and Analysis 20

Step 7: Identify Strategic Opportunities 22

Step 8: Final Review and Market Release 23

Step 9: Customer Feedback and Market Monitoring 24

IMPACT OF COVID-19 ON THE GLOBAL DENTAL BONE GRAFT SUBSTITUTE AND OTHER BIOMATERIALS MARKET 25

2.1 INTRODUCTION 25

2.2 REGIONAL PROFILES 27

2.3 ANALYSIS BY MARKET SEGMENT 28

2.3.1 Worst Case Scenario 28

2.3.2 Base Case Scenario 29

2.3.3 Best Case Scenario 30

DISEASE OVERVIEW 32

3.1 BASIC ANATOMY 32

3.1.1 Dental Anatomy: Oral Cavity and Intraoral Landmarks 32

3.2 DISEASE PATHOLOGY AND DISORDERS 33

3.2.1 General Diagnostics 33

3.2.2 Indication for Dental Implant 33

3.2.3 Periodontal Disease 34

3.2.4 Dental Implant Procedures 35

3.2.5 Guided Bone Regeneration 36

3.3 PATIENT DEMOGRAPHICS 37

3.3.1 General Dental Statistics 37

3.3.2 Tooth Loss Statistics 38

PRODUCT ASSESSMENT 40

4.1 INTRODUCTION 40

4.2 PRODUCT PORTFOLIOS 40

4.2.1 Dental Bone Graft Substitutes 40

4.2.1.1 Allografts 41

4.2.1.1.1 Mineralized Allografts 41

4.2.1.1.2 Demineralized Bone Matrix 41

4.2.1.2 Autografts 42

4.2.1.3 Synthetics 43

4.2.1.4 Xenografts 44

4.2.2 Dental Growth Factors 47

4.2.3 Dental Barrier Membrane 48

4.3 REGULATORY ISSUES AND RECALLS 50

4.3.1 Geistlich 50

4.4 CLINICAL TRIALS 51

4.4.1 Dental Grafts 51

GLOBAL DENTAL BONE GRAFT SUBSTITUTE AND OTHER BIOMATERIALS DEVICE MARKET OVERVIEW 54

5.1 INTRODUCTION 54

5.1.1 Applications of Dental Bone Graft Substitutes 54

5.1.1.1 Dental Implant Procedures 55

5.1.1.2 Periodontal Procedures 55

5.1.2 Types of Dental Bone Graft Substitutes 56

5.1.2.1 Autografts 56

5.1.2.2 Allografts 56

5.1.2.3 Demineralized Bone Matrix Allografts 57

5.1.2.4 Xenografts 57

5.1.2.5 Synthetics 58

5.1.3 Dental Membranes 58

5.1.4 Market Penetration and End Users 58

5.2 MARKET OVERVIEW & TREND ANALYSIS 60

5.2.1 By Segment 60

5.2.2 By Region 63

5.3 DRIVERS AND LIMITERS 66

5.3.1 Market Drivers 66

5.3.2 Market Limiters 67

5.4 COMPETITIVE MARKET SHARE ANALYSIS 69

5.5 MERGERS AND ACQUISITIONS 75

5.6 COMPANY PROFILES 77

5.6.1 ACE Surgical 77

5.6.2 BioHorizons 78

5.6.3 Dentsply Sirona 79

5.6.4 Geistlich 80

5.6.5 LifeNet Health 81

5.6.6 Medtronic 82

5.6.7 Osteogenics Biomedical 83

5.6.8 Zimmer Biomet 84

5.7 SWOT ANALYSIS 85

5.7.1 ACE Surgical 86

5.7.2 BioHorizons 87

5.7.4 Dentsply Sirona 88

5.7.5 Geistlich 89

5.7.6 LifeNet Health 90

5.7.7 Medtronic 91

5.7.8 Osteogenics Biomedical 92

5.7.9 Zimmer Biomet 93

DENTAL BONE GRAFT SUBSTITUTE MARKET 94

6.1 EXECUTIVE SUMMARY 94

6.1.1 Global Dental Bone Graft Substitute Market Overview 94

6.1.2 Competitive Analysis 97

6.1.3 Markets Included 98

6.1.4 Regions Included 99

6.2 INTRODUCTION 101

6.2.1 Autografts 101

6.2.2 Allografts 101

6.2.2.1 Mineralized Allografts 102

6.2.2.2 Demineralized Bone Matrix 102

6.2.3 Xenografts 103

6.2.4 Synthetics 103

6.3 MARKET OVERVIEW 105

6.3.1 By Segment 106

6.3.2 By Region 108

6.4 MARKET ANALYSIS AND FORECAST 110

6.4.1 Total Dental Bone Graft Substitute Market 110

6.4.2 Allograft Market 115

6.4.3 Xenograft Market 120

6.4.4 Synthetic Market 125

6.5 DRIVERS AND LIMITERS 129

6.5.1 Market Drivers 129

6.5.2 Market Limiters 131

6.6 COMPETITIVE MARKET SHARE ANALYSIS 133

DENTAL BARRIER MEMBRANE MARKET 141

7.1 EXECUTIVE SUMMARY 141

7.1.1 Global Dental Barrier Membrane Market Overview 141

7.1.2 Competitive Analysis 144

7.1.3 Markets Included 145

7.1.4 Regions Included 146

7.2 INTRODUCTION 148

7.3 MARKET OVERVIEW 150

7.3.1 By Segment 151

7.3.2 By Region 153

7.4 MARKET ANALYSIS AND FORECAST 155

7.4.1 Total Dental Barrier Membrane Market 155

7.4.2 Resorbable Dental Barrier Membrane Market 160

7.4.3 Non-Resorbable Dental Barrier Membrane Market 164

7.5 DRIVERS AND LIMITERS 169

7.5.1 Market Drivers 169

7.5.2 Market Limiters 170

7.6 COMPETITIVE MARKET SHARE ANALYSIS 172

ABBREVIATIONS 178

LIST OF CHARTS

Chart 1 1: Dental Bone Graft Substitute and Other Biomaterials Market by Segment, Global, 2020 – 2027 3

Chart 1 2: Dental Bone Graft Substitute Units Sold Global, 2020 3

Chart 2 1: Multi-Scenario Dental Bone Graft Substitute and Other Biomaterials Market Forecast, Global, 2017 – 2027 (US$M) 31

Chart 5 1: Dental Bone Graft Substitute and Other Biomaterials Device Market by Segment, Global, 2017 – 2027 62

Chart 5 2: Dental Bone Graft Substitute and Other Biomaterials Device Market by Region, Global, 2017 – 2027 65

Chart 5 3: Leading Competitors, Dental Bone Graft Substitute and Other Biomaterials Device Market, Global, 2020 74

Chart 6 1: Dental Bone Graft Substitute Market, Global, 2017 – 2027 96

Chart 6 2: Dental Bone Graft Substitute Units Sold, Global, 2020 96

Chart 6 3: Dental Bone Graft Substitute Device Market by Segment, Global, 2017 – 2027 107

Chart 6 4: Dental Bone Graft Substitute Device Market by Region, Global, 2017 – 2027 109

Chart 6 5: Leading Competitors, Dental Bone Graft Substitute Market, Global, 2020 140

Chart 7 1: Dental Barrier Membrane Market, Global, 2017 – 2027 143

Chart 7 2: Dental Barrier Membrane Units Sold, Global, 2020 143

Chart 7 3: Dental Barrier Membrane Device Market by Segment, Global, 2017 – 2027 152

Chart 7 4: Dental Barrier Membrane Device Market by Region, Global, 2017 – 2027 154

Chart 7 5: Leading Competitors, Dental Barrier Membrane Market, Global, 2020 177

LIST OF FIGURES

Figure 1 1: Dental Bone Graft Substitute and Other Biomaterials Market Share Ranking by Segment, Global, 2020 4

Figure 1 2: Companies Researched in this Report 5

Figure 1 3: Factors Impacting the Dental Bone Graft Substitute and Other Biomaterials Market by Segment, Global 6

Figure 1 4: Recent Events in the Dental Bone Graft Substitute and Other Biomaterials Market, Global, 2017 – 2021 7

Figure 1 5: Dental Bone Graft Substitute and Other Biomaterials Markets Covered 8

Figure 1 6: Dental Bone Graft Substitute and Other Biomaterials Regions Covered, Global (1 of 2) 9

Figure 1 7: Dental Bone Graft Substitute and Other Biomaterials Regions Covered, Global (2 of 2) 10

Figure 1 8: Version History 10

Figure 2 1: Dental Bone Graft Substitute and Other Biomaterials Market by Segment, Worst Case Scenario, Global, 2017 – 2027 (US$M) 28

Figure 2 2: Dental Bone Graft Substitute and Other Biomaterials Market by Segment, Base Case Scenario, Global, 2017 – 2027 (US$M) 29

Figure 2 3: Dental Bone Graft Substitute and Other Biomaterials Market by Segment, Best Case Scenario, Global, 2017 – 2027 (US$M) 30

Figure 4 1: Dental Bone Graft Substitute Products by Company (1 of 2) 45

Figure 4 2: Dental Bone Graft Substitute Products by Company (2 of 2) 46

Figure 4 3: Dental Growth Factor Products by Company 47

Figure 4 4: Dental Barrier Membrane Products by Company (1 of 2) 48

Figure 4 5: Dental Barrier Membrane Products by Company (2 of 2) 49

Figure 4 6: Class 2 Device Recall Geistlich BioOss Pen 50

Figure 4 7: Immediate Implant With no Graft, Autogenous Graft or Xenograft 51

Figure 4 8: Healing Dynamics in Human Extraction Sockets Grafted with Bio-Oss Collagen® 51

Figure 4 9: Clinical Study on the Use of Symbios Xenograft for Sinus Floor Elevation 52

Figure 4 10: The Use of Dental Pulp Tissue as an Autogenous Graft for Ridge Augmentation 52

Figure 4 11: Influence of Bio-Oss Collagen Grafting at Implant Placement on Buccal Bone Volume Regeneration 53

Figure 4 12: Evaluation of Implants Placed Without Bone Grafts in Two Different Sinus Floor Elevation Techniques 53

Figure 5 1: Dental Bone Graft Substitute and Other Biomaterials Device Market by Segment, Global, 2017 – 2027 (US$M) 61

Figure 5 2: Dental Bone Graft Substitute and Other Biomaterials Device Market by Region, Global, 2017 – 2027 (US$M) 64

Figure 5 3: Leading Competitors, Dental Bone Graft Substitute and Other Biomaterials Device Market by Segment, Global, 2020 73

Figure 5 4: SWOT Analysis, ACE Surgical 86

Figure 5 5: SWOT Analysis, BioHorizons 87

Figure 5 6: SWOT Analysis, Dentsply Sirona 88

Figure 5 7: SWOT Analysis, Geistlich 89

Figure 5 8: SWOT Analysis, LifeNet Health 90

Figure 5 9: SWOT Analysis, Medtronic 91

Figure 5 10: SWOT Analysis, Osteogenics Biomedical 92

Figure 5 11: SWOT Analysis, Zimmer Biomet 93

Figure 6 1: Dental Bone Graft Substitute Markets Covered 98

Figure 6 2: Dental Bone Graft Substitute Regions Covered, Global (1 of 2) 99

Figure 6 3: Dental Bone Graft Substitute Regions Covered, Global (2 of 2) 100

Figure 6 4: Dental Bone Graft Substitute Device Market by Segment, Global, 2017 – 2027 (US$M) 106

Figure 6 5: Dental Bone Graft Substitute Device Market by Region, Global, 2017 – 2027 (US$M) 108

Figure 6 6: Dental Bone Graft Substitute Market, Global, 2017 – 2027 111

Figure 6 7: Units Sold (cc) by Region, Dental Bone Graft Substitute Market, Global, 2017 – 2027 112

Figure 6 8: Average Selling Price by Region, Dental Bone Graft Substitute Market, Global, 2017 – 2027 (US$) 113

Figure 6 9: Market Value by Region, Dental Bone Graft Substitute Market, Global, 2017 – 2027 (US$M) 114

Figure 6 10: Allograft Market, Global, 2017 – 2027 116

Figure 6 11: Units Sold (cc) by Region, Allograft Market, Global, 2017 – 2027 117

Figure 6 12: Average Selling Price by Region, Allograft Market, Global, 2017 – 2027 (US$) 118

Figure 6 13: Market Value by Region, Allograft Market, Global, 2017 – 2027 (US$M) 119

Figure 6 14: Xenograft Market, Global, 2017 – 2027 121

Figure 6 15: Units Sold (cc) by Region, Xenograft Market, Global, 2017 – 2027 122

Figure 6 16: Average Selling Price by Region, Xenograft Market, Global, 2017 – 2027 (US$) 123

Figure 6 17: Market Value by Region, Xenograft Market, Global, 2017 – 2027 (US$M) 124

Figure 6 18: Synthetic Market, Global, 2017 – 2027 125

Figure 6 19: Units Sold (cc) by Region, Synthetic Market, Global, 2017 – 2027 126

Figure 6 20: Average Selling Price by Region, Synthetic Market, Global, 2017 – 2027 (US$) 127

Figure 6 21: Market Value by Region, Synthetic Market, Global, 2017 – 2027 (US$M) 128

Figure 6 22: Leading Competitors, Dental Bone Graft Substitute Market, Global, 2020 138

Figure 6 23: Leading Competitors, Dental Bone Graft Substitute Market, Global, 2020 139

Figure 7 1: Dental Barrier Membrane Markets Covered 145

Figure 7 2: Dental Barrier Membrane Regions Covered, Global (1 of 2) 146

Figure 7 3: Dental Barrier Membrane Regions Covered, Global (2 of 2) 147

Figure 7 4: Dental Barrier Membrane Device Market by Segment, Global, 2017 – 2027 (US$M) 151

Figure 7 5: Dental Barrier Membrane Device Market by Region, Global, 2017 – 2027 (US$M) 153

Figure 7 6: Dental Barrier Membrane Market, Global, 2017 – 2027 156

Figure 7 7: Units Sold by Region, Dental Barrier Membrane Market, Global, 2017 – 2027 157

Figure 7 8: Average Selling Price by Region, Dental Barrier Membrane Market, Global, 2017 – 2027 (US$) 158

Figure 7 9: Market Value by Region, Dental Barrier Membrane Market, Global, 2017 – 2027 (US$M) 159

Figure 7 10: Resorbable Dental Barrier Membrane Market, Global, 2017 – 2027 160

Figure 7 11: Units Sold by Region, Resorbable Dental Barrier Membrane Market, Global, 2017 – 2027 161

Figure 7 12: Average Selling Price by Region, Resorbable Dental Barrier Membrane Market, Global, 2017 – 2027 (US$) 162

Figure 7 13: Market Value by Region, Resorbable Dental Barrier Membrane Market, Global, 2017 – 2027 (US$M) 163

Figure 7 14: Non-Resorbable Dental Barrier Membrane Market, Global, 2017 – 2027 165

Figure 7 15: Units Sold by Region, Non-Resorbable Dental Barrier Membrane Market, Global, 2017 – 2027 166

Figure 7 16: Average Selling Price by Region, Non-Resorbable Dental Barrier Membrane Market, Global, 2017 – 2027 (US$) 167

Figure 7 17: Market Value by Region, Non-Resorbable Dental Barrier Membrane Market, Global, 2017 – 2027 (US$M) 168

Figure 7 18: Leading Competitors, Dental Barrier Membrane Market, Global, 2020 176

iData’s 9-Step Research Methodology

Our reports follow an in-depth 9-step methodology which focuses on the following research systems:

- Original primary research that consists of the most up-to-date market data

- Strong foundation of quantitative and qualitative research

- Focused on the needs and strategic challenges of the industry participants

Step 1: Project Initiation & Team Selection During this preliminary investigation, all staff members involved in the industry discusses the topic in detail.

Step 2: Prepare Data Systems and Perform Secondary Research The first task of the research team is to prepare for the data collection process: Filing systems and relational databases are developed as needed.

Step 3: Preparation for Interviews & Questionnaire Design The core of all iData research reports is primary market research. Interviews with industry insiders represent the single most reliable way to obtain accurate, current data about market conditions, trends, threats and opportunities.

Step 4: Performing Primary Research At this stage, interviews are performed using contacts and information acquired in the secondary research phase.

Step 5: Research Analysis: Establishing Baseline Estimates Following the completion of the primary research phase, the collected information must be synthesized into an accurate view of the market status. The most important question is the current state of the market.

Step 6: Market Forecast and Analysis iData Research uses a proprietary method to combine statistical data and opinions of industry experts to forecast future market values.

Step 7: Identify Strategic Opportunities iData analysts identify in broad terms why some companies are gaining or losing share within a given market segment.

Step 8: Final Review and Market Release An integral part of the iData research methodology is a built-in philosophy of quality control and continuing improvement is integral to the iData philosophy.

Step 9: Customer Feedback and Market Monitoring iData philosophy of continuous improvement requires that reports and consulting projects be monitored after release for customer feedback and market accuracy.

Click Here to Read More About Our Methodology