| Figure 1‑1: Urological Device Market Share Ranking by Segment, Global, 2021 (1 of 2) |

| Figure 1‑2: Urological Device Market Share Ranking by Segment, Global, 2021 (2 of 2) |

| Figure 1‑3: Companies Researched in this Report (1 of 3) |

| Figure 1‑4: Companies Researched in this Report (2 of 3) |

| Figure 1‑5: Companies Researched in this Report (3 of 3) |

| Figure 1‑6: Factors Impacting the Urological Device Market by Segment, Global (1 of 2) |

| Figure 1‑7: Factors Impacting the Urological Device Market by Segment, Global (2 of 2) |

| Figure 1‑8: Recent Events in the Urological Device Market, Global, 2018 – 2022 (1 of 2) |

| Figure 1‑9: Recent Events in the Urological Device Market, Global, 2018 – 2022 (2 of 2) |

| Figure 1‑10: Urological Device Procedures Covered |

| Figure 1‑11: Urological Device Markets Covered (1 of 3) |

| Figure 1‑12: Urological Device Markets Covered (2 of 3) |

| Figure 1‑13: Urological Device Markets Covered (3 of 3) |

| Figure 1‑14: Urological Device Regions Covered, Global (1 of 2) |

| Figure 1‑15: Urological Device Regions Covered, Global (2 of 2) |

| Figure 1‑16: Urological Device Regions Covered, Global (2 of 2) |

| Figure 1‑17: Version History |

| Figure 2‑1: Urological Device Market by Segment, Worst Case Scenario, Global, 2018 – 2028 (US$M) (1 of 2) |

| Figure 2‑2: Urological Device Market by Segment, Worst Case Scenario, Global, 2018 – 2028 (US$M) (2 of 2) |

| Figure 2‑3: Urological Device Market by Segment, Base Case Scenario, Global, 2018 – 2028 (US$M) (1 of 2) |

| Figure 2‑4: Urological Device Market by Segment, Base Case Scenario, Global, 2018 – 2028 (US$M) (2 of 2) |

| Figure 2‑5: Urological Device Market by Segment, Best Case Scenario, Global, 2018 – 2028 (US$M) (1 of 2) |

| Figure 2‑6: Urological Device Market by Segment, Best Case Scenario, Global, 2018 – 2028 (US$M) (2 of 2) |

| Figure 4‑1: Urinary Incontinence Treatments by Company (1 of 3) |

| Figure 4‑2: Urinary Incontinence Treatments by Company (2 of 3) |

| Figure 4‑3: Urinary Incontinence Treatments by Company (3 of 3) |

| Figure 4‑4: Stone Management Devices by Company (1 of 3) |

| Figure 4‑5: Stone Management Devices by Company (2 of 3) |

| Figure 4‑6: Stone Management Devices by Company (3 of 3) |

| Figure 4‑7: BPH Treatments by Company |

| Figure 4‑8: Urological Endoscopes by Company (1 of 2) |

| Figure 4‑9: Urological Endoscopes by Company (2 of 2) |

| Figure 4‑10: Prostate Cancer Treatments by Company |

| Figure 4‑11: Urodynamic Equipment and Consumables by Company |

| Figure 4‑12: Nephrostomy Devices by Company |

| Figure 4‑13: Men’s Reproductive Health Devices by Company |

| Figure 4‑14: Testicular Implants by Company |

| Figure 4‑15: Urinary Guidewires by Company |

| Figure 4‑16: Class 2 Device Recall Magic 3 Intermittent Catheters |

| Figure 4‑17: Class 2 Device Recall Bardex Lubricath 3Way 75cc Continuous Irrigation Foley Catheter |

| Figure 4‑18: Class 2 Device Recall Bard Magic 3 Antibacterial Hydrophilic Intermittent Catheter |

| Figure 4‑19: Class 2 Device Recall SureStep |

| Figure 4‑20: Class 2 Device Recall AMS 800 Artificial Urinary Sphincter AMS 800 Belt Cuff |

| Figure 4‑21: Class 2 Device Recall AMS 700 100 mL Spherical Reservoir with InhibiZone |

| Figure 4‑22: Class 2 Device Recall Uphold LITE w/ Capio SLIM |

| Figure 4‑23: Class 2 Device Recall Stretch VL Ureteral Stent Set |

| Figure 4‑24: Class 2 Device Recall Contour VL Ureteral Stent Set |

| Figure 4‑25: Class 2 Device Recall Auriga 30 Laser System |

| Figure 4‑26: Class 2 Device Recall AURIGA 30 BRAZIL ZERO COST SYSTEM |

| Figure 4‑27: Class 2 Device Recall MoXy Laser Fiber |

| Figure 4‑28: Class 2 Device Recall IcePearl 2.1 CX 90 Cyroablation Needles |

| Figure 4‑29: Class 2 Device Recall IceSphere" Cryoablation Needles |

| Figure 4‑30: Class 2 Device Recall Titan Pump |

| Figure 4‑31: Class 2 Device Recall Dornier |

| Figure 4‑32: Class 2 Device Recall Visual ICE Cryoablation System |

| Figure 4‑33: Class 2 Device Recall Ureteroreno videoscope URFV2; Ureteroreno videoscope URFV2R |

| Figure 4‑34: Class 3 Device Recall RUSCH Urinary Drainage bag |

| Figure 4‑35: Class 2 Device Recall Rusch EasyCath Kit |

| Figure 4‑36: Class 3 Device Recall Teleflex MEDICAL RuSCH One piece Male External Medium Catheter W/O Tape |

| Figure 4‑37: Artificial Urinary Sphincter Clinical Outcomes (AUSCO) |

| Figure 4‑38: Single-incision Versus Retropubic Mid-Urethral Sling (Solyx) for SUI During Minimally Invasive Sacrocolpopexy (SASS) |

| Figure 4‑39: Double-J PLUS Postmarket Registry |

| Figure 4‑40: Rezum I Pilot Study for Benign Prostatic Hyperplasia (Rezum Pilot) |

| Figure 4‑41: Rezum FIM Optimization Study (Rezum FIM) |

| Figure 4‑42: To Evaluate the Feasibility, Preliminary Safety and Performance of Rezūm System in BPH Treatment in China |

| Figure 4‑43: To Evaluate the Safety and Efficacy of LithoVue Ureteroscope System in Chinese Patients With Urinary Disease (LithoVue) |

| Figure 4‑44: Investigation of New Intermittent Catheters in Healthy Volunteers |

| Figure 4‑45: Exploratory Study of a New Urine Collection Device for Men |

| Figure 4‑46: Investigation of Non-CE Marked Intermittent Catheters for Females |

| Figure 4‑47: T-DOC® 5 Fr Pediatric Clinical Investigation |

| Figure 4‑48: T-DOC® NXT Clinical Investigation |

| Figure 4‑49: e۰Sense® Catheter Clinical Investigation |

| Figure 4‑50: T-DOC® 5 Fr Pediatric Clinical Investigation |

| Figure 4‑51: Study of Median Lobe Prostatic UroLift Procedure |

| Figure 4‑52: Urodynamic Feasibility Study Utilizing the UroLift® System (UDS) |

| Figure 4‑53: Comparing UroLift Experience Against Rezūm (CLEAR) |

| Figure 4‑54: ARTUS MONO Artificial Urinary Sphincter |

| Figure 4‑55: Safety and Efficacy Study of USTRAP™ in Male Urinary Incontinence (PROSPECT) |

| Figure 4‑56: Connected Catheter- Safety and Effectiveness Study |

| Figure 4‑57: Evaluation of a New Female Urinary Intermittent Catheter |

| Figure 4‑58: Post-Market Clinical Follow-Up onTVT EXACT® Continence System |

| Figure 4‑59: A Study of the PedSCath Pediatric Sampling Catheter Versus Current Standard of Care. |

| Figure 4‑60: Safety and Device Performance of the Uriprene® Degradable Temporary Ureteral Stent Following Uncomplicated Ureteroscopy (URIPRENE) |

| Figure 4‑61: The RELIEF™ Ureteral Stent - Assessment of Retrograde Urinary Reflux and Distal Coil Bladder Position |

| Figure 4‑62: Single-use Cystoscope System for Direct Visualization of the Urethra and Bladder |

| Figure 4‑63: Evaluation of Performance and Safety of Ambu® aScope™ 4 Cysto and aView™ Urologia for Flexible Cystoscopy |

| Figure 4‑64: LDR vs. HDR Brachytherapy for Prostate Cancer (LDR/HDRmono) |

| Figure 4‑65: Urodynamic Assessment of the Lower Urinary Tract: Water vs. Air - Synchrony |

| Figure 5‑1: Urological Device Market by Segment, Global, 2018 – 2028 (US$M) (1 of 2) |

| Figure 5‑2: Urological Device Market by Segment, Global, 2018 – 2028 (US$M) (2 of 2) |

| Figure 5‑3: Urological Device Market by Region, Global, 2018 – 2028 (US$M) |

| Figure 5‑4: Leading Competitors, Urological Device Market by Segment, Global, 2021 (1 of 2) |

| Figure 5‑5: Leading Competitors, Urological Device Market by Segment, Global, 2021 (2 of 3) |

| Figure 5‑6: Leading Competitors, Urological Device Market by Segment, Global, 2021 (3 of 3) |

| Figure 5‑7: SWOT Analysis, Becton Dickinson |

| Figure 5‑8: SWOT Analysis, Boston Scientific |

| Figure 5‑9: SWOT Analysis, Cardinal Health |

| Figure 5‑10: SWOT Analysis, Coloplast |

| Figure 5‑11: SWOT Analysis, Cook Medical |

| Figure 5‑12: SWOT Analysis, Elekta |

| Figure 5‑13: SWOT Analysis, Karl Storz |

| Figure 5‑14: SWOT Analysis, LABORIE |

| Figure 5‑15: SWOT Analysis, Lumenis |

| Figure 5‑16: SWOT Analysis, Olympus |

| Figure 5‑17: SWOT Analysis, Teleflex |

| Figure 6‑1: Urinary Catheter Markets Covered |

| Figure 6‑2: Urinary Catheter Regions Covered, Global (1 of 2) |

| Figure 6‑3: Urinary Catheter Regions Covered, Global (2 of 2) |

| Figure 6‑4: Urinary Catheter Device Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 6‑5: Urinary Catheter Device Market by Region, Global, 2018 – 2028 (US$M) |

| Figure 6‑6: Urinary Catheter Market, Global, 2018 – 2028 |

| Figure 6‑7: Units Sold by Region, Urinary Catheter Market, Global, 2018 – 2028 |

| Figure 6‑8: Average Selling Price by Region, Urinary Catheter Market, Global, 2018 – 2028 (US$) |

| Figure 6‑9: Market Value by Region, Urinary Catheter Market, Global, 2018 – 2028 (US$M) |

| Figure 6‑10: Intermittent Catheter Market, Global, 2018 – 2028 |

| Figure 6‑11: Units Sold by Region, Intermittent Catheter Market, Global, 2018 – 2028 |

| Figure 6‑12: Average Selling Price by Region, Intermittent Catheter Market, Global, 2018 – 2028 (US$) |

| Figure 6‑13: Market Value by Region, Intermittent Catheter Market, Global, 2018 – 2028 (US$M) |

| Figure 6‑14: Foley Catheter Market, Global, 2018 – 2028 |

| Figure 6‑15: Units Sold by Region, Foley Catheter Market, Global, 2018 – 2028 |

| Figure 6‑16: Average Selling Price by Region, Foley Catheter Market, Global, 2018 – 2028 (US$) |

| Figure 6‑17: Market Value by Region, Foley Catheter Market, Global, 2018 – 2028 (US$M) |

| Figure 6‑18: Male External Catheter Market, Global, 2018 – 2028 |

| Figure 6‑19: Units Sold by Region, Male External Catheter Market, Global, 2018 – 2028 |

| Figure 6‑20: Average Selling Price by Region, Male External Catheter Market, Global, 2018 – 2028 (US$) |

| Figure 6‑21: Market Value by Region, Male External Catheter Market, Global, 2018 – 2028 (US$M) |

| Figure 6‑22: Leading Competitors, Urinary Catheter Market, Global, 2021 |

| Figure 7‑1: Urinary Incontinence Sling Markets Covered |

| Figure 7‑2: Urinary Incontinence Sling Regions Covered, Global (1 of 2) |

| Figure 7‑3: Urinary Incontinence Sling Regions Covered, Global (2 of 2) |

| Figure 7‑4: Urinary Incontinence Sling Procedures by Region, Global, 2018 – 2028 |

| Figure 7‑5: Urinary Incontinence Sling Procedures by Country, North America, 2018 – 2028 |

| Figure 7‑6: Urinary Incontinence Sling Procedures by Country, Latin America, 2018 – 2028 (1 of 2) |

| Figure 7‑7: Urinary Incontinence Sling Procedures by Country, Latin America, 2018 – 2028 (2 of 2) |

| Figure 7‑8: Urinary Incontinence Sling Procedures by Country, Western Europe, 2018 – 2028 |

| Figure 7‑9: Urinary Incontinence Sling Procedures by Country, Central & Eastern Europe, 2018 – 2028 (1 of 2) |

| Figure 7‑10: Urinary Incontinence Sling Procedures by Country, Central & Eastern Europe, 2018 – 2028 (2 of 2) |

| Figure 7‑11: Urinary Incontinence Sling Procedures by Country, Middle East, 2018 – 2028 |

| Figure 7‑12: Urinary Incontinence Sling Procedures by Country, Asia-Pacific, 2018 – 2028 (1 of 3) |

| Figure 7‑13: Urinary Incontinence Sling Procedures by Country, Asia-Pacific, 2018 – 2028 (2 of 3) |

| Figure 7‑14: Urinary Incontinence Sling Procedures by Country, Asia-Pacific, 2018 – 2028 (3 of 3) |

| Figure 7‑15: Urinary Incontinence Sling Procedures by Country, Africa, 2018 – 2028 (1 of 2) |

| Figure 7‑16: Urinary Incontinence Sling Procedures by Country, Africa, 2018 – 2028 (2 of 2) |

| Figure 7‑17: Urinary Incontinence Device Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 7‑18: Urinary Incontinence Device Market by Region, Global, 2018 – 2028 (US$M) |

| Figure 7‑19: Urinary Incontinence Device Market, Global, 2018 – 2028 |

| Figure 7‑20: Units Sold by Region, Urinary Incontinence Device Market, Global, 2018 – 2028 |

| Figure 7‑21: Average Selling Price by Region, Urinary Incontinence Device Market, Global, 2018 – 2028 (US$) |

| Figure 7‑22: Market Value by Region, Urinary Incontinence Device Market, Global, 2018 – 2028 (US$M) |

| Figure 7‑23: Urethral Bulking Agent Market, Global, 2018 – 2028 |

| Figure 7‑24: Units Sold by Region, Urethral Bulking Agent Market, Global, 2018 – 2028 |

| Figure 7‑25: Average Selling Price by Region, Urethral Bulking Agent Market, Global, 2018 – 2028 (US$) |

| Figure 7‑26: Market Value by Region, Urethral Bulking Agent Market, Global, 2018 – 2028 (US$M) |

| Figure 7‑27: Urinary Incontinence Sling Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 7‑28: Total Urinary Incontinence Sling Market, Global, 2018 – 2028 |

| Figure 7‑29: Units Sold by Region, Urinary Incontinence Sling Market, Global, 2018 – 2028 |

| Figure 7‑30: Average Selling Price by Region, Urinary Incontinence Sling Market, Global, 2018 – 2028 (US$) |

| Figure 7‑31: Market Value by Region, Urinary Incontinence Sling Market, Global, 2018 – 2028 (US$M) |

| Figure 7‑32: Transvaginal Tape Female Incontinence Sling Market, Global, 2018 – 2028 |

| Figure 7‑33: Units Sold by Region, Transvaginal Tape Female Incontinence Sling Market, Global, 2018 – 2028 |

| Figure 7‑34: Average Selling Price by Region, Transvaginal Tape Female Incontinence Sling Market, Global, 2018 – 2028 (US$) |

| Figure 7‑35: Market Value by Region, Transvaginal Tape Female Incontinence Sling Market, Global, 2018 – 2028 (US$M) |

| Figure 7‑36: Transobturator Female Incontinence Sling Market, Global, 2018 – 2028 |

| Figure 7‑37: Units Sold by Region, Transobturator Female Incontinence Sling Market, Global, 2018 – 2028 |

| Figure 7‑38: Average Selling Price by Region, Transobturator Female Incontinence Sling Market, Global, 2018 – 2028 (US$) |

| Figure 7‑39: Market Value by Region, Transobturator Female Incontinence Sling Market, Global, 2018 – 2028 (US$M) |

| Figure 7‑40: Single-Incision Female Incontinence Sling Market, Global, 2018 – 2028 |

| Figure 7‑41: Units Sold by Region, Single-Incision Female Incontinence Sling Market, Global, 2018 – 2028 |

| Figure 7‑42: Average Selling Price by Region, Single-Incision Female Incontinence Sling Market, Global, 2018 – 2028 (US$) |

| Figure 7‑43: Market Value by Region, Single-Incision Female Incontinence Sling Market, Global, 2018 – 2028 (US$M) |

| Figure 7‑44: Male Incontinence Sling Market, Global, 2018 – 2028 |

| Figure 7‑45: Units Sold by Region, Male Incontinence Sling Market, Global, 2018 – 2028 |

| Figure 7‑46: Average Selling Price by Region, Male Incontinence Sling Market, Global, 2018 – 2028 (US$) |

| Figure 7‑47: Market Value by Region, Male Incontinence Sling Market, Global, 2018 – 2028 (US$M) |

| Figure 7‑48: Leading Competitors, Urinary Incontinence Sling Market, Global, 2021 |

| Figure 8‑1: Stone Management Procedures Covered |

| Figure 8‑2: Urinary Incontinence Sling Markets Covered |

| Figure 8‑3: Stone Management Regions Covered, Global (1 of 2) |

| Figure 8‑4: Stone Management Regions Covered, Global (2 of 2) |

| Figure 8‑5: Stone Management Procedures by Segment, Global, 2018 – 2028 |

| Figure 8‑6: Stone Management Procedures by Region, Global, 2018 – 2028 |

| Figure 8‑7: Stone Management Procedures by Country, North America, 2018 – 2028 |

| Figure 8‑8: Stone Management Procedures by Country, Latin America, 2018 – 2028 (1 of 2) |

| Figure 8‑9: Stone Management Procedures by Country, Latin America, 2018 – 2028 (2 of 2) |

| Figure 8‑10: Stone Management Procedures by Country, Western Europe, 2018 – 2028 |

| Figure 8‑11: Stone Management Procedures by Country, Central & Eastern Europe, 2018 – 2028 (1 of 2) |

| Figure 8‑12: Stone Management Procedures by Country, Central & Eastern Europe, 2018 – 2028 (2 of 2) |

| Figure 8‑13: Stone Management Procedures by Country, Middle East, 2018 – 2028 |

| Figure 8‑14: Stone Management Procedures by Country, Asia-Pacific, 2018 – 2028 (1 of 3) |

| Figure 8‑15: Stone Management Procedures by Country, Asia-Pacific, 2018 – 2028 (2 of 3) |

| Figure 8‑16: Stone Management Procedures by Country, Asia-Pacific, 2018 – 2028 (3 of 3) |

| Figure 8‑17: Stone Management Procedures by Country, Africa, 2018 – 2028 (1 of 2) |

| Figure 8‑18: Stone Management Procedures by Country, Africa, 2018 – 2028 (2 of 2) |

| Figure 8‑19: ESWL Procedures by Region, Global, 2018 – 2028 |

| Figure 8‑20: ESWL Procedures by Country, North America, 2018 – 2028 |

| Figure 8‑21: ESWL Procedures by Country, Latin America, 2018 – 2028 (1 of 2) |

| Figure 8‑22: ESWL Procedures by Country, Latin America, 2018 – 2028 (2 of 2) |

| Figure 8‑23: ESWL Procedures by Country, Western Europe, 2018 – 2028 |

| Figure 8‑24: ESWL Procedures by Country, Central & Eastern Europe, 2018 – 2028 (1 of 2) |

| Figure 8‑25: ESWL Procedures by Country, Central & Eastern Europe, 2018 – 2028 (2 of 2) |

| Figure 8‑26: ESWL Procedures by Country, Middle East, 2018 – 2028 |

| Figure 8‑27: ESWL Procedures by Country, Asia-Pacific, 2018 – 2028 (1 of 3) |

| Figure 8‑28: ESWL Procedures by Country, Asia-Pacific, 2018 – 2028 (2 of 3) |

| Figure 8‑29: ESWL Procedures by Country, Asia-Pacific, 2018 – 2028 (3 of 3) |

| Figure 8‑30: ESWL Procedures by Country, Africa, 2018 – 2028 (1 of 2) |

| Figure 8‑31: ESWL Procedures by Country, Africa, 2018 – 2028 (2 of 2) |

| Figure 8‑32: Holmium Laser Procedures by Region, Global, 2018 – 2028 |

| Figure 8‑33: Holmium Laser Procedures by Country, North America, 2018 – 2028 |

| Figure 8‑34: Holmium Laser Procedures by Country, Latin America, 2018 – 2028 (1 of 2) |

| Figure 8‑35: Holmium Laser Procedures by Country, Latin America, 2018 – 2028 (2 of 2) |

| Figure 8‑36: Holmium Laser Procedures by Country, Western Europe, 2018 – 2028 |

| Figure 8‑37: Holmium Laser Procedures by Country, Central & Eastern Europe, 2018 – 2028 (1 of 2) |

| Figure 8‑38: Holmium Laser Procedures by Country, Central & Eastern Europe, 2018 – 2028 (2 of 2) |

| Figure 8‑39: Holmium Laser Procedures by Country, Middle East, 2018 – 2028 |

| Figure 8‑40: Holmium Laser Procedures by Country, Asia-Pacific, 2018 – 2028 (1 of 3) |

| Figure 8‑41: Holmium Laser Procedures by Country, Asia-Pacific, 2018 – 2028 (2 of 3) |

| Figure 8‑42: Holmium Laser Procedures by Country, Asia-Pacific, 2018 – 2028 (3 of 3) |

| Figure 8‑43: Holmium Laser Procedures by Country, Africa, 2018 – 2028 (1 of 2) |

| Figure 8‑44: Holmium Laser Procedures by Country, Africa, 2018 – 2028 (2 of 2) |

| Figure 8‑45: PCNL Procedures by Region, Global, 2018 – 2028 |

| Figure 8‑46: PCNL Procedures by Country, North America, 2018 – 2028 |

| Figure 8‑47: PCNL Procedures by Country, Latin America, 2018 – 2028 (1 of 2) |

| Figure 8‑48: PCNL Procedures by Country, Latin America, 2018 – 2028 (2 of 2) |

| Figure 8‑49: PCNL Procedures by Country, Western Europe, 2018 – 2028 |

| Figure 8‑50: PCNL Procedures by Country, Central & Eastern Europe, 2018 – 2028 (1 of 2) |

| Figure 8‑51: PCNL Procedures by Country, Central & Eastern Europe, 2018 – 2028 (2 of 2) |

| Figure 8‑52: PCNL Procedures by Country, Middle East, 2018 – 2028 |

| Figure 8‑53: PCNL Procedures by Country, Asia-Pacific, 2018 – 2028 (1 of 3) |

| Figure 8‑54: PCNL Procedures by Country, Asia-Pacific, 2018 – 2028 (2 of 3) |

| Figure 8‑55: PCNL Procedures by Country, Asia-Pacific, 2018 – 2028 (3 of 3) |

| Figure 8‑56: PCNL Procedures by Country, Africa, 2018 – 2028 (1 of 2) |

| Figure 8‑57: PCNL Procedures by Country, Africa, 2018 – 2028 (2 of 2) |

| Figure 8‑58: Ureteral Stent Placement Procedures by Region, Global, 2018 – 2028 |

| Figure 8‑59: Ureteral Stent Placement Procedures by Country, North America, 2018 – 2028 |

| Figure 8‑60: Ureteral Stent Placement Procedures by Country, Latin America, 2018 – 2028 (1 of 2) |

| Figure 8‑61: Ureteral Stent Placement Procedures by Country, Latin America, 2018 – 2028 (2 of 2) |

| Figure 8‑62: Ureteral Stent Placement Procedures by Country, Western Europe, 2018 – 2028 |

| Figure 8‑63: Ureteral Stent Placement Procedures by Country, Central & Eastern Europe, 2018 – 2028 (1 of 2) |

| Figure 8‑64: Ureteral Stent Placement Procedures by Country, Central & Eastern Europe, 2018 – 2028 (2 of 2) |

| Figure 8‑65: Ureteral Stent Placement Procedures by Country, Middle East, 2018 – 2028 |

| Figure 8‑66: Ureteral Stent Placement Procedures by Country, Asia-Pacific, 2018 – 2028 (1 of 3) |

| Figure 8‑67: Ureteral Stent Placement Procedures by Country, Asia-Pacific, 2018 – 2028 (2 of 3) |

| Figure 8‑68: Ureteral Stent Placement Procedures by Country, Asia-Pacific, 2018 – 2028 (3 of 3) |

| Figure 8‑69: Ureteral Stent Placement Procedures by Country, Africa, 2018 – 2028 (1 of 2) |

| Figure 8‑70: Ureteral Stent Placement Procedures by Country, Africa, 2018 – 2028 (2 of 2) |

| Figure 8‑71: Stone Management Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 8‑72: Stone Management Market by Region, Global, 2018 – 2028 (US$M) |

| Figure 8‑73: Stone Management Market, Global, 2018 – 2028 |

| Figure 8‑74: Units Sold by Region, Stone Management Market, Global, 2018 – 2028 |

| Figure 8‑75: Average Selling Price by Region, Stone Management Market, Global, 2018 – 2028 (US$) |

| Figure 8‑76: Market Value by Region, Stone Management Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑77: ESWL Equipment Market, Global, 2018 – 2028 |

| Figure 8‑78: Units Sold by Region, ESWL Equipment Market, Global, 2018 – 2028 |

| Figure 8‑79: Average Selling Price by Region, ESWL Equipment Market, Global, 2018 – 2028 (US$) |

| Figure 8‑80: Market Value by Region, ESWL Equipment Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑81: Stone Management Laser Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 8‑82: Total Stone Management Laser Market, Global, 2018 – 2028 |

| Figure 8‑83: Units Sold by Region, Stone Management Laser Market, Global, 2018 – 2028 |

| Figure 8‑84: Average Selling Price by Region, Stone Management Laser Market, Global, 2018 – 2028 (US$) |

| Figure 8‑85: Market Value by Region, Stone Management Laser Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑86: Stone Management Laser Equipment Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 8‑87: Total Stone Management Laser Equipment Market, Global, 2018 – 2028 |

| Figure 8‑88: Units Sold by Region, Stone Management Laser Equipment Market, Global, 2018 – 2028 |

| Figure 8‑89: Average Selling Price by Region, Stone Management Laser Equipment Market, Global, 2018 – 2028 (US$) |

| Figure 8‑90: Market Value by Region, Stone Management Laser Equipment Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑91: Holmium Laser Equipment Market, Global, 2018 – 2028 |

| Figure 8‑92: Units Sold by Region, Holmium Laser Equipment Market, Global, 2018 – 2028 |

| Figure 8‑93: Average Selling Price by Region, Holmium Laser Equipment Market, Global, 2018 – 2028 (US$) |

| Figure 8‑94: Market Value by Region, Holmium Laser Equipment Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑95: Thulium Laser Equipment Market, Global, 2018 – 2028 |

| Figure 8‑96: Units Sold by Region, Thulium Laser Equipment, Global, 2018 – 2028 |

| Figure 8‑97: Average Selling Price by Region, Thulium Laser Equipment Market, Global, 2018 – 2028 (US$) |

| Figure 8‑98: Market Value by Region, Thulium Laser Equipment Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑99: Stone Management Laser Fiber Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 8‑100: Total Stone Management Laser Fiber Market, Global, 2018 – 2028 |

| Figure 8‑101: Units Sold by Region, Stone Management Laser Fiber Market, Global, 2018 – 2028 |

| Figure 8‑102: Average Selling Price by Region, Stone Management Laser Fiber Market, Global, 2018 – 2028 (US$) |

| Figure 8‑103: Market Value by Region, Stone Management Laser Fiber Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑104: Holmium Laser Fiber Market, Global, 2018 – 2028 |

| Figure 8‑105: Units Sold by Region, Holmium Laser Fiber Market, Global, 2018 – 2028 |

| Figure 8‑106: Average Selling Price by Region, Holmium Laser Fiber Market, Global, 2018 – 2028 (US$) |

| Figure 8‑107: Market Value by Region, Holmium Laser Fiber Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑108: Thulium Laser Fiber Market, Global, 2018 – 2028 |

| Figure 8‑109: Units Sold by Region, Thulium Laser Fiber Market, Global, 2018 – 2028 |

| Figure 8‑110: Average Selling Price by Region, Thulium Laser Fiber Market, Global, 2018 – 2028 (US$) |

| Figure 8‑111: Market Value by Region, Thulium Laser Fiber Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑112: Stone Fragment Retrieval Device Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 8‑113: Total Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑114: Units Sold by Region, Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑115: Average Selling Price by Region, Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$) |

| Figure 8‑116: Market Value by Region, Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑117: Nitinol Stone Fragment Retrieval Device Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 8‑118: Total Nitinol Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑119: Units Sold by Region, Nitinol Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑120: Average Selling Price by Region, Nitinol Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$) |

| Figure 8‑121: Market Value by Region, Nitinol Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑122: Nitinol Basket Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑123: Units Sold by Region, Nitinol Basket Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑124: Average Selling Price by Region, Nitinol Basket Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$) |

| Figure 8‑125: Market Value by Region, Nitinol Basket Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑126: Nitinol Grasper Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑127: Units Sold by Region, Nitinol Grasper Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑128: Average Selling Price by Region, Nitinol Grasper Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$) |

| Figure 8‑129: Market Value by Region, Nitinol Grasper Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑130: Stainless Steel Stone Fragment Retrieval Device Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 8‑131: Total Stainless Steel Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑132: Units Sold by Region, Stainless Steel Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑133: Average Selling Price by Region, Stainless Steel Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$) |

| Figure 8‑134: Market Value by Region, Stainless Steel Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑135: Stainless Steel Basket Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑136: Units Sold by Region, Stainless Steel Basket Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑137: Average Selling Price by Region, Stainless Steel Basket Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$) |

| Figure 8‑138: Market Value by Region, Stainless Steel Basket Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑139: Stainless Steel Grasper Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑140: Units Sold by Region, Stainless Steel Grasper Stone Fragment Retrieval Device Market, Global, 2018 – 2028 |

| Figure 8‑141: Average Selling Price by Region, Stainless Steel Grasper Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$) |

| Figure 8‑142: Market Value by Region, Stainless Steel Grasper Stone Fragment Retrieval Device Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑143: Ureteral Stent Market, Global, 2018 – 2028 |

| Figure 8‑144: Units Sold by Region, Ureteral Stent Market, Global, 2018 – 2028 |

| Figure 8‑145: Average Selling Price by Region, Ureteral Stent Market, Global, 2018 – 2028 (US$) |

| Figure 8‑146: Market Value by Region, Ureteral Stent Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑147: Access Sheath Market, Global, 2018 – 2028 |

| Figure 8‑148: Units Sold by Region, Access Sheath Market, Global, 2018 – 2028 |

| Figure 8‑149: Average Selling Price by Region, Access Sheath Market, Global, 2018 – 2028 (US$) |

| Figure 8‑150: Market Value by Region, Access Sheath Market, Global, 2018 – 2028 (US$M) |

| Figure 8‑151: Leading Competitors, Stone Management Market, Global, 2021 |

| Figure 9‑1: BPH Treatment Device Procedures Covered |

| Figure 9‑2: BPH Treatment Device Markets Covered |

| Figure 9‑3: BPH Treatment Device Regions Covered, Global (1 of 2) |

| Figure 9‑4: BPH Treatment Device Regions Covered, Global (2 of 2) |

| Figure 9‑5: Intervention BPH Procedures by Segment, Global, 2018 – 2028 |

| Figure 9‑6: Intervention BPH Procedures by Region, Global, 2018 – 2028 |

| Figure 9‑7: Intervention BPH Procedures by Country, North America, 2018 – 2028 |

| Figure 9‑8: Intervention BPH Procedures by Country, Latin America, 2018 – 2028 (1 of 2) |

| Figure 9‑9: Intervention BPH Procedures by Country, Latin America, 2018 – 2028 (2 of 2) |

| Figure 9‑10: Intervention BPH Procedures by Country, Western Europe, 2018 – 2028 |

| Figure 9‑11: Intervention BPH Procedures by Country, Central & Eastern Europe, 2018 – 2028 (1 of 2) |

| Figure 9‑12: Intervention BPH Procedures by Country, Central & Eastern Europe, 2018 – 2028 (2 of 2) |

| Figure 9‑13: Intervention BPH Procedures by Country, Middle East, 2018 – 2028 |

| Figure 9‑14: Intervention BPH Procedures by Country, Asia-Pacific, 2018 – 2028 (1 of 3) |

| Figure 9‑15: Intervention BPH Procedures by Country, Asia-Pacific, 2018 – 2028 (2 of 3) |

| Figure 9‑16: Intervention BPH Procedures by Country, Asia-Pacific, 2018 – 2028 (3 of 3) |

| Figure 9‑17: Intervention BPH Procedures by Country, Africa, 2018 – 2028 (1 of 2) |

| Figure 9‑18: Intervention BPH Procedures by Country, Africa, 2018 – 2028 (2 of 2) |

| Figure 9‑19: TURP Procedures by Region, Global, 2018 – 2028 |

| Figure 9‑20: TURP Procedures by Country, North America, 2018 – 2028 |

| Figure 9‑21: TURP Procedures by Country, Latin America, 2018 – 2028 (1 of 2) |

| Figure 9‑22: TURP Procedures by Country, Latin America, 2018 – 2028 (2 of 2) |

| Figure 9‑23: TURP Procedures by Country, Western Europe, 2018 – 2028 |

| Figure 9‑24: TURP Procedures by Country, Central & Eastern Europe, 2018 – 2028 (1 of 2) |

| Figure 9‑25: TURP Procedures by Country, Central & Eastern Europe, 2018 – 2028 (2 of 2) |

| Figure 9‑26: TURP Procedures by Country, Middle East, 2018 – 2028 |

| Figure 9‑27: TURP Procedures by Country, Asia-Pacific, 2018 – 2028 (1 of 3) |

| Figure 9‑28: TURP Procedures by Country, Asia-Pacific, 2018 – 2028 (2 of 3) |

| Figure 9‑29: TURP Procedures by Country, Asia-Pacific, 2018 – 2028 (3 of 3) |

| Figure 9‑30: TURP Procedures by Country, Africa, 2018 – 2028 (1 of 2) |

| Figure 9‑31: TURP Procedures by Country, Africa, 2018 – 2028 (2 of 2) |

| Figure 9‑32: Laser BPH Procedures by Region, Global, 2018 – 2028 |

| Figure 9‑33: Laser BPH Procedures by Country, North America, 2018 – 2028 |

| Figure 9‑34: Laser BPH Procedures by Country, Latin America, 2018 – 2028 (1 of 2) |

| Figure 9‑35: Laser BPH Procedures by Country, Latin America, 2018 – 2028 (2 of 2) |

| Figure 9‑36: Laser BPH Procedures by Country, Western Europe, 2018 – 2028 |

| Figure 9‑37: Laser BPH Procedures by Country, Central & Eastern Europe, 2018 – 2028 (1 of 2) |

| Figure 9‑38: Laser BPH Procedures by Country, Central & Eastern Europe, 2018 – 2028 (2 of 2) |

| Figure 9‑39: Laser BPH Procedures by Country, Middle East, 2018 – 2028 |

| Figure 9‑40: Laser BPH Procedures by Country, Asia-Pacific, 2018 – 2028 (1 of 3) |

| Figure 9‑41: Laser BPH Procedures by Country, Asia-Pacific, 2018 – 2028 (2 of 3) |

| Figure 9‑42: Laser BPH Procedures by Country, Asia-Pacific, 2018 – 2028 (3 of 3) |

| Figure 9‑43: Laser BPH Procedures by Country, Africa, 2018 – 2028 (1 of 2) |

| Figure 9‑44: Laser BPH Procedures by Country, Africa, 2018 – 2028 (2 of 2) |

| Figure 9‑45: BPH Treatment Device Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 9‑46: BPH Treatment Device Market by Region, Global, 2018 – 2028 (US$M) |

| Figure 9‑47: TURP Market by Segment, Global, 2018 – 2028 |

| Figure 9‑48: Units Sold by Region, TURP Market, Global, 2018 – 2028 |

| Figure 9‑49: Average Selling Price by Region, TURP Market, Global, 2018 – 2028 (US$) |

| Figure 9‑50: Market Value by Region, TURP Market, Global, 2018 – 2028 (US$M) |

| Figure 9‑51: Monopolar Electrode Market, Global, 2018 – 2028 |

| Figure 9‑52: Units Sold by Region, Monopolar Electrode Market, Global, 2018 – 2028 |

| Figure 9‑53: Average Selling Price by Region, Monopolar Electrode Market, Global, 2018 – 2028 (US$) |

| Figure 9‑54: Market Value by Region, Monopolar Electrode Market, Global, 2018 – 2028 (US$M) |

| Figure 9‑55: Bipolar Electrode Market, Global, 2018 – 2028 |

| Figure 9‑56: Units Sold by Region, Bipolar Electrode Market, Global, 2018 – 2028 |

| Figure 9‑57: Average Selling Price by Region, Bipolar Electrode Market, Global, 2018 – 2028 (US$) |

| Figure 9‑58: Market Value by Region, Bipolar Electrode Market, Global, 2018 – 2028 (US$M) |

| Figure 9‑59: Laser BPH Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 9‑60: Total Laser BPH Market, Global, 2018 – 2028 |

| Figure 9‑61: Units Sold by Region, Laser BPH Market, Global, 2018 – 2028 |

| Figure 9‑62: Average Selling Price by Region, Laser BPH Market, Global, 2018 – 2028 (US$) |

| Figure 9‑63: Market Value by Region, Laser BPH Market, Global, 2018 – 2028 (US$M) |

| Figure 9‑64: Laser BPH Equipment Market by Segment, Global, 2018 – 2028 |

| Figure 9‑65: Units Sold by Region, Laser BPH Equipment Market, Global, 2018 – 2028 |

| Figure 9‑66: Average Selling Price by Region, Laser BPH Equipment Market, Global, 2018 – 2028 (US$) |

| Figure 9‑67: Market Value by Region, Laser BPH Equipment Market, Global, 2018 – 2028 (US$M) |

| Figure 9‑68: Holmium Laser BPH Equipment Market, Global, 2018 – 2028 |

| Figure 9‑69: Units Sold by Region, Holmium Laser BPH Equipment Market, Global, 2018 – 2028 |

| Figure 9‑70: Average Selling Price by Region, Holmium Laser BPH Equipment Market, Global, 2018 – 2028 (US$) |

| Figure 9‑71: Market Value by Region, Holmium Laser BPH Equipment Market, Global, 2018 – 2028 (US$M) |

| Figure 9‑72: Thulium Laser BPH Equipment Market, Global, 2018 – 2028 |

| Figure 9‑73: Units Sold by Region, Thulium Laser BPH Equipment Market, Global, 2018 – 2028 |

| Figure 9‑74: Average Selling Price by Region, Thulium Laser BPH Equipment Market, Global, 2018 – 2028 (US$) |

| Figure 9‑75: Market Value by Region, Thulium Laser BPH Equipment Market, Global, 2018 – 2028 (US$M) |

| Figure 9‑76: Laser BPH Fiber Market by Segment, Global, 2018 – 2028 |

| Figure 9‑77: Units Sold by Region, Laser BPH Fiber Market, Global, 2018 – 2028 |

| Figure 9‑78: Average Selling Price by Region, Laser BPH Fiber Market, Global, 2018 – 2028 (US$) |

| Figure 9‑79: Market Value by Region, Laser BPH Fiber Market, Global, 2018 – 2028 (US$M) |

| Figure 9‑80: Holmium Laser BPH Fiber Market, Global, 2018 – 2028 |

| Figure 9‑81: Units Sold by Region, Holmium Laser BPH Fiber Market, Global, 2018 – 2028 |

| Figure 9‑82: Average Selling Price by Region, Holmium Laser BPH Fiber Market, Global, 2018 – 2028 (US$) |

| Figure 9‑83: Market Value by Region, Holmium Laser BPH Fiber Market, Global, 2018 – 2028 (US$M) |

| Figure 9‑84: Thulium Laser BPH Fiber Market, Global, 2018 – 2028 |

| Figure 9‑85: Units Sold by Region, Thulium Laser BPH Fiber Market, Global, 2018 – 2028 |

| Figure 9‑86: Average Selling Price by Region, Thulium Laser BPH Fiber Market, Global, 2018 – 2028 (US$) |

| Figure 9‑87: Market Value by Region, Thulium Laser BPH Fiber Market, Global, 2018 – 2028 (US$M) |

| Figure 9‑88: UroLift Market, Global, 2018 – 2028 |

| Figure 9‑89: Units Sold by Region, UroLift Market, Global, 2018 – 2028 |

| Figure 9‑90: Average Selling Price by Region, UroLift Market, Global, 2018 – 2028 (US$) |

| Figure 9‑91: Market Value by Region, UroLift Market, Global, 2018 – 2028 (US$M) |

| Figure 9‑92: UroLift Procedure by Region, Global, 2018 – 2028 |

| Figure 9‑93: UroLift Procedure by Region, Cost per Case, Global, 2018 – 2028 |

| Figure 9‑94: Rezūm Market, Global, 2018 – 2028 |

| Figure 9‑95: Units Sold by Region, Rezūm Market, Global, 2018 – 2028 |

| Figure 9‑96: Average Selling Price by Region, Rezūm Market, Global, 2018 – 2028 (US$) |

| Figure 9‑97: Market Value by Region, Rezūm Market, Global, 2018 – 2028 (US$M) |

| Figure 9‑98: Leading Competitors, BPH Treatment Device Market, Global, 2021 |

| Figure 10‑1: Urological Endoscope Markets Covered |

| Figure 10‑2: Urological Endoscope Regions Covered, Global (1 of 2) |

| Figure 10‑3: Urological Endoscope Regions Covered, Global (2 of 2) |

| Figure 10‑4: Urological Endoscope Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 10‑5: Urological Endoscope Market by Region, Global, 2018 – 2028 (US$M) |

| Figure 10‑6: Urological Endoscope Market, Global, 2018 – 2028 |

| Figure 10‑7: Units Sold by Region, Urological Endoscope Market, Global, 2018 – 2028 |

| Figure 10‑8: Average Selling Price by Region, Urological Endoscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑9: Market Value by Region, Urological Endoscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑10: Cystoscope Market by Segment, Global, 2018 – 2028 |

| Figure 10‑11: Units Sold by Region, Cystoscope Market, Global, 2018 – 2028 |

| Figure 10‑12: Average Selling Price by Region, Cystoscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑13: Market Value by Region, Cystoscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑14: Single-Use Cystoscope Market, Global, 2018 – 2028 |

| Figure 10‑15: Units Sold by Region, Single-Use Cystoscope Market, Global, 2018 – 2028 |

| Figure 10‑16: Average Selling Price by Region, Single-Use Cystoscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑17: Market Value by Region, Single-Use Cystoscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑18: Rigid Cystoscope Market, Global, 2018 – 2028 |

| Figure 10‑19: Units Sold by Region, Rigid Cystoscope Market, Global, 2018 – 2028 |

| Figure 10‑20: Average Selling Price by Region, Rigid Cystoscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑21: Market Value by Region, Rigid Cystoscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑22: Reusable Flexible Cystoscope Market by Segment, Global, 2018 – 2028 |

| Figure 10‑23: Units Sold by Region, Reusable Flexible Cystoscope Market, Global, 2018 – 2028 |

| Figure 10‑24: Average Selling Price by Region, Reusable Flexible Cystoscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑25: Market Value by Region, Reusable Flexible Cystoscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑26: Fiber Optic Cystoscope Market, Global, 2018 – 2028 |

| Figure 10‑27: Units Sold by Region, Fiber Optic Cystoscope Market, Global, 2018 – 2028 |

| Figure 10‑28: Average Selling Price by Region, Fiber Optic Cystoscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑29: Market Value by Region, Fiber Optic Cystoscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑30: Video Cystoscope Market, Global, 2018 – 2028 |

| Figure 10‑31: Units Sold by Region, Video Cystoscope Market, Global, 2018 – 2028 |

| Figure 10‑32: Average Selling Price by Region, Video Cystoscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑33: Market Value by Region, Video Cystoscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑34: Ureteroscope Market by Segment, Global, 2018 – 2028 |

| Figure 10‑35: Units Sold by Region, Ureteroscope Market, Global, 2018 – 2028 |

| Figure 10‑36: Average Selling Price by Region, Ureteroscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑37: Market Value by Region, Ureteroscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑38: Single-Use Ureteroscope Market, Global, 2018 – 2028 |

| Figure 10‑39: Units Sold by Region, Single-Use Ureteroscope Market, Global, 2018 – 2028 |

| Figure 10‑40: Average Selling Price by Region, Single-Use Ureteroscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑41: Market Value by Region, Single-Use Ureteroscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑42: Semi-Rigid Ureteroscope Market, Global, 2018 – 2028 |

| Figure 10‑43: Units Sold by Region, Semi-Rigid Ureteroscope Market, Global, 2018 – 2028 |

| Figure 10‑44: Average Selling Price by Region, Semi-Rigid Ureteroscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑45: Market Value by Region, Semi-Rigid Ureteroscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑46: Reusable Flexible Ureteroscope Market by Segment, Global, 2018 – 2028 |

| Figure 10‑47: Units Sold by Region, Reusable Flexible Ureteroscope Market, Global, 2018 – 2028 |

| Figure 10‑48: Average Selling Price by Region, Reusable Flexible Ureteroscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑49: Market Value by Region, Reusable Flexible Ureteroscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑50: Fiber Optic Ureteroscope Market, Global, 2018 – 2028 |

| Figure 10‑51: Units Sold by Region, Fiber Optic Ureteroscope Market, Global, 2018 – 2028 |

| Figure 10‑52: Average Selling Price by Region, Fiber Optic Ureteroscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑53: Market Value by Region, Fiber Optic Ureteroscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑54: Video Ureteroscope Market, Global, 2018 – 2028 |

| Figure 10‑55: Units Sold by Region, Video Ureteroscope Market, Global, 2018 – 2028 |

| Figure 10‑56: Average Selling Price by Region, Video Ureteroscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑57: Market Value by Region, Video Ureteroscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑58: Resectoscope Market, Global, 2018 – 2028 |

| Figure 10‑59: Units Sold by Region, Resectoscope Market, Global, 2018 – 2028 |

| Figure 10‑60: Average Selling Price by Region, Resectoscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑61: Market Value by Region, Resectoscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑62: Nephroscope Market, Global, 2018 – 2028 |

| Figure 10‑63: Units Sold by Region, Nephroscope Market, Global, 2018 – 2028 |

| Figure 10‑64: Average Selling Price by Region, Nephroscope Market, Global, 2018 – 2028 (US$) |

| Figure 10‑65: Market Value by Region, Nephroscope Market, Global, 2018 – 2028 (US$M) |

| Figure 10‑66: Leading Competitors, Urological Endoscope Market, Global, 2021 |

| Figure 11‑1: Low Dose Radiation Brachytherapy Market Regions Covered, Global (1 of 2) |

| Figure 11‑2: Low Dose Radiation Brachytherapy Market Regions Covered, Global (2 of 2) |

| Figure 11‑3: Low Dose Radiation Brachytherapy Market, Global, 2018 – 2028 |

| Figure 11‑4: Units Sold by Region, Low Dose Radiation Brachytherapy Market, Global, 2018 – 2028 |

| Figure 11‑5: Average Selling Price by Region, Low Dose Radiation Brachytherapy Market, Global, 2018 – 2028 (US$) |

| Figure 11‑6: Market Value by Region, Low Dose Radiation Brachytherapy Market, Global, 2018 – 2028 (US$M) |

| Figure 11‑7: Leading Competitors, Low Dose Radiation Brachytherapy Market, Global, 2021 |

| Figure 12‑1: Nephrostomy Markets Covered |

| Figure 12‑2: Nephrostomy Regions Covered, Global (1 of 2) |

| Figure 12‑3: Nephrostomy Regions Covered, Global (2 of 2) |

| Figure 12‑4: Nephrostomy Procedures by Region, Global, 2018 – 2028 |

| Figure 12‑5: Nephrostomy Procedures by Country, North America, 2018 – 2028 |

| Figure 12‑6: Nephrostomy Procedures by Country, Latin America, 2018 – 2028 (1 of 2) |

| Figure 12‑7: Nephrostomy Procedures by Country, Latin America, 2018 – 2028 (2 of 2) |

| Figure 12‑8: Nephrostomy Procedures by Country, Western Europe, 2018 – 2028 |

| Figure 12‑9: Nephrostomy Procedures by Country, Central & Eastern Europe, 2018 – 2028 (1 of 2) |

| Figure 12‑10: Nephrostomy Procedures by Country, Central & Eastern Europe, 2018 – 2028 (2 of 2) |

| Figure 12‑11: Nephrostomy Procedures by Country, Middle East, 2018 – 2028 |

| Figure 12‑12: Nephrostomy Procedures by Country, Asia-Pacific, 2018 – 2028 (1 of 3) |

| Figure 12‑13: Nephrostomy Procedures by Country, Asia-Pacific, 2018 – 2028 (2 of 3) |

| Figure 12‑14: Nephrostomy Procedures by Country, Asia-Pacific, 2018 – 2028 (3 of 3) |

| Figure 12‑15: Nephrostomy Procedures by Country, Africa, 2018 – 2028 (1 of 2) |

| Figure 12‑16: Nephrostomy Procedures by Country, Africa, 2018 – 2028 (2 of 2) |

| Figure 12‑17: Nephrostomy Device Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 12‑18: Nephrostomy Device Market by Region, Global, 2018 – 2028 (US$M) |

| Figure 12‑19: Percutaneous Nephrostomy Set Market, Global, 2018 – 2028 |

| Figure 12‑20: Units Sold by Region, Percutaneous Nephrostomy Set Market, Global, 2018 – 2028 |

| Figure 12‑21: Average Selling Price by Region, Percutaneous Nephrostomy Set Market, Global, 2018 – 2028 (US$) |

| Figure 12‑22: Market Value by Region, Percutaneous Nephrostomy Set Market, Global, 2018 – 2028 (US$M) |

| Figure 12‑23: Nephrostomy Balloon Catheter Market, Global, 2018 – 2028 |

| Figure 12‑24: Units Sold by Region, Nephrostomy Balloon Catheter Market, Global, 2018 – 2028 |

| Figure 12‑25: Average Selling Price by Region, Nephrostomy Balloon Catheter Market, Global, 2018 – 2028 (US$) |

| Figure 12‑26: Market Value by Region, Nephrostomy Balloon Catheter Market, Global, 2018 – 2028 (US$M) |

| Figure 12‑27: Nephrostomy Drainage Tube Market, Global, 2018 – 2028 |

| Figure 12‑28: Units Sold by Region, Nephrostomy Drainage Tube Market, Global, 2018 – 2028 |

| Figure 12‑29: Average Selling Price by Region, Nephrostomy Drainage Tube Market, Global, 2018 – 2028 (US$) |

| Figure 12‑30: Market Value by Region, Nephrostomy Drainage Tube Market, Global, 2018 – 2028 (US$M) |

| Figure 12‑31: Leading Competitors, Nephrostomy Device Market, Global, 2021 |

| Figure 13‑1: Erectile Dysfunction Device Markets Covered |

| Figure 13‑2: Erectile Dysfunction Device Regions Covered, Global (1 of 2) |

| Figure 13‑3: Erectile Dysfunction Device Regions Covered, Global (2 of 2) |

| Figure 13‑4: Erectile Dysfunction Device Market by Segment, Global, 2018 – 2028 (US$M) |

| Figure 13‑5: Erectile Dysfunction Device Market by Region, Global, 2018 – 2028 (US$M) |

| Figure 13‑6: Erectile Dysfunction Device Market, Global, 2018 – 2028 |

| Figure 13‑7: Units Sold by Region, Erectile Dysfunction Device Market, Global, 2018 – 2028 |

| Figure 13‑8: Average Selling Price by Region, Erectile Dysfunction Device Market, Global, 2018 – 2028 (US$) |

| Figure 13‑9: Market Value by Region, Erectile Dysfunction Device Market, Global, 2018 – 2028 (US$M) |

| Figure 13‑10: Inflatable Erectile Dysfunction Device Market, Global, 2018 – 2028 |

| Figure 13‑11: Units Sold by Region, Inflatable Erectile Dysfunction Device Market, Global, 2018 – 2028 |

| Figure 13‑12: Average Selling Price by Region, Inflatable Erectile Dysfunction Device Market, Global, 2018 – 2028 (US$) |

| Figure 13‑13: Market Value by Region, Inflatable Erectile Dysfunction Device Market, Global, 2018 – 2028 (US$M) |

| Figure 13‑14: Malleable Erectile Dysfunction Device Market, Global, 2018 – 2028 |

| Figure 13‑15: Units Sold by Region, Malleable Erectile Dysfunction Device Market, Global, 2018 – 2028 |

| Figure 13‑16: Average Selling Price by Region, Malleable Erectile Dysfunction Device Market, Global, 2018 – 2028 (US$) |

| Figure 13‑17: Market Value by Region, Malleable Erectile Dysfunction Device Market, Global, 2018 – 2028 (US$M) |

| Figure 13‑18: Leading Competitors, Erectile Dysfunction Device Market, Global, 2021 |

| Figure 14‑1: Urinary Guidewire Regions Covered, Global (1 of 2) |

| Figure 14‑2: Urinary Guidewire Regions Covered, Global (2 of 2) |

| Figure 14‑3: Urinary Guidewire Market, Global, 2018 – 2028 |

| Figure 14‑4: Units Sold by Region, Urinary Guidewire Market, Global, 2018 – 2028 |

| Figure 14‑5: Average Selling Price by Region, Urinary Guidewire Market, Global, 2018 – 2028 (US$) |

| Figure 14‑6: Market Value by Region, Urinary Guidewire Market, Global, 2018 – 2028 (US$M) |

| Figure 14‑7: Leading Competitors, Urinary Guidewire Market, Global, 2021 |

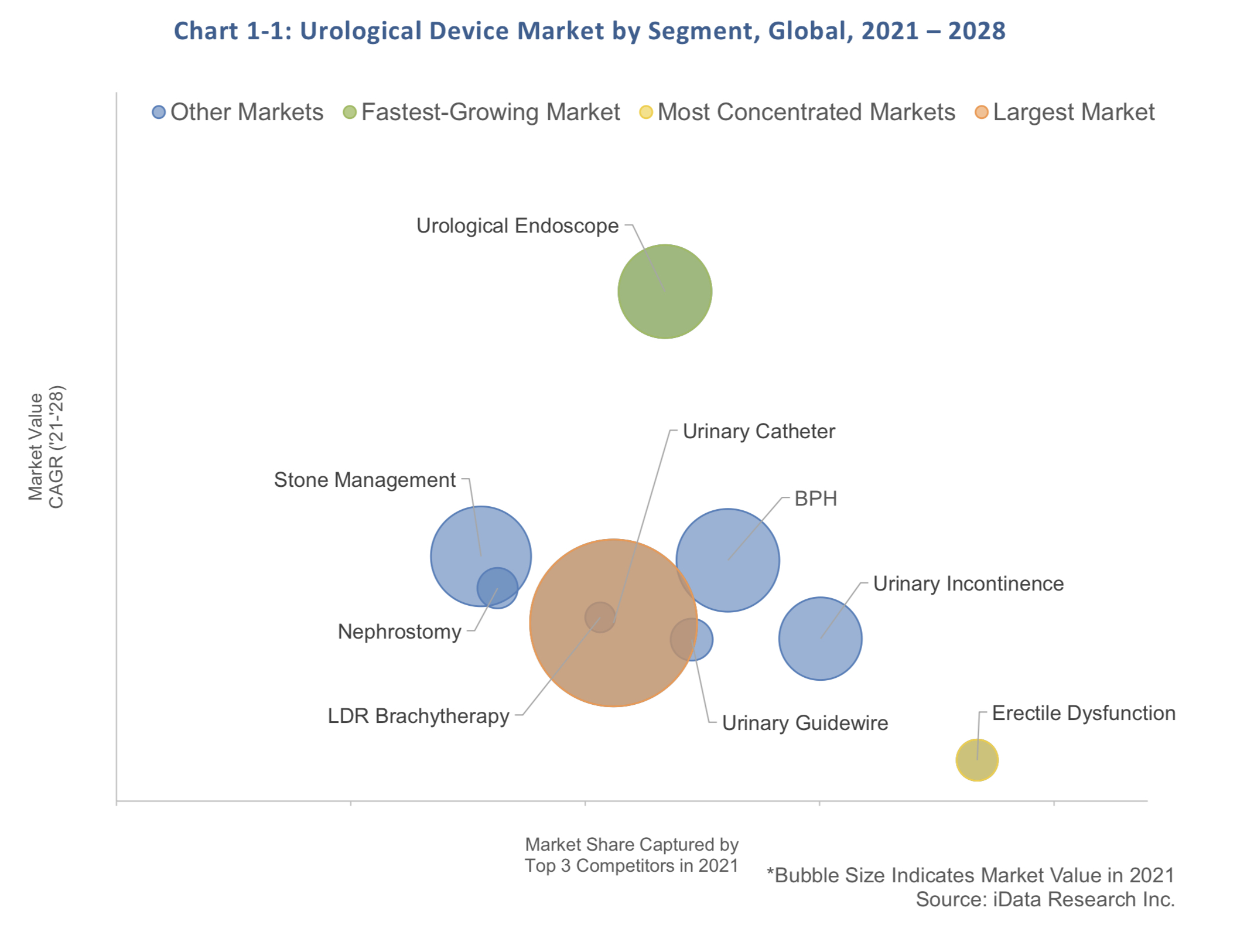

One of the most successful innovations in the urological device market was the inception of the single-use flexible ureteroscope market with the launch of Boston Scientific’s LithoVueTM in 2016. Because of the single-use nature of the device, the costly process of reprocessing and sterilization is eliminated. The success of the market has spawned a number of companies seeking to cash in on single-use scopes. Indeed, the advent of single-use ureteroscopes has inspired single-use cystoscopes as well.

One of the most successful innovations in the urological device market was the inception of the single-use flexible ureteroscope market with the launch of Boston Scientific’s LithoVueTM in 2016. Because of the single-use nature of the device, the costly process of reprocessing and sterilization is eliminated. The success of the market has spawned a number of companies seeking to cash in on single-use scopes. Indeed, the advent of single-use ureteroscopes has inspired single-use cystoscopes as well. In 2021, the leading competitor in the global urological device market was Boston Scientific. The company held the leading positions in the urinary incontinence, stone management, BPH treatment and erectile dysfunction device markets.

In 2021, the leading competitor in the global urological device market was Boston Scientific. The company held the leading positions in the urinary incontinence, stone management, BPH treatment and erectile dysfunction device markets.