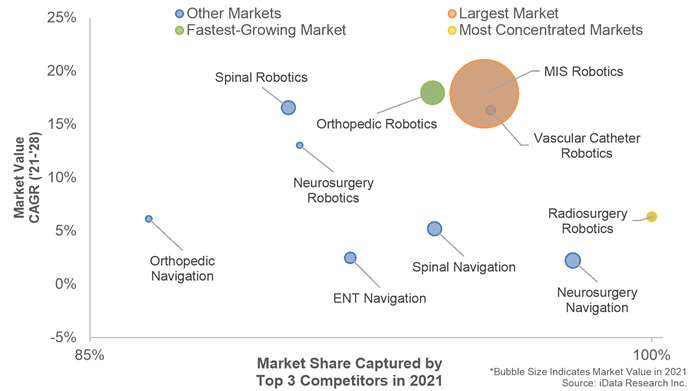

| Figure 1‑1: Surgical Navigation and Robotics Market Share Ranking by Segment, U.S., 2021 |

| Figure 1‑2: Companies Researched in this Report (1 of 2) |

| Figure 1‑3: Companies Researched in this Report (2 of 2) |

| Figure 1‑4: Factors Impacting the Surgical Navigation and Robotics Market by Segment, U.S. |

| Figure 1‑5: Recent Events in the Surgical Navigation and Robotics Market, 2018 – 2022 (1 of 6) |

| Figure 1‑6: Recent Events in the Surgical Navigation and Robotics Market, 2018 – 2022 (2 of 6) |

| Figure 1‑7: Recent Events in the Surgical Navigation and Robotics Market, 2018 – 2022 (3 of 6) |

| Figure 1‑8: Recent Events in the Surgical Navigation and Robotics Market, 2018 – 2022 (4 of 6) |

| Figure 1‑9: Recent Events in the Surgical Navigation and Robotics Market, 2018 – 2022 (5 of 6) |

| Figure 1‑10: Recent Events in the Surgical Navigation and Robotics Market, 2018 – 2022 (6 of 6) |

| Figure 1‑11: Surgical Navigation Procedures Covered (1 of 2) |

| Figure 1‑12: Surgical Robotics Procedures Covered (2 of 2) |

| Figure 1‑13: CPT Procedure Codes Investigated (1 of 2) |

| Figure 1‑14: CPT Procedure Codes Investigated (2 of 2) |

| Figure 1‑15: Surgical Navigation Markets Covered (1 of 2) |

| Figure 1‑16: Surgical Navigation Markets Covered (2 of 2) |

| Figure 1‑17: Surgical Robotics Markets Covered (1 of 2) |

| Figure 1‑18: Surgical Robotics Markets Covered (2 of 2) |

| Figure 1‑19: Key Report Updates |

| Figure 1‑20: Version History |

| Figure 2‑1: Surgical Navigation and Robotics Market by Segment, Worst Case Scenario, U.S., 2018 – 2028 (US$M) |

| Figure 2‑2: Surgical Navigation and Robotics Market by Segment, Base Case Scenario, U.S., 2018 – 2028 (US$M) |

| Figure 2‑3: Surgical Navigation and Robotics Market by Segment, Best Case Scenario, U.S., 2018 – 2028 (US$M) |

| Figure 4‑1: ENT Navigation Products by Company |

| Figure 4‑2: Neurosurgery Navigation Products by Company |

| Figure 4‑3: Orthopedic Navigation Products by Company |

| Figure 4‑4: Spine Navigation Products by Company |

| Figure 4‑5: Robot-Assisted Laparoscopy and Flexible Endoscopy Products by Company |

| Figure 4‑6: Robot-Assisted Orthopedic Surgery Products by Company |

| Figure 4‑7: Robot-Assisted Spine Surgery Products by Company |

| Figure 4‑8: Robot-Assisted Neurosurgery Products by Company |

| Figure 4‑9: Robot-Assisted Radiosurgery Products by Company |

| Figure 4‑10: Robot-Assisted Catheter Placement Products by Company |

| Figure 4‑11: Class 2 Device Recall ExacTrac Dynamic Software |

| Figure 4‑12: Class 2 Device Recall ExacTrac Dynamic |

| Figure 4‑13: Class 2 Device Recall Kick Navigation System |

| Figure 4‑14: Class 2 Device Recall Brainlab Cranial Image Guided Surgery System / Instrument, Stereotaxic |

| Figure 4‑15: |

| Figure 4‑16: Class 2 Device Recall Mazor X System (Mazor X Stealth Edition) |

| Figure 4‑17: Class 2 Device Recall NavLock Blue Tracker |

| Figure 4‑18: |

| Figure 4‑19: Class 2 Device Recall Mazor X Stealth Edition Snapshot Orthopedic stereotaxic instrument |

| Figure 4‑20 Class 2 Device Recall Medtronic Navigation |

| Figure 4‑21: Class 2 Device Recall Polaris Spectra Camera for StealthStation S7 System |

| Figure 4‑22:Class 2 Device Recall Streamline MIS Navigation System |

| Figure 4‑23 Class 2 Device Recall Catalyst System |

| Figure 4‑24: Class 2 Device Recall VERICIS CARDIOVASCULAR IMAGE AND INFORMATION SYSTEM, MODEL 4.0 |

| Figure 4‑25 Class 2 Device Recall Leksell Vantage Stereotactic System |

| Figure 4‑26: Class 2 Device Recall Intellijoint Navigation System |

| Figure 4‑27: Class 2 Device Recall MRIdian Linac Systems |

| Figure 4‑28: Class 2 Device Recall Exactech GPS Orthopedic stereotaxic instrument |

| Figure 4‑29: Class 2 Device Recall TruDi NAV Suction Instruments |

| Figure 4‑30: Class 2 Device Recall CyberKnife Treatment Delivery System |

| Figure 4‑31: Class 2 Device Recall Mechatronic Vario Guide |

| Figure 4‑32: Class 2 Device Recall da Vinci X/Xi Instrument Arm Drapes |

| Figure 4‑33:Class 2 Device Recall Ion Endoluminal System |

| Figure 4‑34 Class 2 Device Recall da Vinci SP Camera |

| Figure 4‑35: Class 2 Device Recall da Vinci SP Surgical System |

| Figure 4‑36:Class 2 Device Recall da Vinci X Surgical System |

| Figure 4‑37 Class 2 Device Recall daVinci XI Sureform 60 Reload |

| Figure 4‑38: Class 2 Device Recall Medtronic |

| Figure 4‑39:Class 2 Device Recall ARTISTE, MEVATRON, ONCOR, and PRIMUS |

| Figure 4‑40: Class 2 Device Recall Mako Integrated Cutting System (MICS) Handpiece |

| Figure 4‑41: Class 2 Device Recall Mako Hip End Effector |

| Figure 4‑42:Class 2 Device Recall ROSA Brain 3.0 and 3.1 ApplicationBrain |

| Figure 4‑43: Class 2 Device Recall Elekta Harmony Pro, Elekta Infinity, and Elekta Versa HD |

| Figure 4‑44 Class 2 Device Recall Elekta Unity MRLinac, ImageGuided Radiation Therapy System |

| Figure 4‑45: Class 2 Device Recall Elekta Unity |

| Figure 4‑46: Class 2 Device Recall MRIdian Linac System |

| Figure 4‑47: Class 2 Device Recall MRIdian Linac System with 138leaf Collimator |

| Figure 4‑48 Class 2 Device Recall Leksell Vantage Stereotactic System |

| Figure 4‑49: Class 2 Device Recall MRIdian & MRIdian Linac Radiation Therapy System |

| Figure 4‑50: Class 1 Device Recall BrightMatter Guide |

| Figure 4‑51: Orthopilot Elite Post-Market Clinical Follow-Up |

| Figure 4‑52: The Spinal Navigation Trial - Surgical Navigation or Free Hand Technique in Spine Surgery (SPINAV) |

| Figure 4‑53: Medacta NextAR TKA Pivotal Trial |

| Figure 4‑54: Comparing Surgical and Economical Parameters of Total Knee Replacement |

| Figure 4‑55:Medtronic X Versus O-arm Navigation for Pedicle Screw Insertion (RGNV) |

| Figure 4‑56: The European Robotic Spinal Instrumentation (EUROSPIN) Study: A European Prospective Multicenter Multinational Pragmatic Trial on Robot-guided Versus Navigated Versus Freehand Pedicle Screw Fixation |

| Figure 4‑57: Robotic vs. Freehand Corrective Surgery for Pediatric Scoliosis (PEDSCOLI) |

| Figure 4‑58: MIS ReFRESH: Robotic vs. Freehand Minimally Invasive Spinal Surgeries |

| Figure 4‑59: Evaluation Protocol of the Installation of Knee Unicompartmental Prosthesis (Journey (Smith & Nephew)) With Mechanical Ancillary Versus Robotic Assisted (Navio System). (PUC NAVIO) |

| Figure 4‑60: Navio Robotic Versus Conventional Total Knee Arthroplasty |

| Figure 4‑61: RCT: Mako Medial Unicondylar Knee Arthroplasty vs Oxford Unicondylar Knee Arthroplasty |

| Figure 4‑62:Cardiac Positioning System (CPS) - a Navigation System to Guide Pace Mapping of Ischemic Scar During Catheter Ablation Therapy of Post-myocardial Infarction (MI) Ventricular Tachycardia (VT) in Adults |

| Figure 4‑63: Evaluation of the Accuracy of Surgical Navigation in Spine Instrumentation Using Augmented Reality (HoloNavi) |

| Figure 4‑64: Clinical Study to Prove Safety and Effectiveness When Applying RUS™ Surgical Navigation |

| Figure 4‑65: Electromagnetic Navigation During Ultrasound Guided Foam Sclerotherapy for Venous Malformations (SCLERONAV) |

| Figure 4‑66: A Randomized Controlled Trial for Patients Underwent Total Hip Arthroplasties Assisted by Surgical Navigation System |

| Figure 4‑67: CyberKnife Radiosurgery for Localized Prostatic Carcinoma |

| Figure 4‑68: A Phase II Study of Cyberknife Radiosurgery for Renal Cell Carcinoma |

| Figure 4‑69: Patients' Expectations About Effects of Robotic Surgery for Cancer |

| Figure 4‑70: Measuring the Quality of Surgical Care and Setting Benchmarks for Training Using Intuitive Data Recorder Technology (MASTERY) |

| Figure 4‑71: MicroPort® Endoscopic Instrument Control System to Accomplish Robotic-assisted Surgery in Urology (MARS) |

| Figure 4‑72: Survivorship and Outcomes of Robot Assisted Medial Partial Knee Replacement |

| Figure 4‑73: Clinical and Economic Comparison of Robot Assisted Versus Manual Knee Replacement |

| Figure 4‑74: Conventional Total Hip Arthroplasty vs Mako Robotic-arm Assisted Total Hip Arthroplasty |

| Figure 4‑75:Mako Functionally Aligned Total Knee Arthroplasty vs Mako Mechanically Aligned Total Knee Arthroplasty |

| Figure 4‑76: Outcomes of Robotic Total Hip Arthroplasty |

| Figure 4‑77: SWOT Analysis, Accuray |

| Figure 4‑78: SWOT Analysis, Auris Health |

| Figure 4‑79: SWOT Analysis, Brainlab AG |

| Figure 4‑80: SWOT Analysis, Catheter Precision |

| Figure 4‑81: SWOT Analysis, Globus Medical |

| Figure 4‑82: SWOT Analysis, Intuitive Surgical |

| Figure 4‑83: SWOT Analysis, Medtronic |

| Figure 4‑84: SWOT Analysis, Siemens Healthineers |

| Figure 4‑85: SWOT Analysis, Smith & Nephew |

| Figure 4‑86: SWOT Analysis, Stryker |

| Figure 4‑87: SWOT Analysis, Zimmer Biomet |

| Figure 5‑1: CPT Procedure Codes Investigated (1 of 2) |

| Figure 5‑2: CPT Procedure Codes Investigated (2 of 2) |

| Figure 5‑3: Surgical Navigation Procedures by Segment, U.S., 2018 – 2028 |

| Figure 5‑4: Orthopedic Procedures with Surgical Navigation by Anatomy, U.S., 2018 – 2028 |

| Figure 5‑5: Orthopedic Procedures with Surgical Navigation by Care Setting, U.S., 2018 – 2028 |

| Figure 5‑6: Spinal Procedures with Surgical Navigation by Type, U.S., 2018 – 2028 |

| Figure 5‑7: Thoracolumbar Spinal Fixation Navigation Procedures by Type, U.S., 2018 – 2028 |

| Figure 5‑8: Spinal Procedures with Surgical Navigation by Care Setting, U.S., 2018 – 2028 |

| Figure 5‑9: Neurosurgery Procedures with Surgical Navigation by Care Setting, U.S., 2018 – 2028 |

| Figure 5‑10: ENT Procedures with Surgical Navigation by Care Setting, U.S., 2018 – 2028 |

| Figure 5‑11: Robotic-Assisted Procedures by Segment, U.S., 2018 – 2028 |

| Figure 5‑12: Robotic-Assisted Minimally Invasive Procedures by Anatomy, U.S., 2018 – 2028 |

| Figure 5‑13: Robotic-Assisted Minimally Invasive Procedures by Care Setting, U.S., 2018 – 2028 |

| Figure 5‑14: Robotic-Assisted Orthopedic Procedures by Anatomy, U.S., 2018 – 2028 |

| Figure 5‑15: Robotic-Assisted Orthopedic Procedures by Care Setting, U.S., 2018 – 2028 |

| Figure 5‑16: Robotic-Assisted Spinal Procedures by Anatomy, U.S., 2018 – 2028 |

| Figure 5‑17: Thoracolumbar Spinal Fixation Robotic-Assisted Procedures by Type, U.S., 2018 – 2028 |

| Figure 5‑18: Robotic-Assisted Spinal Procedures by Care Setting, U.S., 2018 – 2028 |

| Figure 5‑19: Robotic-Assisted Neurosurgery Procedures by Care Setting, U.S., 2018 – 2028 |

| Figure 5‑20: Robotic-Assisted Radiosurgery Procedures by Care Setting, U.S., 2018 – 2028 |

| Figure 5‑21: Robotic-Assisted Vascular Catheter Placement Procedures by Care Setting, U.S., 2018 – 2028 |

| Figure 6‑1: Limited Use Accessories (LUA) Market Segment |

| Figure 6‑2: Most Frequently Used Navigation-Specific LUA by Surgical Application |

| Figure 6‑3: Surgical Navigation Market by Segment, U.S., 2018 – 2028 (US$M) |

| Figure 6‑4: Surgical Navigation Market by Revenue Type, U.S., 2018 – 2028 (US$M) |

| Figure 6‑5: Leading Competitors by Segment, Surgical Navigation Market, U.S., 2021 |

| Figure 7‑1: Limited Use Accessories (LUA) Market Segment |

| Figure 7‑2: Most Frequently Used Orthopedic Navigation LUA |

| Figure 7‑3: Orthopedic Navigation System Market by Segment, U.S., 2018 – 2028 (US$M) |

| Figure 7‑4: Orthopedic Navigation Sensor Market, U.S., 2018 – 2028 |

| Figure 7‑5: Orthopedic Navigation Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 7‑6: Orthopedic Navigation Capital Equipment Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 7‑7: Orthopedic Navigation Hospital Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 7‑8: Orthopedic Navigation Alternate Care Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 7‑9: Orthopedic Navigation Capital Equipment Market by Size, U.S., 2018 – 2028 (US$M) |

| Figure 7‑10: Orthopedic Navigation Small Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 7‑11: Orthopedic Navigation Large Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 7‑12: Orthopedic Navigation LUA Market, U.S., 2018 – 2028 |

| Figure 7‑13: Orthopedic Navigation LUA Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 7‑14: Orthopedic Navigation Hospital LUA Market, U.S., 2018 – 2028 |

| Figure 7‑15: Orthopedic Navigation Alternate Care LUA Market, U.S., 2018 – 2028 |

| Figure 7‑16: Orthopedic Navigation Service and Maintenance Revenue, U.S., 2018 – 2028 |

| Figure 7‑17: Orthopedic Navigation System Placements by Financial Arrangements, U.S., 2018 – 2028 |

| Figure 7‑18: Leading Competitors, Orthopedic Navigation System Market, U.S., 2021 |

| Figure 8‑1: Limited Use Accessories (LUA) Market Segment |

| Figure 8‑2: Most Frequently Used Spinal Surgery Navigation LUA |

| Figure 8‑3: Spine Navigation System Market by Segment, U.S., 2018 – 2028 (US$M) |

| Figure 8‑4: Spine Navigation Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 8‑5: Spine Navigation Capital Equipment Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 8‑6: Spine Navigation Hospital Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 8‑7: Spine Navigation Alternate Care Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 8‑8: Spine Navigation LUA Market, U.S., 2018 – 2028 |

| Figure 8‑9: Spine Navigation LUA Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 8‑10: Spine Navigation Hospital LUA Market, U.S., 2018 – 2028 |

| Figure 8‑11: Spine Navigation Alternate Care LUA Market, U.S., 2018 – 2028 |

| Figure 8‑12: Spine Navigation Service and Maintenance Revenue, U.S., 2018 – 2028 |

| Figure 8‑13: Spine Navigation System Placements by Financial Arrangements, U.S., 2018 – 2028 |

| Figure 8‑14: Leading Competitors, Spine Navigation System Market, U.S., 2021 |

| Figure 9‑1: Limited Use Accessories (LUA) Market Segment |

| Figure 9‑2: Most Frequently Used Neurosurgery Navigation LUA |

| Figure 9‑3: Neurosurgery Navigation System Market by Segment, U.S., 2018 – 2028 (US$M) |

| Figure 9‑4: Neurosurgery Navigation Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 9‑5: Neurosurgery Navigation Capital Equipment Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 9‑6: Neurosurgery Navigation Hospital Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 9‑7: Neurosurgery Navigation Alternate Care Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 9‑8: Neurosurgery Navigation LUA Market, U.S., 2018 – 2028 |

| Figure 9‑9: Neurosurgery Navigation LUA Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 9‑10: Neurosurgery Navigation Hospital LUA Market, U.S., 2018 – 2028 |

| Figure 9‑11: Neurosurgery Navigation Alternate Care LUA Market, U.S., 2018 – 2028 |

| Figure 9‑12: Neurosurgery Navigation Service and Maintenance Revenue, U.S., 2018 – 2028 |

| Figure 9‑13: Neurosurgery Navigation System Placements by Financial Arrangements, U.S., 2018 – 2028 |

| Figure 9‑14: Leading Competitors, Neurosurgery Navigation System Market, U.S., 2021 |

| Figure 10‑1: Limited Use Accessories (LUA) Market Segment |

| Figure 10‑2: Most Frequently Used ENT Navigation LUA |

| Figure 10‑3: ENT Navigation System Market by Segment, U.S., 2018 – 2028 (US$M) |

| Figure 10‑4: ENT Navigation Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 10‑5: ENT Navigation Capital Equipment Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 10‑6: ENT Navigation Hospital Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 10‑7: ENT Navigation Alternate Care Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 10‑8: ENT Navigation LUA Market, U.S., 2018 – 2028 |

| Figure 10‑9: ENT Navigation LUA Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 10‑10: ENT Navigation Hospital LUA Market, U.S., 2018 – 2028 |

| Figure 10‑11: ENT Navigation Alternate Care LUA Market, U.S., 2018 – 2028 |

| Figure 10‑12: ENT Navigation Service and Maintenance Revenue, U.S., 2018 – 2028 |

| Figure 10‑13: ENT Navigation System Placements by Financial Arrangements, U.S., 2018 – 2028 |

| Figure 10‑14: Leading Competitors, ENT Navigation System Market, U.S., 2021 |

| Figure 11‑1: Limited Use Accessories (LUA) Market Segment |

| Figure 11‑2: Surgical Robotics Market by Segment, U.S., 2018 – 2028 (US$M) |

| Figure 11‑3: Surgical Robotics Market by Revenue Type, U.S., 2018 – 2028 (US$M) |

| Figure 11‑4: Leading Competitors by Segment, Surgical Robotics Market, U.S., 2021 |

| Figure 12‑1: Limited Use Accessories (LUA) Market Segment |

| Figure 12‑2: Minimally Invasive Surgery Robotic System Market by Segment, U.S., 2018 – 2028 (US$M) |

| Figure 12‑3: MIS Robotic Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 12‑4: MIS Robotic Capital Equipment Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 12‑5: MIS Robotic Hospital Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 12‑6: MIS Robotic Alternate Care Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 12‑7: MIS Robotic LUA Market, U.S., 2018 – 2028 |

| Figure 12‑8: MIS Robotic LUA Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 12‑9: MIS Robotic Hospital LUA Market, U.S., 2018 – 2028 |

| Figure 12‑10: MIS Robotic Alternate Care LUA Market, U.S., 2018 – 2028 |

| Figure 12‑11: MIS Robotic System Service and Maintenance Revenue, U.S., 2018 – 2028 |

| Figure 12‑12: MIS Robotic System Placements by Financial Arrangements U.S., 2018 – 2028 |

| Figure 12‑13: Leading Competitors, Minimally Invasive Surgery Robotic System Market, U.S., 2021 |

| Figure 13‑1: Limited Use Accessories (LUA) Market Segment |

| Figure 13‑2: Robotic-Assisted Orthopedic Surgery System Market by Segment, U.S., 2018 – 2028 (US$M) |

| Figure 13‑3: Robotic-Assisted Orthopedic Surgery Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 13‑4: Robotic-Assisted Orthopedic Surgery Capital Equipment Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 13‑5: Robotic-Assisted Orthopedic Surgery Hospital Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 13‑6: Robotic-Assisted Orthopedic Surgery Alternate Care Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 13‑7: Robotic-Assisted Orthopedic Surgery LUA Market, U.S., 2018 – 2028 |

| Figure 13‑8: Robotic-Assisted Orthopedic Surgery LUA Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 13‑9: Robotic-Assisted Orthopedic Surgery Hospital LUA Market, U.S., 2018 – 2028 |

| Figure 13‑10: Robotic-Assisted Orthopedic Surgery Alternate Care LUA Market, U.S., 2018 – 2028 |

| Figure 13‑11: Robotic-Assisted Orthopedic Surgery Service and Maintenance Revenue, U.S., 2018 – 2028 |

| Figure 13‑12: Robotic-Assisted Orthopedic Surgery System Placements by Financial Arrangements U.S., 2018 – 2028 |

| Figure 14‑1: Limited Use Accessories (LUA) Market Segment |

| Figure 14‑2: Robotic-Assisted Spinal Surgery System Market by Segment, U.S., 2018 – 2028 (US$M) |

| Figure 14‑3: Robotic-Assisted Spinal Surgery Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 14‑4: Robotic-Assisted Spinal Surgery Capital Equipment Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 14‑5: Robotic-Assisted Spinal Surgery Hospital Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 14‑6: Robotic-Assisted Spinal Surgery Alternate Care Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 14‑7: Robotic-Assisted Spinal Surgery LUA Market, U.S., 2018 – 2028 |

| Figure 14‑8: Robotic-Assisted Spinal Surgery LUA Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 14‑9: Robotic-Assisted Spinal Surgery Hospital LUA Market, U.S., 2018 – 2028 |

| Figure 14‑10: Robotic-Assisted Spinal Surgery Alternate Care LUA Market, U.S., 2018 – 2028 |

| Figure 14‑11: Robotic-Assisted Spinal Surgery Service and Maintenance Revenue, U.S., 2018 – 2028 |

| Figure 14‑12: Robotic-Assisted Spinal Surgery System Placements by Financial Arrangements U.S., 2018 – 2028 |

| Figure 14‑13: Leading Competitors, Robotic-Assisted Spinal Surgery Market, U.S., 2021 |

| Figure 15‑1: Robotic-Assisted Neurosurgery System Market by Segment, U.S., 2018 – 2028 (US$M) |

| Figure 15‑2: Robotic-Assisted Neurosurgery Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 15‑3: Robotic-Assisted Neurosurgery Capital Equipment Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 15‑4: Robotic-Assisted Neurosurgery Hospital Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 15‑5: Robotic-Assisted Neurosurgery Alternate Care Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 15‑6: Robotic-Assisted Neurosurgery Service and Maintenance Revenue, U.S., 2018 – 2028 |

| Figure 15‑7: Robotic-Assisted Neurosurgery System Placements by Financial Arrangements U.S., 2018 – 2028 |

| Figure 15‑8: Leading Competitors, Robotic-Assisted Neurosurgery Market, U.S., 2021 |

| Figure 16‑1: Robotic Radiosurgery System Market by Segment, U.S., 2018 – 2028 (US$M) |

| Figure 16‑2: Robotic Radiosurgery Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 16‑3: Robotic Radiosurgery Capital Equipment Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 16‑4: Robotic Radiosurgery Hospital Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 16‑5: Robotic Radiosurgery Alternate Care Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 16‑6: Robotic Radiosurgery Service and Maintenance Revenue, U.S., 2018 – 2028 |

| Figure 16‑7: Robotic Radiosurgery System Placements by Financial Arrangements, U.S., 2018 – 2028 |

| Figure 16‑8: Leading Competitors, Robotic Radiosurgery System Market, U.S., 2021 |

| Figure 17‑1: Limited Use Accessories (LUA) Market Segment |

| Figure 17‑2: Robotic Vascular Catheter System Market by Segment, U.S., 2018 – 2028 (US$M) |

| Figure 17‑3: Robotic Vascular Catheter Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 17‑4: Robotic Vascular Catheter Capital Equipment Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 17‑5: Robotic Vascular Catheter Hospital Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 17‑6: Robotic Vascular Catheter Alternate Care Capital Equipment Market, U.S., 2018 – 2028 |

| Figure 17‑7: Robotic Vascular Catheter LUA Market, U.S., 2018 – 2028 |

| Figure 17‑8: Robotic Vascular Catheter LUA Market by Care Setting, U.S., 2018 – 2028 (US$M) |

| Figure 17‑9: Robotic Vascular Catheter Hospital LUA Market, U.S., 2018 – 2028 |

| Figure 17‑10: Robotic Vascular Catheter Alternate Care LUA Market, U.S., 2018 – 2028 |

| Figure 17‑11: Robotic Vascular Catheter Service and Maintenance Revenue Market, U.S., 2018 – 2028 |

| Figure 17‑12: Robotic Vascular Catheter System Placements by Financial Arrangements U.S., 2018 – 2028 |

| Figure 17‑13: Leading Competitors, Robotic Catheter System Market, U.S., 2021 |

A general trend that is being observed across all segments of the RNAV market is the shift from hospitals toward alternate care centers. In segments with lower-risk surgeries, such as orthopedic surgery, the shift toward alternate care centers is occurring more rapidly compared to segments with higher-risk surgeries such as neurosurgery or spinal surgery.

A general trend that is being observed across all segments of the RNAV market is the shift from hospitals toward alternate care centers. In segments with lower-risk surgeries, such as orthopedic surgery, the shift toward alternate care centers is occurring more rapidly compared to segments with higher-risk surgeries such as neurosurgery or spinal surgery.