According to the latest market analysis by iData Research, the US vascular access market was valued at $4.8 billion by 2020 and is expected to reach $5.7 billion in 2026. One of the biggest contributors to this growth will be the PICC, CVC, and PIVC line insertion and securement accessories market.

This market growth is primarily attributed to evidence suggesting that vascular access accessories help reduce infection rates and other catheter-related complications.

Thus, this article aims to provide insight into how this market segment is going to contribute to the growth of the overall vascular access market in the US.

Article Overview

- The Use of Accessories is on a Rise

- Shift Towards Premium Insertion Accessories

- Increasing Securement Accessories Uptake for PIVCs

- Pricing Within the Industry

- Diverse Competition

1. The Use of Accessories is on a Rise

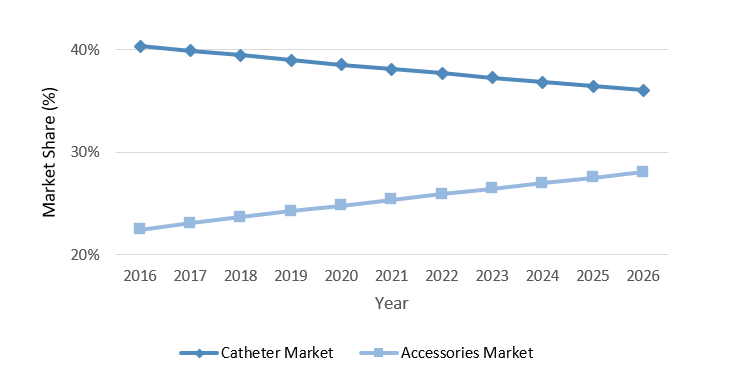

In 2019, the market share of vascular access catheters exceeded that of vascular access accessories by nearly 15%. By 2026 this gap is expected to fall below 10% (see the graph above).

Through 2026, the growth rate for the revenue of the accessories market is expected to be approximately 5%. In comparison, the rate of vascular access catheters is expected to be less than half of that value.

A prominent driver in the vascular access market for the past decade has been the desire to reduce catheter-related complications, such as bloodstream infections and needle stick injuries.

A popular approach that has been taken in reducing these complications is to utilize catheter line insertion and securement accessories. Due to this trend, they have all been experiencing rapid growth in recent years and are expected to drive the growth of the overall vascular access market.

2. Shift Towards Premium Insertion Accessories

Disposable accessories are intended to improve catheter performance in a number of ways. For instance, manufactured catheter securement devices are intended to reduce the number of dislodged or failed catheters. These products have been shown to reduce catheter-related complications by up to 42%.

Catheter patches disinfect the patient’s skin surrounding the access site and have been shown to reduce the rate of catheter-related bloodstream infections in hospitals. Catheter caps perform a similar function but with a focus on disinfecting and protecting the interior of the catheter line.

Capital products tend to have more focus on improving the rate of successful catheter insertions. For instance, ultrasound systems are utilized for major types of vascular access catheters, such as peripheral intravenous catheters (PIVCs) and central venous catheters (CVCs). They are mostly utilized for insertions of long-dwelling peripheral catheters, such as peripherally inserted central catheters (PICCs) and midline catheters.

On the other hand, vein visualization devices employ near-infrared technology to assist with catheter insertions on patients with difficult access and have been shown to improve rates of first stick success. Tip-placement systems are used almost exclusively for placement of PICC tips into the patient’s superior vena cava and are currently utilized in the majority of PICC insertions in the U.S.

3. Increasing Securement Accessories Uptake for PIVCs

PIVCs represent the vast majority of all catheters inserted in the U.S. every year, but less than half of all PIVCs utilize premium-priced disposable products. This leaves significant room for the accessories market to penetrate the PIVC space.

Unit sales of PIVCs in the U.S. dominate all other catheter segments, with nearly 50 PIVCs being sold for every catheter of any other type. Increasing the fraction of PIVCs that utilize a particular vascular access accessory by only 1% or 2% has the potential to increase unit sales of that device by 10% year-over-year.

The U.S. is trending towards increased usage of premium devices for PIVCs. This can be seen in the recent history of increased uptake of manufactured catheter securement devices and ultrasound placements for PIVCs. Despite the fact that less than 30% of all PIVCs are utilizing either of these devices, modest increases in uptake have translated to considerable increases in unit sales.

4. Pricing Within the Industry

The cost of many catheter line insertion and securement accessories is expected to remain constant or drop over the next few years. Acquired hospital purchase data through our MedSku service indicates that the cost of catheter securement, catheter caps, and antimicrobial patches have all remained flat in recent years.

Increased utilization of accessories with PIVCs is expected to lead to price declines in the market. The main reason for the price drop is a relatively low cost of PIVC themselves (typically less than $2). Using any optional accessories can double or triple the cost of a PIVC line insertion, which many healthcare facilities are hesitant to do.

In response, the market-wide average selling prices of these products have been declining. To limit further declines, many competitors have conducted studies to quantify the long-term cost and time savings associated with using their optional accessories.

Hospital purchase order data also indicates that prices of capital products have been in decline as well. The main driver for these devices is the increasing frequency of upgrades and the number of units being purchased at a discount.

It is common for healthcare facilities to upgrade their capital products every 2-3 years, despite the fact that most of the devices are intended to last for 5-10 years. These upgrades typically come at a reduced cost compared to a new purchase. As technological advancement continues to accelerate, the frequency of upgrades is increasing and market-wide prices are expected to decline correspondingly.

5. Diverse Competition

Due to the diversity of catheter insertion and securement accessories, the overall market is comprised of vastly differing companies. Becton Dickinson is the only major competitor involved in multiple accessories markets while having a great presence in the catheter business. The company’s notable products include its Site~Rite® line of vascular access ultrasound machines, its Statlock stabilization devices, and its Sherlock 3CG® tip-placement system.

Other large companies, like 3M or Johnson & Johnson, produce many disposable medical devices, only some of which can be classified as vascular access accessories. There are also companies, such as AccuVein, who exclusively develop products for vein visualization and are not present in any other medical device market.

The diversity in size and scope of these competitors reflects both the growing popularity of vascular access accessories as well as the variety of products that healthcare providers are seeking. The variety of products on the market, coupled with the downward pressure on market-wide prices, indicates that more competitors could enter the market and start offering similar products at competitive price points.

Conclusion

The vascular access device market has been growing consistently year-over-year. Continued growth in the market is expected. However, as the markets for most catheters mature, the total market will be driven forward by the emergence of catheter line insertion and securement accessories.

These accessories serve a myriad of functions, but all have the primary goal of improving the quality of vascular access procedures. In the long run, they also aim to save time and money for healthcare providers.

Significant drivers in the market are the fact that healthcare providers are increasingly seeking out premium accessories that perform more features while the use of accessories with PIVCs is becoming increasingly common. However, future market growth will be limited by pricing pressures within the industry and the intense competitive landscape present in the market.

For a more in-depth analysis of the U.S. vascular access market, refer to iData Research’s Vascular Access Devices and Accessories Market Report Suite | United States | 2020-2026 | MedSuite. It will help you gain insight into the industry’s competitive landscape with projected industry growth until the year 2026.

References

|

[1] |

iData Research Inc., “U.S. Vascular Access Device Market Report – 2020”. |

|

[2] |

B. Smith and T. Royer, “New standards for improving peripheral I.V. catheter securement,” vol. 3, no. 37, 2007. |

|

[3] |

J. Banton and V. Bann, “Impact on catheter-related bloodstream infections with the use of BIOPATCH Protective Disk with CHG dressing,” no. Fall, 2002. |

|

[4] |

A. Voor In ‘t Holt and H. O. e. al., “Antiseptic barrier cap effective in reducing central line-associated bloodstream infections: a systematic review and meta-analysis,” International Journal of Nursing Studies, no. 69, pp. 34-40, 2017. |

|

[5] |

D. Demir and S. Inal, “Does the Use of a Vein Visualization Device for Peripheral Venous Catheter Placement Increase Success Rate in Pediatric Patients?,” Pediatric Emergency Care Journal, vol. 35, no. 7, pp. 474-479, 2019. |

|

[6] |

iData Research Inc., “MedSKU Project on Vascular Access Accessories”. |

|

[7] |

K. D. D. C. e. a. Beeler C, ” Strategies for the successful implementation of disinfecting port protectors to reduce CLABSI in a large tertiary care teaching hospital,” American Journal of Infection Control, vol. 47, no. 12, pp. 1505-1507, 2019. |

|

[8] |

B. Dickinson, “Ultrasound Systems,” 2019. |

|

[9] |

Becton Dickinson, “Stabilization Devices,” 2019. |

|

[10] |

Becton Dickinson, “Tip Confirmation System,” 2019. |

|

[11] |

3M, “Curos,” 2019. |

|

[12] |

Johnson & Johnson, “BIOPATCH Protective Disk,” 2019. |

|

[13] |

AccuVein, “AV500 Vein Viewing System,” 2019. |