According to the latest market study by iData research, the European Infusion Therapy market size was estimated at around $926 million in 2020 which is almost a 10% decline from the previous year. COVID-19 is expected to play a significant role in this market due to elective procedure deferrals as well as restrictions limiting sales representatives and technicians from entering hospitals.

As we know, infusion therapy procedures can be performed either via gravity drip infusion or by using an electronic pump to automate the process. Gravity infusion is cheaper and simpler since gravity infusion sets tend to cost less than pump sets, and gravity infusion doesn’t require the purchase of an expensive infusion pump. However, pump infusion has many benefits, including an ability to deliver very specific doses of medication over lengthy periods of time.

Today, the standard of care in Europe is still gravity drip infusion. Many European countries tend to place greater emphasis on utilizing the best standards of practice to treat patients as opposed to purchasing more advanced devices. However, the pump infusions are expected to see accelerated growth in popularity and eventually overtake the gravity drip infusions.

Pump Sets on the Rise in the European Infusion Therapy Market

A “primary” intravenous set is the main line of the infusion. This device can be either a gravity set or a pump set. Pump sets typically cost a significant amount more than gravity sets. The first reason for this is that pump sets need to be manufactured in such a way that the guaranteed flow rates of the infusion pump are actually met. The second reason is that many pump sets are designed to work with only one type of infusion pump. Therefore, the manufacturers of the pump can charge a premium on the IV set, since it is required in order to perform the infusion.

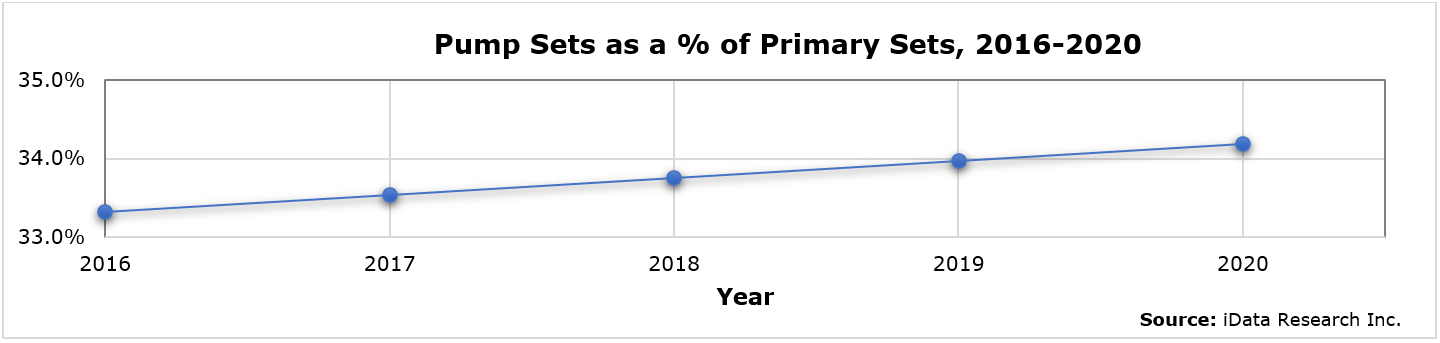

In 2019 in Europe, only about one-third of all primary sets were considered pump sets. However, this percentage has been slowly increasing over time, by fractions of a percent each year. This is a fairly slow increase, with the change from 2016 to 2020 only amounting to about 1% more primary sets being pump sets. By 2026, the number could easily exceed 35% and translate into thousands of new pump sets being used every year. In some countries where pump infusion is more prevalent, it won’t be long before more than 40% of all infusion sets sold are designed as pump sets.

The slow uptick in the penetration of pump sets is reflective of the general attitude in European healthcare and can be viewed as an early indicator of accelerated growth. However, even though there are many benefits to using pump infusion, there are also many drawbacks. One of the main safety concerns with utilizing an infusion pump is ensuring that it is actually delivering the correct dosage to patients. For this reason, many healthcare professionals in Europe would still prefer to employ gravity sets in order to ensure a simpler route to safe infusions.

Infusion Therapy Competitive Breakdown in Europe

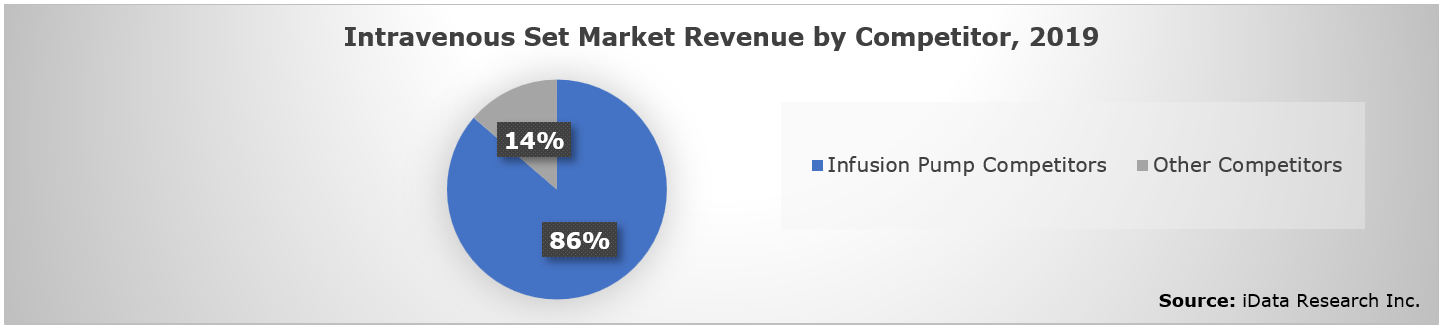

Despite the increased costs and general risk concerns, pump infusion is still poised to become the standard of care in Europe eventually. The primary reason for this is that the vast majority of the intravenous sets market in 2019 was controlled by competitors who also hold significant shares of the infusion pump capital equipment market. In fact, nearly 90% of intravenous set revenue (pump sets, gravity sets, secondary sets, and extensions sets combined) was awarded to companies who held approximately 10% or more market share of the infusion pump capital equipment market.

What this says is that the majority of the intravenous sets market holds a vested interest in expanding the usage of pump sets. Manufacturers are already thinking of ways to make an increased usage of pump infusion a lot easier. For example, in Spain and Italy, it is very common for infusion pump manufacturers to give away infusion pumps for little to no cost. In exchange, the healthcare facility agrees to pay a significant premium on infusion disposables over the course of multiple years. These types of deals, often referred to as commadato deals, make it more affordable for hospitals to increase the number of infusion pumps and sets they are currently using.

European Infusion Therapy Market Forecast

It is expected that over time pump infusion will overtake gravity infusion in terms of the prevalence of use in Europe. However, currently pump infusions represent less than half of the total number of infusion procedures performed in Europe each year. The trend of pump infusion increasing has the chance to accelerate over time, given that many of the competitors who sell infusion pumps are also major players for intravenous sets.

Register to receive a free Infusion Therapy Report Suite for Europe 2020-2026 synopsis

However, one of the key factors limiting the expansion of pump infusion in Europe will be the increased cost and risk associated with pump infusion over the traditional gravity drip method. Based on the latest market study by iData Research, the European Infusion Therapy market is still expected to reach an astounding $1,252 million in 2026.