Product Description

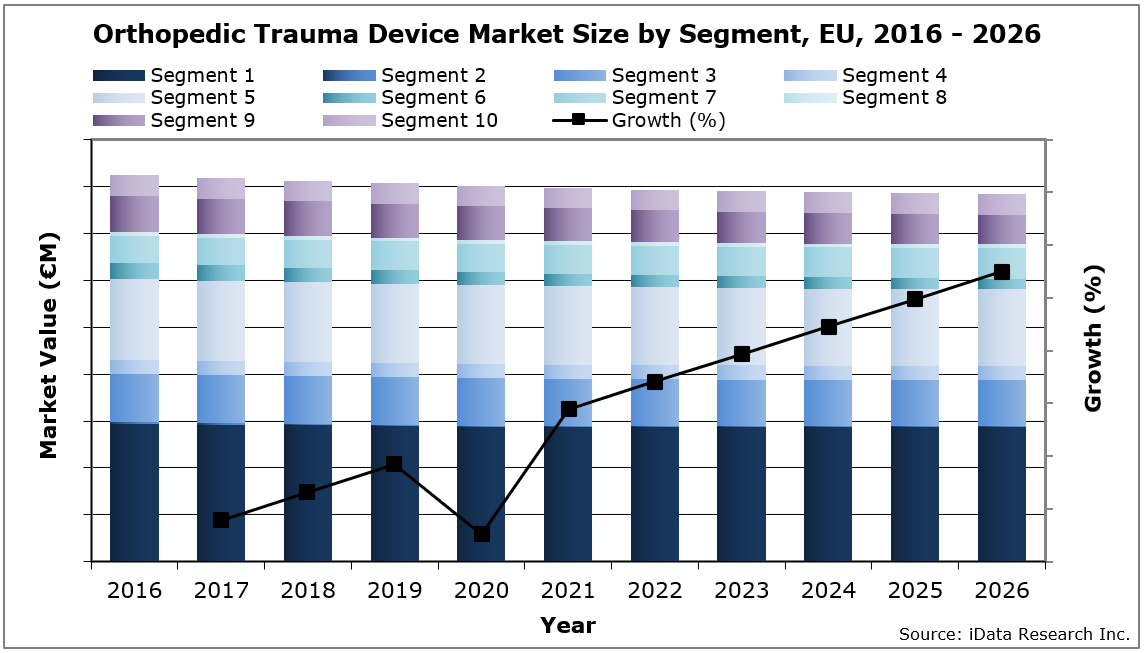

In 2020, Europe’s orthopedic trauma device market size was valued at €807 million, with over 790,000 plate and screw units sold every year. The market size is expected to decrease at a compound annual growth rate (CAGR) of -0.4% reaching €783.1 million in 2026.

Throughout this medical market research, we analyzed 41 trauma device companies across Europe and used our comprehensive methodology to understand the market sizes, unit sales, company market shares, and to create accurate forecasts.

While this MedSuite report contains all the EU Trauma Devices market data and analysis, each of the market segments is also available as stand-alone MedCore reports. This allows you to get access to only the market research that you need.

Data Types Included

- Unit Sales, Average Selling Prices, Market Value & Growth Trends

- Forecasts Until 2026, and Historical Data to 2016

- Market Drivers & Limiters for Each Trauma Device market segment

- Competitive Analysis with Market Shares for Each Segment

- Recent Mergers & Acquisitions

- Orthopedic Trauma Procedure Volumes

- Disease Overviews and Demographic Information

- Company Profiles, Product Portfolios and SWOT for Top Competitors

- COVID19 Impact Analysis

COVID-19 Impact Analysis

The impact analysis is included as an addendum to Europe’s orthopedic trauma devices market analysis in response to the medical crisis declared from the COVID-19 pandemic in 2020. This analysis, conducted during the outbreak, is designed to provide directional guidance in terms of the long-term impacts of the global pandemic. The chapter includes the worst case, best case, and base projections for the total market. The base case scenario represents the most likely outcome for each of the orthopedic trauma device markets under the influence of COVID-19, while the best-case and worst-case scenarios illustrate the possible range of impacts as a result of uncertainty in the global market.

Europe’s Orthopedic Trauma Devices Market Insights

One of the major limiters to the European trauma market is the new Medical Device Regulation (MDR) that will be put into force by the European Union (EU) in 2021. This will change the procedures for introducing new products into the market, making it a considerably more time-intensive and cost-intensive process. Furthermore, the regulations also apply to all products that are currently available on the market.

One of the major drivers of this market is demographics. The growing and aging population are increasing unit sales, as there is a relatively high number of bone fractures in the elderly population. Furthermore, obesity increases the risk of bone fractures and, since the number of obese people in Europe is rising, unit sales will rise accordingly.

One of the major drivers of this market is demographics. The growing and aging population are increasing unit sales, as there is a relatively high number of bone fractures in the elderly population. Furthermore, obesity increases the risk of bone fractures and, since the number of obese people in Europe is rising, unit sales will rise accordingly.

Titanium products are gaining popularity in the European orthopedic trauma device market. The decreasing cost of titanium in Europe is expected to play a role in furthering surgeons’ use of titanium products in the trauma device market.

Europe’s Orthopedic Trauma Devices Market Share Insights

By 2020, DePuy Synthes led the European orthopedic trauma market by maintaining its majority share of the plate and screw market, as well as holding a top-three position in all of the other segments, except bioabsorbable trauma fixation and bone growth stimulators markets.

Stryker continued to lead the intramedullary hip screw market, as well as maintain a key position in several other major segments, securing it the second-leading spot in the overall market. Smith & Nephew held key market shares in all of the major segments, excluding bioabsorbable, staple, and external trauma fixation devices markets. The company has an especially strong market share in the Nordic countries.

Research Regional Coverage

Throughout this research series, iData Research has covered several countries in great detail. Each country may be purchased as a stand-alone report, tailoring the data to your needs. The countries covered are:

- Germany

- France

- The U.K.

- Italy

- Spain

- Benelux (Belgium, Netherlands, and Luxembourg)

- Switzerland

- Austria

- Portugal

- Scandinavia

Report Suite Coverage

While this report suite contains all data, each of the markets is also available as stand-alone MedCore reports. This allows you to get access to only the market research that you need. You can view all these included reports and segmentation here:

- Procedure Numbers for Orthopedic Trauma Device Market – MedPro – Discusses trauma procedure volumes performed in the European market, such as Nephrectomy, Appendectomy, Adrenalectomy, Hernia Repair, Hysterectomy, and Video-Assisted Thoracoscopic Surgery procedures.

- Plates and Screws Market – MedCore – The market is comprised of the markets for Anatomical and Generic devices.

- Bioabsorbable Trauma Fixation Market – MedCore – In-depth analysis of the Bioabsorbable Fixation Market.

- Intramedullary Nails Market – MedCore – This market is comprised of the markets for Humeral, Forearm, Femoral, Tibial, and Ankle devices.

- Cannulated Screws Market – MedCore – The market is further broken down by material type Stainless Steel and Titanium.

- Intramedullary Hip Screws Market – MedCore – The chapter includes a breakdown by material types, such as Stainless Steel and Titanium screws.

- Conventional Hip Screw Market – MedCore – The market is further broken down by material type into Stainless Steel and Titanium screws.

- Staple Trauma Fixation Market – MedCore – In-depth analysis of the European Staple Trauma Fixation market. The chapter includes market segments, such as the Shape Memory device market, and the Mechanical Compression device market.

- Bone Pins Market – MedCore – In-depth analysis of the Bone Pins market.

- External Trauma Fixation Market – MedCore – The analysis is primarily focused on Unilateral and Circular device types.

- Bone Growth Stimulation Market – MedCore – The market is further broken down into segments for Ultrasound and Electrical devices.

Detailed Market Segmentation

| Market Segment | |||

| Plates and Screws | Device Type | ||

| Anatomical | Anatomy | ||

| Clavicle | |||

| Proximal Humerus | |||

| Elbow | |||

| Distal Radius | |||

| Hand | |||

| Proximal Femur | |||

| Distal Femur | |||

| Proximal Tibia | |||

| Distal Tibia | |||

| F oot | |||

| Generic | Material Type | ||

| Stainless Steel | Size | ||

| Mini | |||

| Small | |||

| Large | |||

| Material Type | |||

| Titanium | Size | ||

| Mini | |||

| Small | |||

| Large | |||

| Bioabsorbable Fixation | |||

| Intramedullary Nails | Anatomy | ||

| Humeral | |||

| Forearm | |||

| Femoral | |||

| Tibial | |||

| Ankle | |||

| Cannulated Screws | Material Type | ||

| Stainless Steel | Size | ||

| Small | |||

| Medium | |||

| Large | |||

| Titanium | Size | ||

| Small | |||

| Medium | |||

| Large | |||

| Intramedullary Hip Screws | Material Type | ||

| Stainless Steel | |||

| Titanium | |||

| Conventional Hip Screw | Material Type | ||

| Stainless Steel | |||

| Titanium | |||

| Staple Fixation | Device Type | ||

| Shape Memory | |||

| Mechanical Compression | |||

| Bone Pins | |||

| External Fixation | Device Type | ||

| Unilateral | |||

| Circular | |||

| Bone Growth Stimulation | Device Type | ||

| Ultrasound | |||

| Electrical | |||

DON’T SEE THE SEGMENT OR DATA YOU NEED?

Feel free to contact us or send a request by clicking on “Request Customization”.