| Figure 1‑1: Orthopedic Soft Tissue Repair Market Share Ranking by Segment, Global, 2022 (1 of 2) |

| Figure 1‑2: Orthopedic Soft Tissue Repair Market Share Ranking by Segment, Global, 2022 (2 of 2) |

| Figure 1‑3: Companies Researched in This Report |

| Figure 1‑4: Factors Impacting the Orthopedic Soft Tissue Repair Market by Segment, Global (1 of 2) |

| Figure 1‑5: Factors Impacting the Orthopedic Soft Tissue Repair Market by Segment, Global (2 of 2) |

| Figure 1‑6: Recent Events in the Orthopedic Soft Tissue Repair Market, Global, 2019 – 2022 (1 of 3) |

| Figure 1‑7: Recent Events in the Orthopedic Soft Tissue Repair Market, Global, 2019 – 2022 (2 of 3) |

| Figure 1‑8: Recent Events in the Orthopedic Soft Tissue Repair Market, Global, 2019 – 2022 (3 of 3) |

| Figure 1‑9: Orthopedic Soft Tissue Repair Procedures Covered |

| Figure 1‑10: Orthopedic Soft Tissue Repair Markets Covered (1 of 2) |

| Figure 1‑11: Orthopedic Soft Tissue Repair Markets Covered (2 of 2) |

| Figure 1‑12: Orthopedic Soft Tissue Repair Regions Covered, Global (1 of 2) |

| Figure 1‑13: Orthopedic Soft Tissue Repair Regions Covered, Global (2 of 2) |

| Figure 1‑14: Version History |

| Figure 2‑1: Orthopedic Soft Tissue Repair Market by Segment, Worst Case Scenario, Global, 2019 – 2029 (US$M) |

| Figure 2‑2: Orthopedic Soft Tissue Repair Market by Segment, Base Case Scenario, Global, 2019 – 2029 (US$M) |

| Figure 2‑3: Orthopedic Soft Tissue Repair Market by Segment, Best Case Scenario, Global, 2019 – 2029 (US$M) |

| Figure 4‑1: Achilles Tendon Repair by Company (1 of 2) |

| Figure 4‑2: Achilles Tendon Repair by Company (2 of 2) |

| Figure 4‑3: Rotator Cuff Repair by Company (1 of 3) |

| Figure 4‑4: Rotator Cuff Repair by Company (2 of 3) |

| Figure 4‑5: Rotator Cuff Repair by Company (3 of 3) |

| Figure 4‑6: Shoulder Labrum Repair by Company (1 of 2) |

| Figure 4‑7: Shoulder Labrum Repair by Company (2 of 2) |

| Figure 4‑8: Biceps Tenodesis by Company (1 of 2) |

| Figure 4‑9: Biceps Tenodesis by Company (2 of 2) |

| Figure 4‑10: ACL/PCL Repair by Company (1 of 3) |

| Figure 4‑11: ACL/PCL Repair by Company (2 of 3) |

| Figure 4‑12: ACL/PCL Repair by Company (3 of 3) |

| Figure 4‑13: Meniscal Repair by Company |

| Figure 4‑14: Hip Arthroscopy by Company (1 of 2) |

| Figure 4‑15: Hip Arthroscopy by Company (2 of 2) |

| Figure 4‑16: Class 2 Device Recall Arthrex SwiveLock Anchor |

| Figure 4‑17: Class 2 Device Recall Arthrex Suture Anchor |

| Figure 4‑18: Class 2 Device Recall Arthrex SwiveLock Anchors |

| Figure 4‑19: Class 2 Device Recall Infinity ACL Tibial Elbow and Tip Guides |

| Figure 4‑20: Class 2 Device Recall KIT_INFINITY_BASE Custom Procedural Kit Italy |

| Figure 4‑21: Class 2 Device Recall KIT_INFINITY_BASE Custom Procedural Kit Italy |

| Figure 4‑22: Class 2 Device Recall INFINITY_TRAY Custom Procedural Kit Canada |

| Figure 4‑23: Class 2 Device Recall PopLok" Knotless Suture Anchor with Disposable Driver |

| Figure 4‑24: Class 2 Device Recall QuickGraft |

| Figure 4‑25: Class 2 Device Recall HEALIX ADVANCE" |

| Figure 4‑26: Class 2 Device Recall HEALICOIL Absorbable Suture Anchors |

| Figure 4‑27: Class 2 Device Recall TWINFIX ULTRA Absorbable Suture Anchor |

| Figure 4‑28: Class 2 Device Recall TWINFIX 5.0MM AB SUTURE ANCHOR Absorbable Suture Anchors |

| Figure 4‑29: Class 2 Device Recall TWINFIX 6.5MM AB PRELOADED ULTRABRAID Absorbable Suture Anchors |

| Figure 4‑30: Class 2 Device Recall TWINFIX 6.5MM AB PRELOADED SUTURE ANCHOR Absorbable Suture Anchors |

| Figure 4‑31: Class 2 Device Recall TWINFIX AB 5.0 SUTR ANCHR W/2 38 ULTRAAbsorbable Suture Anchors |

| Figure 4‑32: Class 2 Device Recall TWINFIX AB 5.0 SUTR ANCHR W/2 38 DURABAbsorbable Suture Anchors |

| Figure 4‑33: Class 2 Device Recall RAPTORMITE 3.7MM AB W/ NEEDLES AND TWOAbsorbable Suture Anchor |

| Figure 4‑34: Class 2 Device Recall Smith & Nephew FOOTPRINT Ultra Suture Anchor |

| Figure 4‑35: Class 2 Device Recall BIORAPTOR 2.9MM SUTURE ANCHORAbsorbable Suture Anchor |

| Figure 4‑36: Class 2 Device Recall MICRORAPTOR REGENESORB SUTURE ANCHOR Absorbable Suture Anchor |

| Figure 4‑37: Class 2 Device Recall OSTEORAPTOR |

| Figure 4‑38: Class 2 Device Recall ULTRA FASTFIX AB ASSEMBLY STRAIGHTAbsorbable Suture Anchors |

| Figure 4‑39: Class 2 Device Recall SUTUREFIX ULTRA Suture |

| Figure 4‑40: Class 2 Device Recall WHIPKNOT Soft Tissue Cinch |

| Figure 4‑41: Class 2 Device Recall Smith & Nephew |

| Figure 4‑42: Class 2 Device Recall Stryker AllPEEK Knotless Anchor System |

| Figure 4‑43: Class 2 Device Recall ACL DISPOSABLE PACK BONETENDONBONE |

| Figure 4‑44: Class 2 Device Recall STRYKER WEDGE INTERFERENCE SCREW SYSTEM, ACL Interface Screw |

| Figure 4‑45: Class 2 Device Recall CinchLock SS Knotless Anchor with Inserter |

| Figure 4‑46: Class 2 Device Recall ComposiTCP |

| Figure 4‑47: Class 2 Device Recall Gentle Thread PLGA Full Thread Interference Screw |

| Figure 4‑48: Class 2 Device Recall Gentle Threads |

| Figure 4‑49: Class 2 Device Recall Smooth or Threaded Metallic Bone Fixation Fastener |

| Figure 4‑50: Class 2 Device Recall JUGGERKNOT |

| Figure 4‑51: S&P of Q-Fix™ All-Suture Anchor System |

| Figure 4‑52: Safety and Performance of PEEK Anchors (Dynomite, Spyromite, Raptomite) in Extremities |

| Figure 4‑53: Anterior Cruciate Ligament (ACL) Reconstruction With Bone Tendon Bone Autograft With Versus Without Internal Bracing |

| Figure 4‑54: LIVing Donor Allograft for Anterior Cruciate Ligament Reconstruction Study (LivD_ACLR) |

| Figure 4‑55: Evaluating the Use of a Bioinductive Graft in Treating Massive Rotator Cuff Tears |

| Figure 4‑56: BIOSURE™ RG Knee Safety & Performance Study |

| Figure 4‑57: Arthroscopic Primary Repair of the Anterior Cruciate Ligament (ACL) |

| Figure 4‑58: BioCleanse Tibialis Tendon Anterior Cruciate Ligament (ACL) Study |

| Figure 4‑59: Individualized Treatment of Acute Achilles Tendon Rupture |

| Figure 4‑60: A RCT for Y-Knot All-suture Anchor in Ankle Ligaments Injury Repair |

| Figure 4‑61: SLAP Repair vs. Biceps Tenodesis in Patients Under 30: A Randomized Clinical Trial |

| Figure 4‑62: A Prospective Study Comparing Suture Anchor and Soft Tissue Pectoralis Major Tendon Techniques for Biceps Tenodesis |

| Figure 4‑63: Biceps Tenodesis Versus Tenotomy (BicepsTvsT) |

| Figure 4‑64: MDR SureLock All-Suture Anchor |

| Figure 4‑65: PMCF Study on PEEK Suture Anchors for Shoulder Indications |

| Figure 4‑66: Rotator Cuff Tears Repair With or Without Dermal Patch Augmentation (CUFFPATCH) |

| Figure 4‑67: Massive Rotator Cuff Tear Reconstruction (SCR) |

| Figure 4‑68: Arthroscopic Superior Capsular Reconstruction - Study of Different Types of Grafts |

| Figure 4‑69: LifeNet: Extracellular Matrix Graft in Rotator Cuff Repair |

| Figure 4‑70: Allograft Reconstruction of Massive Rotator Cuff Tears vs Partial Repair Alone |

| Figure 4‑71: A Pivotal Study to Assess the InSpace™ Device for Treatment of Full Thickness Massive Rotator Cuff Tears |

| Figure 4‑72: Evaluation of Tendon-to-Bone Healing Potential in Arthroscopic Rotator Cuff Repair Through Biological Stimulation |

| Figure 4‑73: Efficacy of an Amniotic Fluid Derived Allograft, (FlōGraft®) in Rotator Cuff Repairs: A Prospective Study |

| Figure 4‑74: Suture Anchor Comparison in Rotator Cuff Repairs |

| Figure 4‑75: Use of Human Dehydrated Umbilical Cord Allograft in Supraspinatus Tendon Repair |

| Figure 4‑76: Evaluation of the Healicoil Suture Anchor for Rotator Cuff Repair |

| Figure 4‑77: SoftStitch™ for All-Inside Meniscal Repair: Comparative Analysis of Patient Reported Outcome Measures |

| Figure 4‑78: Safety and Performance Study of the FAST-FIX FLEX System for Meniscal Repairs and Meniscal Transplantations (FAST-FIX FLEX) |

| Figure 4‑79: JuggerStitch Post Market Clinical Follow-up Study |

| Figure 4‑80: Study of Suture Repair of Torn Meniscus in the Knee |

| Figure 4‑81: Safety and Performance of MICRORAPTOR™ Suture Anchors in Shoulder and Hip |

| Figure 4‑82: HAFAI Cohort 5 Year Follow up of Patients With Femoroacetabular Impingement Undergoing Hip Arthroscopy |

| Figure 4‑83: Safety and Performance of the SUTUREFIX ULTRA and SUTUREFIX CURVED Suture Anchors in Shoulder and Hip Arthroscopic Repair (SuturefixUltra) |

| Figure 4‑84: PMCF Study on PEEK Suture Anchors for Hip Indications |

| Figure 5‑1: Orthopedic Soft Tissue Repair Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 5‑2: Orthopedic Soft Tissue Repair Market by Region, Global, 2019 – 2029 (US$M) |

| Figure 5‑3: Leading Competitors, Orthopedic Soft Tissue Repair Market by Segment, Global, 2022 |

| Figure 5‑4: SWOT Analysis, AlloSource |

| Figure 5‑5: SWOT Analysis, Arthrex |

| Figure 5‑6: SWOT Analysis, CONMED |

| Figure 5‑7: SWOT Analysis, DePuy Synthes |

| Figure 5‑8: SWOT Analysis, MTF Biologics |

| Figure 5‑9: SWOT Analysis, RTI Surgical |

| Figure 5‑10: SWOT Analysis, Smith & Nephew (1 of 2) |

| Figure 5‑11: SWOT Analysis, Smith & Nephew (2 of 2) |

| Figure 5‑12: SWOT Analysis, Stryker |

| Figure 5‑13: SWOT Analysis, Zimmer Biomet |

| Figure 6‑1: Achilles Tendon Repair & Reconstruction Markets Covered |

| Figure 6‑2: Achilles Tendon Repair & Reconstruction Regions Covered, Global (1 of 2) |

| Figure 6‑3: Achilles Tendon Repair & Reconstruction Regions Covered, Global (2 of 2) |

| Figure 6‑4: Achilles Tendon Repair and Reconstruction Procedures by Region, Global, 2019 – 2029 |

| Figure 6‑5: Achilles Tendon Repair and Reconstruction Procedures by Country, North America, 2019 – 2029 |

| Figure 6‑6: Achilles Tendon Repair and Reconstruction Procedures by Country, Latin America, 2019 – 2029 (1 of 2) |

| Figure 6‑7: Achilles Tendon Repair and Reconstruction Procedures by Country, Latin America, 2019 – 2029 (2 of 2) |

| Figure 6‑8: Achilles Tendon Repair and Reconstruction Procedures by Country, Western Europe, 2019 – 2029 |

| Figure 6‑9: Achilles Tendon Repair and Reconstruction Procedures by Country, Central & Eastern Europe, 2019 – 2029 (1 of 2) |

| Figure 6‑10: Achilles Tendon Repair and Reconstruction Procedures by Country, Central & Eastern Europe, 2019 – 2029 (2 of 2) |

| Figure 6‑11: Achilles Tendon Repair and Reconstruction Procedures by Country, Middle East, 2019 – 2029 |

| Figure 6‑12: Achilles Tendon Repair and Reconstruction Procedures by Country, Asia-Pacific, 2019 – 2029 (1 of 3) |

| Figure 6‑13: Achilles Tendon Repair and Reconstruction Procedures by Country, Asia-Pacific, 2019 – 2029 (2 of 3) |

| Figure 6‑14: Achilles Tendon Repair and Reconstruction Procedures by Country, Asia-Pacific, 2019 – 2029 (3 of 3) |

| Figure 6‑15: Achilles Tendon Repair and Reconstruction Procedures by Country, Africa, 2019 – 2029 |

| Figure 6‑16: Achilles Tendon Repair & Reconstruction Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 6‑17: Achilles Tendon Repair & Reconstruction Market by Region, Global, 2019 – 2029 (US$M) |

| Figure 6‑18: Market Value by Region, Achilles Tendon Repair & Reconstruction Market, Global, 2019 – 2029 (US$M) |

| Figure 6‑19: Achilles Tendon Graft Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 6‑20: Total Achilles Tendon Graft Market, Global, 2019 – 2029 |

| Figure 6‑21: Units Sold by Region, Achilles Tendon Graft Market, Global, 2019 – 2029 |

| Figure 6‑22: Average Selling Price by Region, Achilles Tendon Graft Market, Global, 2019 – 2029 (US$) |

| Figure 6‑23: Market Value by Region, Achilles Tendon Graft Market, Global, 2019 – 2029 (US$M) |

| Figure 6‑24: Allograft Achilles Tendon Graft Market, Global, 2019 – 2029 |

| Figure 6‑25: Units Sold by Region, Allograft Achilles Tendon Graft Market, Global, 2019 – 2029 |

| Figure 6‑26: Average Selling Price by Region, Allograft Achilles Tendon Graft Market, Global, 2019 – 2029 (US$) |

| Figure 6‑27: Market Value by Region, Allograft Achilles Tendon Graft Market, Global, 2019 – 2029 (US$M) |

| Figure 6‑28: Xenograft Achilles Tendon Graft Market, Global, 2019 – 2029 |

| Figure 6‑29: Units Sold by Region, Xenograft Achilles Tendon Graft Market, Global, 2019 – 2029 |

| Figure 6‑30: Average Selling Price by Region, Xenograft Achilles Tendon Graft Market, Global, 2019 – 2029 (US$) |

| Figure 6‑31: Market Value by Region, Xenograft Achilles Tendon Graft Market, Global, 2019 – 2029 (US$M) |

| Figure 6‑32: Synthetic Achilles Tendon Graft Market, Global, 2019 – 2029 |

| Figure 6‑33: Units Sold by Region, Synthetic Achilles Tendon Graft Market, Global, 2019 – 2029 |

| Figure 6‑34: Average Selling Price by Region, Synthetic Achilles Tendon Graft Market, Global, 2019 – 2029 (US$) |

| Figure 6‑35: Market Value by Region, Synthetic Achilles Tendon Graft Market, Global, 2019 – 2029 (US$M) |

| Figure 6‑36: Achilles Tendon Suture Anchor Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 6‑37: Total Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 |

| Figure 6‑38: Units Sold by Region, Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 |

| Figure 6‑39: Average Selling Price by Region, Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 6‑40: Market Value by Region, Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 6‑41: Biocomposite Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 |

| Figure 6‑42: Units Sold by Region, Biocomposite Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 |

| Figure 6‑43: Average Selling Price by Region, Biocomposite Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 6‑44: Market Value by Region, Biocomposite Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 6‑45: PEEK Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 |

| Figure 6‑46: Units Sold by Region, PEEK Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 |

| Figure 6‑47: Average Selling Price by Region, PEEK Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 6‑48: Market Value by Region, PEEK Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 6‑49: Metal Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 |

| Figure 6‑50: Units Sold by Region, Metal Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 |

| Figure 6‑51: Average Selling Price by Region, Metal Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 6‑52: Market Value by Region, Metal Achilles Tendon Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 6‑53: Leading Competitors, Achilles Tendon Repair & Reconstruction Market, Global, 2022 |

| Figure 7‑1: Rotator Cuff Repair & Reconstruction Markets Covered |

| Figure 7‑2: Rotator Cuff Repair & Reconstruction Regions Covered, Global (1 of 2) |

| Figure 7‑3: Rotator Cuff Repair & Reconstruction Regions Covered, Global (2 of 2) |

| Figure 7‑4: Rotator Cuff Repair & Reconstruction Procedures by Surgical Technique, Global, 2019 – 2029 |

| Figure 7‑5: Rotator Cuff Repair & Reconstruction Single Row Procedures by Region, Global, 2019 – 2029 |

| Figure 7‑6: Rotator Cuff Repair & Reconstruction Double Row Procedures by Region, Global, 2019 – 2029 |

| Figure 7‑7: Rotator Cuff Repair & Reconstruction Procedures by Region, Global, 2019 – 2029 |

| Figure 7‑8: Rotator Cuff Repair Procedures by Country, North America, 2019 – 2029 |

| Figure 7‑9: Rotator Cuff Repair & Reconstruction Procedures by Country, Latin America, 2019 – 2029 (1 of 2) |

| Figure 7‑10: Rotator Cuff Repair & Reconstruction Procedures by Country, Latin America, 2019 – 2029 (2 of 2) |

| Figure 7‑11: Rotator Cuff Repair & Reconstruction Procedures by Country, Western Europe, 2019 – 2029 |

| Figure 7‑12: Rotator Cuff Repair & Reconstruction Procedures by Country, Central & Eastern Europe, 2019 – 2029 (1 of 2) |

| Figure 7‑13: Rotator Cuff Repair & Reconstruction Procedures by Country, Central & Eastern Europe, 2019 – 2029 (2 of 2) |

| Figure 7‑14: Rotator Cuff Repair & Reconstruction Procedures by Country, Middle East, 2019 – 2029 |

| Figure 7‑15: Rotator Cuff Repair & Reconstruction Procedures by Country, Asia-Pacific, 2019 – 2029 (1 of 3) |

| Figure 7‑16: Rotator Cuff Repair & Reconstruction Procedures by Country, Asia-Pacific, 2019 – 2029 (2 of 3) |

| Figure 7‑17: Rotator Cuff Repair & Reconstruction Procedures by Country, Asia-Pacific, 2019 – 2029 (3 of 3) |

| Figure 7‑18: Rotator Cuff Repair & Reconstruction Procedures by Country, Africa, 2019 – 2029 |

| Figure 7‑19: Single Row Procedures by Region, Global, 2019 – 2029 |

| Figure 7‑20: Double Row Procedures by Region, Global, 2019 – 2029 |

| Figure 7‑21: Rotator Cuff Repair & Reconstruction Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 7‑22: Rotator Cuff Repair & Reconstruction Market by Region, Global, 2019 – 2029 (US$M) |

| Figure 7‑23: Market Value by Region, Rotator Cuff Repair & Reconstruction Market, Global, 2019 – 2029 (US$M) |

| Figure 7‑24: Rotator Cuff Graft Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 7‑25: Total Rotator Cuff Graft Market, Global, 2019 – 2029 |

| Figure 7‑26: Units Sold by Region, Rotator Cuff Graft Market, Global, 2019 – 2029 |

| Figure 7‑27: Average Selling Price by Region, Rotator Cuff Graft Market, Global, 2019 – 2029 (US$) |

| Figure 7‑28: Market Value by Region, Rotator Cuff Graft Market, Global, 2019 – 2029 (US$M) |

| Figure 7‑29: Allograft Rotator Cuff Graft Market, Global, 2019 – 2029 |

| Figure 7‑30: Units Sold by Region, Allograft Rotator Cuff Graft Market, Global, 2019 – 2029 |

| Figure 7‑31: Average Selling Price by Region, Allograft Rotator Cuff Graft Market, Global, 2019 – 2029 (US$) |

| Figure 7‑32: Market Value by Region, Allograft Rotator Cuff Graft Market, Global, 2019 – 2029 (US$M) |

| Figure 7‑33: Xenograft Rotator Cuff Graft Market, Global, 2019 – 2029 |

| Figure 7‑34: Units Sold by Region, Xenograft Rotator Cuff Graft Market, Global, 2019 – 2029 |

| Figure 7‑35: Average Selling Price by Region, Xenograft Rotator Cuff Graft Market, Global, 2019 – 2029 (US$) |

| Figure 7‑36: Market Value by Region, Xenograft Rotator Cuff Graft Market, Global, 2019 – 2029 (US$M) |

| Figure 7‑37: Synthetic Rotator Cuff Graft Market, Global, 2019 – 2029 |

| Figure 7‑38: Units Sold by Region, Synthetic Rotator Cuff Graft Market, Global, 2019 – 2029 |

| Figure 7‑39: Average Selling Price by Region, Synthetic Rotator Cuff Graft Market, Global, 2019 – 2029 (US$) |

| Figure 7‑40: Market Value by Region, Synthetic Rotator Cuff Graft Market, Global, 2019 – 2029 (US$M) |

| Figure 7‑41: Rotator Cuff Suture Anchor Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 7‑42: Total Rotator Cuff Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑43: Units Sold by Region, Rotator Cuff Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑44: Average Selling Price by Region, Rotator Cuff Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 7‑45: Market Value by Region, Rotator Cuff Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 7‑46: Biocomposite Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑47: Units Sold by Region, Biocomposite Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑48: Average Selling Price by Region, Biocomposite Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 7‑49: Market Value by Region, Biocomposite Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 7‑50: PEEK Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑51: Units Sold by Region, PEEK Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑52: Average Selling Price by Region, PEEK Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 7‑53: Market Value by Region, PEEK Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 7‑54: Metal Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑55: Units Sold by Region, Metal Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑56: Average Selling Price by Region, Metal Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 7‑57: Market Value by Region, Metal Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 7‑58: All-Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑59: Units Sold by Region, All-Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑60: Average Selling Price by Region, All-Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 7‑61: Market Value by Region, All-Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 7‑62: PEEK CF Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑63: Units Sold by Region, PEEK CF Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑64: Average Selling Price by Region, PEEK CF Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 7‑65: Market Value by Region, PEEK CF Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 7‑66: PLA Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑67: Units Sold by Region, PLA Suture Anchor Market, Global, 2019 – 2029 |

| Figure 7‑68: Average Selling Price by Region, PLA Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 7‑69: Market Value by Region, PLA Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 7‑70: Leading Competitors, Rotator Cuff Repair & Reconstruction Market, Global, 2022 |

| Figure 8‑1: Shoulder Labrum Repair Markets Covered |

| Figure 8‑2: Shoulder Labrum Repair Regions Covered, Global (1 of 2) |

| Figure 8‑3: Shoulder Labrum Repair Regions Covered, Global (2 of 2) |

| Figure 8‑4: Shoulder Labrum Repair Procedures by Region, Global, 2019 – 2029 |

| Figure 8‑5: Shoulder Labrum Repair Procedures by Country, North America, 2019 – 2029 |

| Figure 8‑6: Shoulder Labrum Repair Procedures by Country, Latin America, 2019 – 2029 (1 of 2) |

| Figure 8‑7: Shoulder Labrum Repair Procedures by Country, Latin America, 2019 – 2029 (2 of 2) |

| Figure 8‑8: Shoulder Labrum Repair Procedures by Country, Western Europe, 2019 – 2029 |

| Figure 8‑9: Shoulder Labrum Repair Procedures by Country, Central & Eastern Europe, 2019 – 2029 (1 of 2) |

| Figure 8‑10: Shoulder Labrum Repair Procedures by Country, Central & Eastern Europe, 2019 – 2029 (2 of 2) |

| Figure 8‑11: Shoulder Labrum Repair Procedures by Country, Middle East, 2019 – 2029 |

| Figure 8‑12: Shoulder Labrum Repair Procedures by Country, Asia-Pacific, 2019 – 2029 (1 of 3) |

| Figure 8‑13: Shoulder Labrum Repair Procedures by Country, Asia-Pacific, 2019 – 2029 (2 of 3) |

| Figure 8‑14: Shoulder Labrum Repair Procedures by Country, Asia-Pacific, 2019 – 2029 (3 of 3) |

| Figure 8‑15: Shoulder Labrum Repair Procedures by Country, Africa, 2019 – 2029 |

| Figure 8‑16: Shoulder Labrum Repair Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 8‑17: Shoulder Labrum Repair Market by Region, Global, 2019 – 2029 (US$M) |

| Figure 8‑18: Total Shoulder Labrum Repair Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑19: Units Sold by Region, Shoulder Labrum Repair Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑20: Average Selling Price by Region, Shoulder Labrum Repair Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 8‑21: Market Value by Region, Shoulder Labrum Repair Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 8‑22: Total Biocomposite Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑23: Units Sold by Region, Biocomposite Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑24: Average Selling Price by Region, Biocomposite Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 8‑25: Market Value by Region, Biocomposite Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 8‑26: Total PEEK Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑27: Units Sold by Region, PEEK Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑28: Average Selling Price by Region, PEEK Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 8‑29: Market Value by Region, PEEK Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 8‑30: Total All-Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑31: Units Sold by Region, All-Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑32: Average Selling Price by Region, All-Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 8‑33: Market Value by Region, All-Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 8‑34: Total PLA Resorbable Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑35: Units Sold by Region, PLA Resorbable Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑36: Average Selling Price by Region, PLA Resorbable Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 8‑37: Market Value by Region, PLA Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 8‑38: PEEK CF Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑39: Units Sold by Region, PEEK CF Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑40: Average Selling Price by Region, PEEK CF Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 8‑41: Market Value by Region, PEEK CF Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 8‑42: Metal Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑43: Shoulder Labrum Repair Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 8‑44: Units Sold by Region, Metal Suture Anchor Market, Global, 2019 – 2029 |

| Figure 8‑45: Average Selling Price by Region, Metal Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 8‑46: Market Value by Region, Metal Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 8‑47: Leading Competitors, Shoulder Labrum Repair Market, Global, 2022 |

| Figure 9‑1: Biceps Tenodesis Markets Covered |

| Figure 9‑2: Biceps Tenodesis Regions Covered, Global (1 of 2) |

| Figure 9‑3: Biceps Tenodesis Regions Covered, Global (2 of 2) |

| Figure 9‑4: Biceps Repair Procedures by Segment, Global, 2019 – 2029 |

| Figure 9‑5: Biceps Repair Procedures by Region, Global, 2019 – 2029 |

| Figure 9‑6: Biceps Repair Procedures by Country, North America, 2019 – 2029 |

| Figure 9‑7: Biceps Repair Procedures by Country, Latin America, 2019 – 2029 (1 of 2) |

| Figure 9‑8: Biceps Repair Procedures by Country, Latin America, 2019 – 2029 (2 of 2) |

| Figure 9‑9: Biceps Repair Procedures by Country, Western Europe, 2019 – 2029 |

| Figure 9‑10: Biceps Repair Procedures by Country, Central & Eastern Europe, 2019 – 2029 (1 of 2) |

| Figure 9‑11: Biceps Repair Procedures by Country, Central & Eastern Europe, 2019 – 2029 (2 of 2) |

| Figure 9‑12: Biceps Repair Procedures by Country, Middle East, 2019 – 2029 |

| Figure 9‑13: Biceps Repair Procedures by Country, Asia-Pacific, 2019 – 2029 (1 of 3) |

| Figure 9‑14: Biceps Repair Procedures by Country, Asia-Pacific, 2019 – 2029 (2 of 3) |

| Figure 9‑15: Biceps Repair Procedures by Country, Asia-Pacific, 2019 – 2029 (3 of 3) |

| Figure 9‑16: Biceps Repair Procedures by Country, Africa, 2019 – 2029 |

| Figure 9‑17: Biceps Tenodesis Repair Procedures by Region, Global, 2019 – 2029 |

| Figure 9‑18: Biceps Tenotomy Procedures by Region, Global, 2019 – 2029 |

| Figure 9‑19: Biceps Tenodesis Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 9‑20: Biceps Tenodesis Market by Region, Global, 2019 – 2029 (US$M) |

| Figure 9‑21: Biceps Tenodesis Market, Global, 2019 – 2029 |

| Figure 9‑22: Units Sold by Region, Biceps Tenodesis Market, Global, 2019 – 2029 |

| Figure 9‑23: Average Selling Price by Region, Biceps Tenodesis Market, Global, 2019 – 2029 (US$) |

| Figure 9‑24: Market Value by Region, Biceps Tenodesis Market, Global, 2019 – 2029 (US$M) |

| Figure 9‑25: Biceps Tenodesis Suture Anchor Market, Global, 2019 – 2029 |

| Figure 9‑26: Units Sold by Region, Biceps Tenodesis Suture Anchor Market, Global, 2019 – 2029 |

| Figure 9‑27: Average Selling Price by Region, Biceps Tenodesis Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 9‑28: Market Value by Region, Biceps Tenodesis Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 9‑29: Biceps Tenodesis Screw Market, Global, 2019 – 2029 |

| Figure 9‑30: Units Sold by Region, Biceps Tenodesis Screw Market, Global, 2019 – 2029 |

| Figure 9‑31: Average Selling Price by Region, Biceps Tenodesis Screw Market, Global, 2019 – 2029 (US$) |

| Figure 9‑32: Market Value by Region, Biceps Tenodesis Screw Market, Global, 2019 – 2029 (US$M) |

| Figure 9‑33: Leading Competitors, Biceps Tenodesis Market, Global, 2022 |

| Figure 10‑1: ACL/PCL Reconstruction Markets Covered |

| Figure 10‑2: ACL/PCL Reconstruction Regions Covered, Global (1 of 2) |

| Figure 10‑3: ACL/PCL Reconstruction Regions Covered, Global (2 of 2) |

| Figure 10‑4: ACL/PCL Reconstruction Procedures by Region, Global, 2019 – 2029 |

| Figure 10‑5: ACL/PCL Reconstruction Procedures by Country, North America, 2019 – 2029 |

| Figure 10‑6: ACL/PCL Reconstruction Procedures by Country, Latin America, 2019 – 2029 (1 of 2) |

| Figure 10‑7: ACL/PCL Reconstruction Procedures by Country, Latin America, 2019 – 2029 (2 of 2) |

| Figure 10‑8: ACL/PCL Reconstruction Procedures by Country, Western Europe, 2019 – 2029 |

| Figure 10‑9: ACL/PCL Reconstruction Procedures by Country, Central & Eastern Europe, 2019 – 2029 (1 of 2) |

| Figure 10‑10: ACL/PCL Reconstruction Procedures by Country, Central & Eastern Europe, 2019 – 2029 (2 of 2) |

| Figure 10‑11: ACL/PCL Reconstruction Procedures by Country, Middle East, 2019 – 2029 |

| Figure 10‑12: ACL/PCL Reconstruction Procedures by Country, Asia-Pacific, 2019 – 2029 (1 of 3) |

| Figure 10‑13: ACL/PCL Reconstruction Procedures by Country, Asia-Pacific, 2019 – 2029 (2 of 3) |

| Figure 10‑14: ACL/PCL Reconstruction Procedures by Country, Asia-Pacific, 2019 – 2029 (3 of 3) |

| Figure 10‑15: ACL/PCL Reconstruction Procedures by Country, Africa, 2019 – 2029 |

| Figure 10‑16: ACL/PCL Reconstruction Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 10‑17: ACL/PCL Reconstruction Market by Region, Global, 2019 – 2029 (US$M) |

| Figure 10‑18: Units Sold by Region, ACL/PCL Reconstruction Market, Global, 2019 – 2029 |

| Figure 10‑19: Market Value by Region, ACL/PCL Reconstruction Market, Global, 2019 – 2029 (US$M) |

| Figure 10‑20: ACL/PCL Allograft Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 10‑21: Total ACL/PCL Allograft Market, Global, 2019 – 2029 |

| Figure 10‑22: Units Sold by Region, ACL/PCL Allograft Market, Global, 2019 – 2029 |

| Figure 10‑23: Average Selling Price by Region, ACL/PCL Allograft Market, Global, 2019 – 2029 (US$) |

| Figure 10‑24: Market Value by Region, ACL/PCL Allograft Market, Global, 2019 – 2029 (US$M) |

| Figure 10‑25: BTB Allograft Market, Global, 2019 – 2029 |

| Figure 10‑26: Units Sold by Region, BTB Allograft Market, Global, 2019 – 2029 |

| Figure 10‑27: Average Selling Price by Region, BTB Allograft Market, Global, 2019 – 2029 (US$) |

| Figure 10‑28: Market Value by Region, BTB Allograft Market, Global, 2019 – 2029 (US$M) |

| Figure 10‑29: Non-Sutured Soft Tissue Allograft Market, Global, 2019 – 2029 |

| Figure 10‑30: Units Sold by Region, Non-Sutured Soft Tissue Allograft Market, Global, 2019 – 2029 |

| Figure 10‑31: Average Selling Price by Region, Non-Sutured Soft Tissue Allograft Market, Global, 2019 – 2029 (US$) |

| Figure 10‑32: Market Value by Region, Non-Sutured Soft Tissue Allograft Market, Global, 2019 – 2029 (US$M) |

| Figure 10‑33: Pre-Sutured Soft Tissue Allograft Market, Global, 2019 – 2029 |

| Figure 10‑34: Units Sold by Region, Pre-Sutured Soft Tissue Allograft Market, Global, 2019 – 2029 |

| Figure 10‑35: Average Selling Price by Region, Pre-Sutured Soft Tissue Allograft Market, Global, 2019 – 2029 (US$) |

| Figure 10‑36: Market Value by Region, Pre-Sutured Soft Tissue Allograft Market, Global, 2019 – 2029 (US$M) |

| Figure 10‑37: ACL/PCL Fixation Device Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 10‑38: Total ACL/PCL Fixation Device Market, Global, 2019 – 2029 |

| Figure 10‑39: Units Sold by Region, ACL/PCL Fixation Device Market, Global, 2019 – 2029 |

| Figure 10‑40: Average Selling Price by Region, ACL/PCL Fixation Device Market, Global, 2019 – 2029 (US$) |

| Figure 10‑41: Market Value by Region, ACL/PCL Fixation Device Market, Global, 2019 – 2029 (US$M) |

| Figure 10‑42: Interference Screw Market, Global, 2019 – 2029 |

| Figure 10‑43: Units Sold by Region, Interference Screw Market, Global, 2019 – 2029 |

| Figure 10‑44: Average Selling Price by Region, Interference Screw Market, Global, 2019 – 2029 (US$) |

| Figure 10‑45: Market Value by Region, Interference Screw Market, Global, 2019 – 2029 (US$M) |

| Figure 10‑46: Cortical Fixation Device Market, Global, 2019 – 2029 |

| Figure 10‑47: Units Sold by Region, Cortical Fixation Device Market, Global, 2019 – 2029 |

| Figure 10‑48: Average Selling Price by Region, Cortical Fixation Device Market, Global, 2019 – 2029 (US$) |

| Figure 10‑49: Market Value by Region, Cortical Fixation Device Market, Global, 2019 – 2029 (US$M) |

| Figure 10‑50: Intratunnel Fixation Device Market, Global, 2019 – 2029 |

| Figure 10‑51: Units Sold by Region, Intratunnel Fixation Device Market, Global, 2019 – 2029 |

| Figure 10‑52: Average Selling Price by Region, Intratunnel Fixation Device Market, Global, 2019 – 2029 (US$) |

| Figure 10‑53: Market Value by Region, Intratunnel Fixation Device Market, Global, 2019 – 2029 (US$M) |

| Figure 10‑54: Washer and Post Market, Global, 2019 – 2029 |

| Figure 10‑55: Units Sold by Region, Washer and Post Market, Global, 2019 – 2029 |

| Figure 10‑56: Average Selling Price by Region, Washer and Post Market, Global, 2019 – 2029 (US$) |

| Figure 10‑57: Market Value by Region, Washer and Post Market, Global, 2019 – 2029 (US$M) |

| Figure 10‑58: Cross-Pin Market, Global, 2019 – 2029 |

| Figure 10‑59: Units Sold by Region, Cross-Pin Market, Global, 2019 – 2029 |

| Figure 10‑60: Average Selling Price by Region, Cross-Pin Market, Global, 2019 – 2029 (US$) |

| Figure 10‑61: Market Value by Region, Cross-Pin Market, Global, 2019 – 2029 (US$M) |

| Figure 10‑62: Leading Competitors, ACL/PCL Reconstruction Market, Global, 2022 |

| Figure 11‑1: Meniscal Repair Markets Covered |

| Figure 11‑2: Meniscal Repair Regions Covered, Global (1 of 2) |

| Figure 11‑3: Meniscal Repair Regions Covered, Global (2 of 2) |

| Figure 11‑4: Meniscal Repair Procedures by Region, Global, 2019 – 2029 |

| Figure 11‑5: Meniscal Repair Procedures by Segment, Global, 2019 – 2029 |

| Figure 11‑6: Meniscal Repair Procedures by Region, Global, 2019 – 2029 |

| Figure 11‑7: Meniscal Repair Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 11‑8: Meniscal Repair Market by Region, Global, 2019 – 2029 (US$M) |

| Figure 11‑9: Meniscal Repair Market, Global, 2019 – 2029 |

| Figure 11‑10: Units Sold by Region, Meniscal Repair Market, Global, 2019 – 2029 |

| Figure 11‑11: Average Selling Price by Region, Meniscal Repair Market, Global, 2019 – 2029 (US$) |

| Figure 11‑12: Market Value by Region, Meniscal Repair Market, Global, 2019 – 2029 (US$M) |

| Figure 11‑13: Meniscal Repair Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 11‑14: Total Meniscal Repair Market, Global, 2019 – 2029 |

| Figure 11‑15: Units Sold by Region, Meniscal Repair Market, Global, 2019 – 2029 |

| Figure 11‑16: Average Selling Price by Region, Meniscal Repair Market, Global, 2019 – 2029 (US$) |

| Figure 11‑17: Market Value by Region, Meniscal Repair Market, Global, 2019 – 2029 (US$M) |

| Figure 11‑18: Implant Meniscal Market, Global, 2019 – 2029 |

| Figure 11‑19: Units Sold by Region, Implant Meniscal Market, Global, 2019 – 2029 |

| Figure 11‑20: Average Selling Price by Region, Implant Meniscal Market, Global, 2019 – 2029 (US$) |

| Figure 11‑21: Market Value by Region, Implant Meniscal Market, Global, 2019 – 2029 (US$M) |

| Figure 11‑22: Suture Meniscal Repair Market, Global, 2019 – 2029 |

| Figure 11‑23: Units Sold by Region, Suture Meniscal Repair Market, Global, 2019 – 2029 |

| Figure 11‑24: Average Selling Price by Region, Suture Meniscal Repair Market, Global, 2019 – 2029 (US$) |

| Figure 11‑25: Market Value by Region, Suture Meniscal Repair Market, Global, 2019 – 2029 (US$M) |

| Figure 11‑26: Hybrid Meniscal Repair Market, Global, 2019 – 2029 |

| Figure 11‑27: Units Sold by Region, Hybrid Meniscal Repair Market, Global, 2019 – 2029 |

| Figure 11‑28: Average Selling Price by Region, Hybrid Meniscal Repair Market, Global, 2019 – 2029 (US$) |

| Figure 11‑29: Market Value by Region, Hybrid Meniscal Repair Market, Global, 2019 – 2029 (US$M) |

| Figure 11‑30: Leading Competitors, Meniscal Repair Market, Global, 2022 |

| Figure 12‑1: Hip Arthroscopy Markets Covered |

| Figure 12‑2: Hip Arthroscopy Regions Covered, Global (1 of 2) |

| Figure 12‑3: Hip Arthroscopy Regions Covered, Global (2 of 2) |

| Figure 12‑4: Hip Arthroscopy Procedures by Region, Global, 2019 – 2029 |

| Figure 12‑5: Hip Arthroscopy Procedures by Country, North America, 2019 – 2029 |

| Figure 12‑6: Hip Arthroscopy Procedures by Country, Latin America, 2019 – 2029 (1 of 2) |

| Figure 12‑7: Hip Arthroscopy Procedures by Country, Latin America, 2019 – 2029 (2 of 2) |

| Figure 12‑8: Hip Arthroscopy Procedures by Country, Western Europe, 2019 – 2029 |

| Figure 12‑9: Hip Arthroscopy Procedures by Country, Central & Eastern Europe, 2019 – 2029 (1 of 2) |

| Figure 12‑10: Hip Arthroscopy Procedures by Country, Central & Eastern Europe, 2019 – 2029 (2 of 2) |

| Figure 12‑11: Hip Arthroscopy Procedures by Country, Middle East, 2019 – 2029 |

| Figure 12‑12: Hip Arthroscopy Procedures by Country, Asia-Pacific, 2019 – 2029 (1 of 3) |

| Figure 12‑13: Hip Arthroscopy Procedures by Country, Asia-Pacific, 2019 – 2029 (2 of 3) |

| Figure 12‑14: Hip Arthroscopy Procedures by Country, Asia-Pacific, 2019 – 2029 (3 of 3) |

| Figure 12‑15: Hip Arthroscopy Procedures by Country, Africa, 2019 – 2029 |

| Figure 12‑16: Hip Arthroscopy Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 12‑17: Hip Arthroscopy Market by Region, Global, 2019 – 2029 (US$M) |

| Figure 12‑18: Hip Arthroscopy Market by Segment, Global, 2019 – 2029 (US$M) |

| Figure 12‑19: Total Hip Arthroscopy Market, Global, 2019 – 2029 |

| Figure 12‑20: Units Sold by Region, Hip Arthroscopy Market, Global, 2019 – 2029 |

| Figure 12‑21: Average Selling Price by Region, Hip Arthroscopy Market, Global, 2019 – 2029 (US$) |

| Figure 12‑22: Market Value by Region, Hip Arthroscopy Market, Global, 2019 – 2029 (US$M) |

| Figure 12‑23: Articulating Radiofrequency Probe Market, Global, 2019 – 2029 |

| Figure 12‑24: Units Sold by Region, Articulating Radiofrequency Probe Market, Global, 2019 – 2029 |

| Figure 12‑25: Average Selling Price by Region, Articulating Radiofrequency Probe Market, Global, 2019 – 2029 (US$) |

| Figure 12‑26: Market Value by Region, Articulating Radiofrequency Probe Market, Global, 2019 – 2029 (US$M) |

| Figure 12‑27: Static Radiofrequency Probe Market, Global, 2019 – 2029 |

| Figure 12‑28: Units Sold by Region, Static Radiofrequency Probe Market, Global, 2019 – 2029 |

| Figure 12‑29: Average Selling Price by Region, Static Radiofrequency Probe Market, Global, 2019 – 2029 (US$) |

| Figure 12‑30: Market Value by Region, Static Radiofrequency Probe Market, Global, 2019 – 2029 (US$M) |

| Figure 12‑31: Banana Blade Market, Global, 2019 – 2029 |

| Figure 12‑32: Units Sold by Region, Banana Blade Market, Global, 2019 – 2029 |

| Figure 12‑33: Average Selling Price by Region, Banana Blade Market, Global, 2019 – 2029 (US$) |

| Figure 12‑34: Market Value by Region, Banana Blade Market, Global, 2019 – 2029 (US$M) |

| Figure 12‑35: Hip Access Kit Market, Global, 2019 – 2029 |

| Figure 12‑36: Units Sold by Region, Hip Access Kit Market, Global, 2019 – 2029 |

| Figure 12‑37: Average Selling Price by Region, Hip Access Kit Market, Global, 2019 – 2029 (US$) |

| Figure 12‑38: Market Value by Region, Hip Access Kit Market, Global, 2019 – 2029 (US$M) |

| Figure 12‑39: Suture Anchor Market, Global, 2019 – 2029 |

| Figure 12‑40: Units Sold by Region, Suture Anchor Market, Global, 2019 – 2029 |

| Figure 12‑41: Average Selling Price by Region, Suture Anchor Market, Global, 2019 – 2029 (US$) |

| Figure 12‑42: Market Value by Region, Suture Anchor Market, Global, 2019 – 2029 (US$M) |

| Figure 12‑43: Disposable Kit Market, Global, 2019 – 2029 |

| Figure 12‑44: Units Sold by Region, Disposable Kit Market, Global, 2019 – 2029 |

| Figure 12‑45: Average Selling Price by Region, Disposable Kit Market, Global, 2019 – 2029 (US$) |

| Figure 12‑46: Market Value by Region, Disposable Kit Market, Global, 2019 – 2029 (US$M) |

| Figure 12‑47: Leading Competitors, Hip Arthroscopy Market, Global, 2022 |

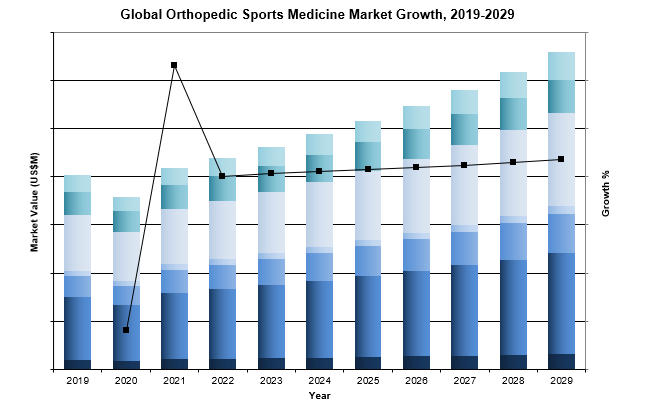

The major drivers of the market are demographic factors, mixed with an active lifestyle trend and an established professional sports industry. The majority of musculoskeletal injuries occur due to recreational and sports activities. Patient demographics include both younger populations, also involved in professional sports, as well as the elderly population, usually requiring treatment for degenerative disorders and chronic diseases.

The major drivers of the market are demographic factors, mixed with an active lifestyle trend and an established professional sports industry. The majority of musculoskeletal injuries occur due to recreational and sports activities. Patient demographics include both younger populations, also involved in professional sports, as well as the elderly population, usually requiring treatment for degenerative disorders and chronic diseases. In 2022, almost two thirds of the global orthopedic soft tissue market was controlled by three main companies: Arthrex, Smith & Nephew and DePuy Synthes. The remaining competitors each shared small portions of the market. The total market is largely fragmented due to the presence of both medical device manufacturers and tissue banks.

In 2022, almost two thirds of the global orthopedic soft tissue market was controlled by three main companies: Arthrex, Smith & Nephew and DePuy Synthes. The remaining competitors each shared small portions of the market. The total market is largely fragmented due to the presence of both medical device manufacturers and tissue banks.