Product Description

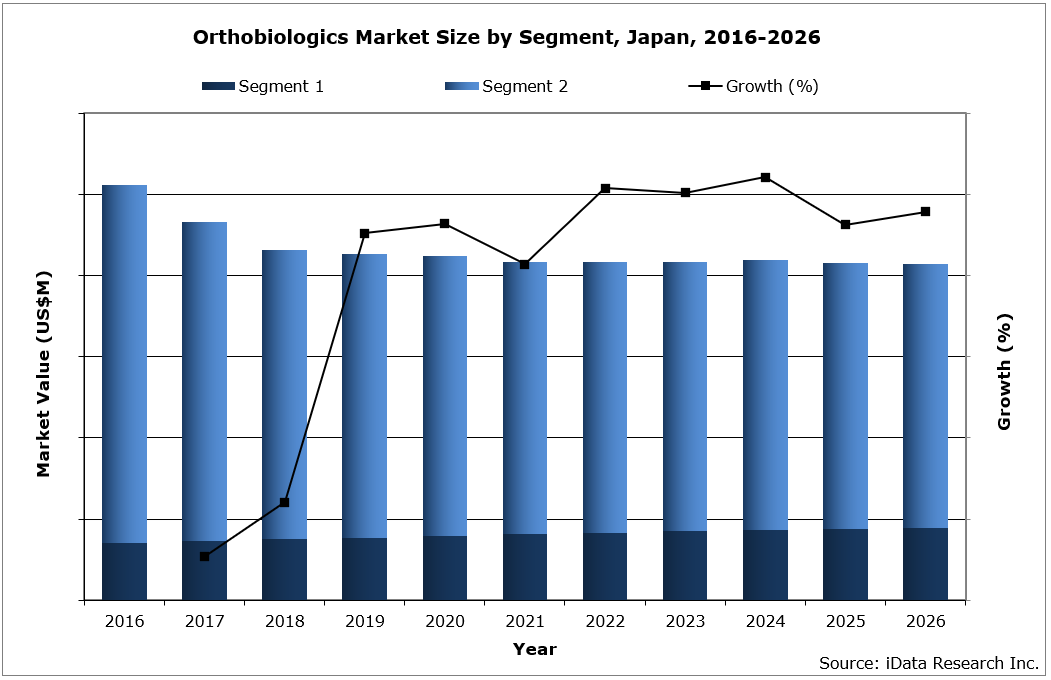

In 2020, the Japanese orthobiologics market size was valued at $426.9 million, with over 221,000 bone grafting procedures performed every year. The market size is expected to fluctuate over the forecast period with a -0.4% compound annual growth rate (CAGR).

Throughout this medical market research, we analyzed 16 orthobiologics companies across Japan and used our comprehensive methodology to understand the market sizes, unit sales, company market shares, and to create accurate forecasts.

While this MedSuite report contains all of the Japanese Orthopedic Biomaterials market data and analysis, each of the market segments is also available as stand-alone MedCore reports. This allows you to get access to only the market research that you need.

DATA TYPES INCLUDED

- Unit Sales, Average Selling Prices, Market Value & Growth Trends

- Orthobiologics Procedure Volumes

- Market Forecasts Until 2026, and Historical Data to 2016

- Competitive Analysis with Market Shares for Each Segment

- Market Drivers & Limiters for Each Orthopedic Biomaterials Device market

- Recent Mergers & Acquisitions

- Disease Overviews and Demographic Information

- Company Profiles, Product Portfolios and SWOT for Top Competitors

Market Value and Industry Trends

A lack of product differentiation across similar injection cycle products has led to commoditization, which has stifled innovation and the further development of new products. The prices of HA viscosupplementation products in Japan have drastically decreased since their introduction and are among the lowest in the world.

Surgical procedures that require the use of orthopedic biomaterials are generally associated with diseases and indications that become more prevalent in the population with an increase in age, such as osteoarthritis of the spine and knee. In 2019, approximately 29% of the Japanese population were aged 65 and over; this proportion is projected to grow steadily over the forecast period, as further cohorts of baby boomers turn 65. Growth of this population is expected to stimulate growth across all segments of the orthopedic biomaterials market.

In August 2018, Medtronic received PMDA approval for its Grafton® DBM allograft product, which is the first DBM allograft to be approved in Japan. Grafton® was commercially launched in February 2019. The growth of this product will be primarily driven by spine procedures and other orthopedic procedures that it is indicated for.

Competitive Analysis

By 2020, the leading competitor in the Japanese orthopedic biomaterials market was Seikagaku, which was attributed to its dominant position in the HA viscosupplementation market. The company’s portfolio includes the five-injection ARTZ® product line.

Chugai was the second-leading competitor in the Japanese market, which was attributed to its second-leading position in the HA viscosupplementation market. The company’s portfolio includes the Suvenyl® product line.

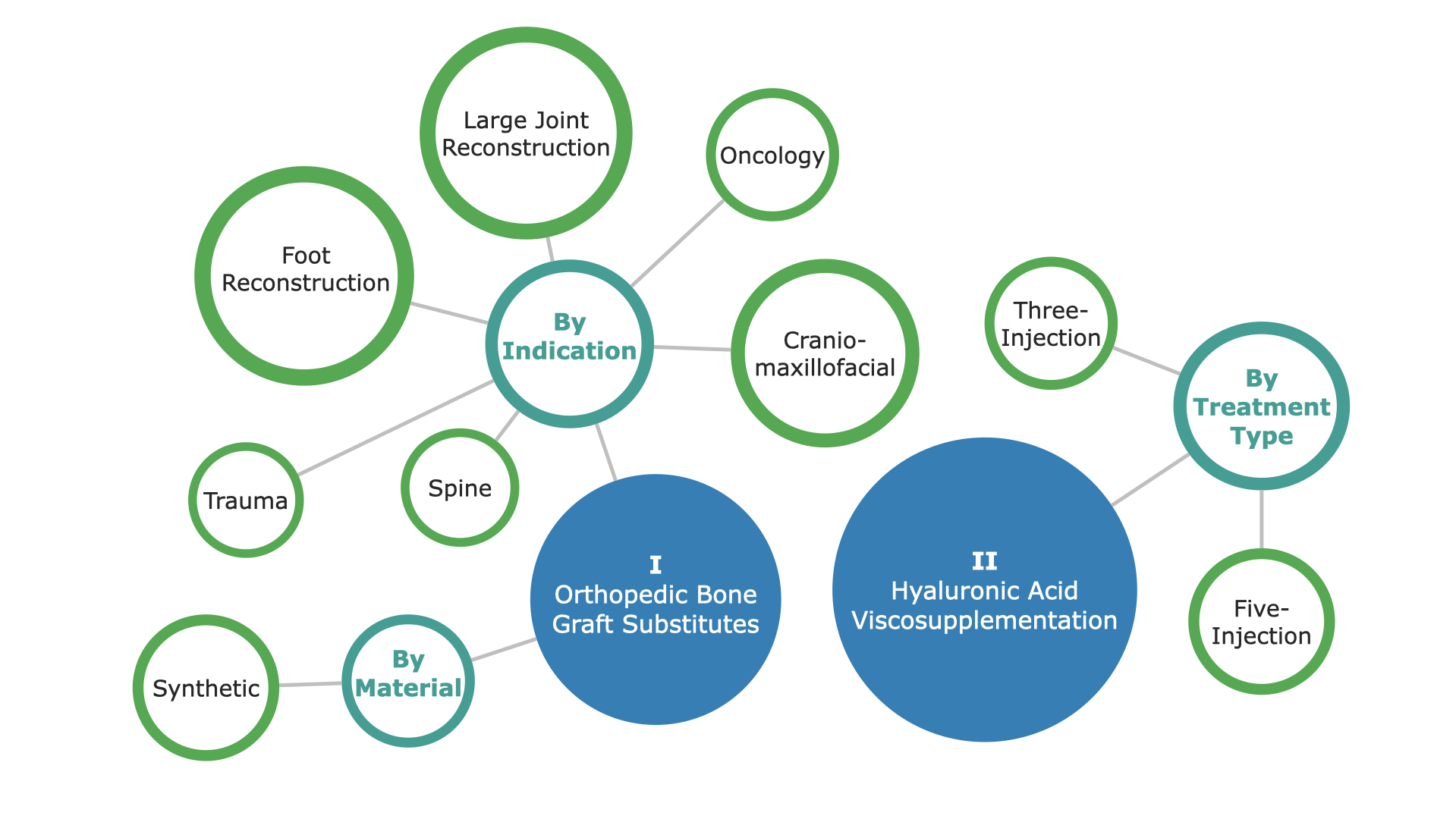

Segments Covered

Click on each title to view more detailed market segmentation.

- Procedure Volumes for Orthopedic Biomaterials Devices – MedPro – The complete procedural analysis for each segment of the Japanese Orthopedic Biomaterials market.

- Orthopedic Bone Graft Substitute Market – MedCore – This market is further segmented by Indication, including Spine, Trauma, Large Joint Reconstruction, Craniomaxillofacial, and Oncology.

- Hyaluronic Acid Viscosupplementation Market – MedCore – This market is categorized by Treatment Type, including Three-Injection and Five-Injection.

Detailed Market Segmentation

DON’T SEE THE SEGMENT OR DATA YOU NEED?

Feel free to contact us or send a request by pressing one of the buttons below.

FREE Sample Report

TABLE OF CONTENTS I

LIST OF FIGURES VII

LIST OF CHARTS XII

EXECUTIVE SUMMARY 1

JAPANESE ORTHOPEDIC BIOMATERIALS MARKET OVERVIEW 1

COMPETITIVE ANALYSIS 3

MARKET TRENDS 5

MARKET DEVELOPMENTS 6

PROCEDURE NUMBERS 7

MARKETS INCLUDED 8

VERSION HISTORY 8

RESEARCH METHODOLOGY 9

Step 1: Project Initiation & Team Selection 9

Step 2: Prepare Data Systems and Perform Secondary Research 12

Step 3: Preparation for Interviews & Questionnaire Design 14

Step 4: Performing Primary Research 15

Step 5: Research Analysis: Establishing Baseline Estimates 17

Step 6: Market Forecast and Analysis 18

Step 7: Identify Strategic Opportunities 20

Step 8: Final Review and Market Release 21

Step 9: Customer Feedback and Market Monitoring 22

PRODUCT ASSESSMENT 23

2.1 INTRODUCTION 23

2.2 PRODUCT PORTFOLIOS 23

2.2.1 Bone Graft Substitutes 24

2.2.2 Growth Factors 30

2.2.2.1 Other Products 33

2.2.3 Hyaluronic Acid Viscosupplementation (HAV) 35

2.3 REGULATORY ISSUES AND RECALLS 38

2.3.1 Bone Graft Substitutes 38

2.3.1.1 Allografts 38

2.3.1.1.1 MTF 38

2.3.1.2 DBM 38

2.3.1.2.1 AlloSource 38

2.3.1.2.2 SeaSpine 39

2.3.1.2.3 RTI Surgical 39

2.3.1.3 Synthetics 39

2.3.1.3.1 Abyrx 39

2.3.1.3.2 Zimmer Biomet 40

2.3.2 Growth Factors 40

2.3.2.1.1 Medtronic 40

2.3.3 Hyaluronic Acid Viscosupplementation 41

2.3.3.1 Three-injection 41

2.3.3.1.1 Ferring Pharmaceuticals 41

2.4 CLINICAL TRIALS 42

2.4.1 Bone Graft Substitutes 42

2.4.1.1 Allografts 42

2.4.1.1.1 Providence Medical Technology 42

2.4.1.1.2 The University of Texas Health Science 42

2.4.1.1.3 University of Winchester 43

2.4.1.2 BDM 43

2.4.1.2.1 K2M 43

2.4.1.2.2 Zimmer Biomet 44

2.4.1.3 Synthetics 44

2.4.1.3.1 Baxter 44

2.4.1.3.2 Bonesupport 45

2.4.1.3.3 DePuy Synthes 45

2.4.1.3.4 NuVasive 47

2.4.1.3.5 RTI surgical 47

2.4.1.3.6 Sunstar GUIDOR 48

2.4.1.4 Other materials and comparison 49

2.4.1.4.1 Seoul National University Hospital. 49

2.4.1.4.2 Sewon Cellontech 49

2.4.1.4.3 SurgaColl Technologies Limited 50

2.4.1.4.4 University of Colorado 50

2.4.1.4.5 University of Padova 51

2.4.2 Growth Factors 51

2.4.2.1.1 Bioventus 51

2.4.2.1.2 Cerapedics 52

2.4.2.1.3 CGBio 52

2.4.2.1.4 Isto 53

2.4.2.1.5 Medtronic 53

2.4.2.1.6 NuVasive 55

2.4.2.1.7 Wright 55

2.4.2.1.8 Others 56

2.4.3 Hyaluronic Acid Viscosupplementation 57

2.4.3.1.1 Anika Therapeutics 57

2.4.3.1.2 Bioventus 58

2.4.3.1.3 Cairo University 59

2.4.3.1.4 Ferring Pharmaceuticals 59

2.4.3.1.5 Federal University of Minas Gerais 60

2.4.3.1.6 Fidia Pharma USA Inc. 60

2.4.3.1.7 Istituto Ortopedico Rizzoli 61

2.4.3.1.8 University Hospital 61

2.4.3.1.9 Universidade Nova de Lisboa 62

JAPAN ORTHOPEDIC BIOMATERIALS MARKET OVERVIEW 63

3.1 INTRODUCTION 63

3.1.1 Bone Graft Substitutes 63

3.1.2 Growth Factors 63

3.1.3 Hyaluronic Acid (HA) Viscosupplementation 64

3.2 CURRENCY EXCHANGE RATE 65

3.3 MARKET OVERVIEW AND TREND ANALYSIS 66

3.4 DRIVERS AND LIMITERS 73

3.4.1 Market Drivers 73

3.4.2 Market Limiters 73

3.5 COMPETITIVE MARKET SHARE ANALYSIS 75

3.6 MERGERS AND ACQUISITIONS 79

3.7 COMPANY PROFILES 81

3.7.1 Anika Therapeutics 81

3.7.2 Bioventus 82

3.7.3 DePuy Synthes 83

3.7.4 Ferring Pharmaceuticals 84

3.7.5 Fidia Pharmaceuticals 85

3.7.6 Genzyme (Sanofi Group) 86

3.7.7 Harvest Technologies (Terumo BCT) 87

3.7.8 Integra LifeSciences 88

3.7.9 Medtronic 89

3.7.10 Musculoskeletal Transplant Foundation (MTF) 91

3.7.11 NuVasive 92

3.7.12 Orthofix 93

3.7.13 RTI Surgical 94

3.7.14 Stryker 95

3.7.15 Vericel Corporation (formerly Aastrom Bioscience) 96

3.7.16 Zimmer Biomet 97

3.8 SWOT ANALYSIS 99

3.8.1 Anika Therapeutics 99

3.8.2 Bioventus 101

3.8.3 DePuy Synthes 103

3.8.4 Ferring Pharmaceuticals 104

3.8.5 Fidia Pharmaceuticals 105

3.8.7 Harvest Technologies (Terumo BCT) 107

3.8.8 Integra LifeSciences 108

3.8.9 Medtronic 109

3.8.10 Musculoskeletal Transplant Foundation (MTF) 110

3.8.11 NuVasive 111

3.8.12 Orthofix 112

3.8.14 Stryker 114

3.8.15 Vericel Corporation (formerly Aastrom Bioscience) 115

3.8.16 Zimmer Biomet 116

PROCEDURE NUMBERS 118

4.1 INTRODUCTION 118

4.2 PROCEDURES 119

4.2.1 Orthopedic Biomaterial Procedures by Segment 119

4.2.2 Orthopedic Bone Grafting Procedures 121

4.2.2.1 Units per Procedure by Indication 123

4.2.2.2 Autograft Orthopedic Bone Grafting Procedures by Indication 124

4.2.2.3 Synthetic Orthopedic Bone Grafting Procedures by Indication 127

4.2.3 Hyaluronic Acid Supplementation Procedures 130

4.2.3.1 Hyaluronic Acid Supplementation Procedures by Injection Cycle 130

ORTHOPEDIC BONE GRAFT SUBSTITUTE MARKET 132

5.1 INTRODUCTION 132

5.2 MARKET ANALYSIS AND FORECAST 133

5.2.1.1 Synthetic Bone Graft Substitute Market 133

5.2.1.1.1 Synthetic Bone Graft Substitute Market by Indication 135

5.2.1.2 Demineralized Bone Matrix Allograft Bone Graft Substitute Market 161

5.3 DRIVERS AND LIMITERS 162

5.3.1 Market Drivers 162

5.3.2 Market Limiters 162

5.4 COMPETITIVE MARKET SHARE ANALYSIS 164

HYALURONIC ACID VISCOSUPPLEMENTATION MARKET 167

6.1 INTRODUCTION 167

6.1.1 Benefits of Viscosupplementation 168

6.1.2 Synovial Fluid 168

6.2 MARKET OVERVIEW 169

6.3 MARKET ANALYSIS AND FORECAST 175

6.3.1 Total Hyaluronic Acid Viscosupplementation Market 175

6.3.2 Three-Injection Hyaluronic Acid Viscosupplementation Market 177

6.3.3 Five-Injection Hyaluronic Acid Viscosupplementation Market 179

6.4 DRIVERS AND LIMITERS 181

6.4.1 Market Drivers 181

6.4.2 Market Limiters 181

6.5 COMPETITIVE MARKET SHARE ANALYSIS 183

ABBREVIATIONS 187

The

Orthobiologics Market Report Suite | Japan | 2020-2026 | MedSuite includes analysis on the following companies currently active in this market:

- Chugai Pharma

- CoorsTek

- DePuy Synthes

- HOYA Technosurgical

- Kuraray

- Maruho

- Medtronic

- Meiji Seika Pharma

|

- NGKNTK

- Olympus Terumo Biomaterials

- Sanofi

- Seikagaku

- Stryker

- Taisho

- Wright Medical

- Zimmer Biomet

|

LIST OF CHARTS

Chart 1 1: Orthopedic Biomaterials Market by Segment, Japan, 2016 – 2026 2

Chart 1 2: Orthopedic Biomaterials Market Overview, Japan, 2019 & 2026 2

Chart 3 1: Orthopedic Biomaterials Market by Segment, Japan, 2016 – 2026 68

Chart 3 2: Orthopedic Biomaterials Market Breakdown, Japan, 2019 69

Chart 3 3: Orthopedic Biomaterials Market Breakdown, Japan, 2026 70

Chart 3 4: Growth Rates by Segment, Orthopedic Biomaterials Market, Japan, 2017 – 2026 72

Chart 3 5: Leading Competitors, Orthopedic Biomaterials Market, Japan, 2019 78

Chart 4 1: Orthopedic Biomaterials Procedures by Segment, Japan, 2016 – 2026 120

Chart 4 2: Orthopedic Bone Grafting Procedures by Material, Japan, 2016 – 2026 122

Chart 4 3: Autograft Orthopedic Procedures by Indication, Japan, 2016 – 2026 126

Chart 4 4: Synthetic Orthopedic Bone Grafting Procedures by Indication, Japan, 2016 – 2026 129

Chart 4 5: Hyaluronic Acid Viscosupplementation Procedures by Injection Cycle, Japan, 2016 – 2026 131

Chart 5 1: Synthetic Bone Graft Substitute Market, Japan, 2016 – 2026 134

Chart 5 2: Synthetic Bone Graft Substitute Market by Indication, Japan, 2016 – 2026 136

Chart 5 3: Spine Synthetic Market, Japan, 2016 – 2026 138

Chart 5 4: Cervical Spine Synthetic Market, Japan, 2016 – 2026 140

Chart 5 5: Thoracolumbar Spine Synthetic Market, Japan, 2016 – 2026 142

Chart 5 6: Trauma Synthetic Market, Japan, 2016 – 2026 144

Chart 5 7: Non-Union Trauma Synthetic Market, Japan, 2016 – 2026 146

Chart 5 8: Fresh Fracture Trauma Synthetic Market, Japan, 2016 – 2026 148

Chart 5 9: Large Joint Reconstruction Synthetic Market, Japan, 2016 – 2026 150

Chart 5 10: Hip Reconstruction Synthetic Market, Japan, 2016 – 2026 152

Chart 5 11: Knee Reconstruction Synthetic Market, Japan, 2016 – 2026 154

Chart 5 12: Foot Reconstruction Synthetic Market, Japan, 2016 – 2026 156

Chart 5 13: Craniomaxillofacial Synthetic Market, Japan, 2016 – 2026 158

Chart 5 14: Oncology Synthetic Market, Japan, 2016 – 2026 160

Chart 5 15: Leading Competitors, Orthopedic Bone Graft Substitute Market, Japan, 2019 166

Chart 6 1: Hyaluronic Acid Viscosupplementation Market by Segment, Japan, 2016 – 2026 172

Chart 6 2: Hyaluronic Acid Viscosupplementation Market Breakdown, Japan, 2019 173

Chart 6 3: Hyaluronic Acid Viscosupplementation Market Breakdown, Japan, 2026 174

Chart 6 4: Total Hyaluronic Acid Viscosupplementation Market, Japan, 2016 – 2026 176

Chart 6 5: Three-Injection Hyaluronic Acid Viscosupplementation Market, Japan, 2016 – 2026 178

Chart 6 6: Five-Injection Hyaluronic Acid Viscosupplementation Market, Japan, 2016 – 2026 180

Chart 6 7: Leading Competitors, Hyaluronic Acid Viscosupplementation Market, Japan, 2019 186

LIST OF FIGURES

Figure 1 1: Orthopedic Biomaterials Market Share Ranking by Segment, Japan, 2019 3

Figure 1 2: Companies Researched in this Report 4

Figure 1 3: Factors Impacting the Orthopedic Biomaterials Market by Segment, Japan 5

Figure 1 4: Recent Events in the Orthopedic Biomaterials Market, Japan, 2017 – 2019 6

Figure 1 5: Orthopedic Biomaterials Procedures Covered, Japan 7

Figure 1 6: Orthopedic Biomaterials Markets Covered, Japan 8

Figure 1 7: Version History 8

Figure 2 1: Bone Graft Substitutes Products by Company (1 of 4) 26

Figure 2 2: Bone Graft Substitutes Products by Company (2 of 4) 27

Figure 2 3: Bone Graft Substitutes Products by Company (3 of 4) 28

Figure 2 4: Bone Graft Substitutes Products by Company (4 of 4) 29

Figure 2 5: Growth Factor Products by Company 34

Figure 2 6: Hyaluronic Acid Viscosupplementation by Products by Company 37

Figure 2 7: Class 2 Device Recall Musculoskeletal Transplant Foundation Allofix Insertion Kit 38

Figure 2 8: Class 2 Device Recall AlloFuse DBM Putty 5cc 38

Figure 2 9: Class 2 Device Recall Accell Evo3c Demineralized Bone Matrix Putty 39

Figure 2 10: Class 2 Device Recall RTI Biologics BioSet IC RT Paste 2 cc 39

Figure 2 11: Class 2 Device Recall Hemostatic Bone Putty 39

Figure 2 12: Class 2 Device Recall Endobon Xenograft Granules 40

Figure 2 13: Class 2 Device Recall Endobon Xenograft Granules 40

Figure 2 14: Class 2 Device Recall INFUSE Bone Graft X SMALL KIT 40

Figure 2 15: Class 3 Device Recall Euflexxa (1 sodium hyaluronate) 41

Figure 2 16: Evaluation of DTRAX Graft in Patients with Cervical Degenerative Disc Disease 42

Figure 2 17: Ridge Preservation Using FDBA and a Collagen Wound Dressing in Molar Sites. 42

Figure 2 18: Assessing Physical Activity Levels of Patients Following HTO. 43

Figure 2 19: Evaluation of Fusion Rate Using K2M VESUVIUS® Demineralized Fibers with K2M EVEREST® Spinal System 43

Figure 2 20: Evaluation of Zimmer Puros® Allograft vs. Creos™ Allograft for Alveolar Ridge Preservation 44

Figure 2 21: Synthetic Bone Graft Substitute vs. Autologous Spongiosa in Revision Anterior Cruciate Ligament Reconstruction 44

Figure 2 22: Cerament Treatment of Fracture Defects (CERTiFy) 45

Figure 2 23: Comparison of Bioactive Glass and Beta-Tricalcium Phosphate as Bone Graft Substitute (BAGvsTCP) 45

Figure 2 24: Evaluation of Fusion Rate of Anterior Cervical Discectomy and Fusion (ACDF) Using Cervios ChronOs™ and Bonion™ 46

Figure 2 25: AttraX® Putty vs. Autograft in XLIF® 47

Figure 2 26: Comparison of nanOss Bioactive with Autograft and Bone Marrow Aspirate to Autograft in the Posterolateral Spine 47

Figure 2 27: Assessment of nanOss Bioactive 3D in the Posterolateral Spine 48

Figure 2 28: Assessment of Ridge Preservation Using Moldable Beta-tricalcium Phosphate Bone Grafting System 48

Figure 2 29: Outcome Comparison of Allograft and Synthetic Bone Substitute in High Tibial Osteotomy 49

Figure 2 30: Efficacy and Safety of SurgiFill™ on Spinal Fusion 49

Figure 2 31: Assessment of HydroxyColl Bone Graft Substitute in High Tibial Osteotomy Wedge Grafting. (HColl_HTO) 50

Figure 2 32: Outcomes of the Evans Calcaneal Lengthening Based on Bone Grafting Material 50

Figure 2 33: Deproteinized Bovine Bone in Alveolar Bone Critical Size Defect (>2cm) Secondary to Cyst Removal 51

Figure 2 34: A Prospective Study of Instrumented, Posterolateral Lumbar Fusions (PLF) With OsteoAMP® 51

Figure 2 35: The Clinical Effect of i-FACTOR® Versus Allograft in Non-instrumented Posterolateral Spondylodesis Operation 52

Figure 2 36: Clinical Study of Injectable Ceramics Bone Graft Substitute Containing rhBMP-2 52

Figure 2 37: Prospective Study of Safety and Efficacy of InQu® Bone Graft Extender in Lumbar Interbody Fusion Surgery (Intebody) 53

Figure 2 38: A Study of INFUSE Bone Graft (BMP-2) in the Treatment of Tibial Pseudarthrosis in Neurofibromatosis Type 1 53

Figure 2 39: Clinical Study of INFUSE® Bone Graft Compared to Autogenous Bone Graft for Vertical Ridge Augmentation 54

Figure 2 40: Parallel Study Between BMP-2 and Autologous Bone Graft After Ilizarow Treatment 54

Figure 2 41: RCT of AttraX® Putty vs. Autograft in Instrumented Posterolateral Spinal Fusion (AxA) 55

Figure 2 42: Long-term Safety and Effectiveness of AUGMENT® Bone Graft Compared to Autologous Bone Graft 55

Figure 2 43: rhBMP-2 vs Autologous Bone Grafting for the Treatment of Non-union of the Docking Site in Tibial Bone Transport 56

Figure 2 44: Evaluation of Radiculitis Following Use of Bone Morphogenetic Protein-2 for Interbody Arthrodesis in Spinal Surgery 56

Figure 2 45: Study of Cingal™ for the Relief of Knee Osteoarthritis Compared to Triamcinolone Hexacetonide at 39 Weeks Follow-Up (Cingal17-02) 57

Figure 2 46: HyaloFAST Trial for Repair of Articular Cartilage in the Knee (FastTRACK) 57

Figure 2 47: Effectiveness of Two Hyaluronic Acids in Osteoarthritis of the Knee 58

Figure 2 48: The Effect of Topical Application of Hyaluronic Acid on Immediate Dental Implant 59

Figure 2 49: To Look at the Characteristics of Synovial Fluid and Cartilage Matrix in Osteoarthritic Knees After Hyaluronic Acid Injection 59

Figure 2 50: Use of Hyaluronic Acid as a Therapeutic Strategy for Bone Repair in Humans 60

Figure 2 51: Two Weekly Intra-articular Hyaluronan Knee Injections, Given One Week Apart, of HYMOVIS Combined With a Physical Exercise Program (PEP) Compared to PEP Alone, in a Relatively Young, Active Population of Subjects With Patellofemoral Osteoarthritis (PFOA) and/or Tibiofemoral Osteoarthritis (TFOA) 60

Figure 2 52: Comparative Assessment of Viscosupplementation With Polynucleotides and Hyaluronic Acid (PNHA1401) 61

Figure 2 53: Trial Comparing Botulin Toxin Versus Hyaluronic Acid by Intra-articular Injection (GOTOX) 61

Figure 2 54: Trial to Assess the Structural Effect and Long-term Symptomatic Relief of Intra-articular Injections of HA (ViscOA) 62

Figure 3 1: Currency Exchange Rate, 2019 65

Figure 3 2: Orthopedic Biomaterials Market by Segment, Japan, 2016 – 2026 (US$M) 67

Figure 3 3: Orthopedic Biomaterials Market by Segment, Japan, 2016 – 2026 (JP¥M) 67

Figure 3 4: Orthopedic Biomaterials Market Growth by Segment, Japan, 2016 – 2026 71

Figure 3 5: Drivers and Limiters, Orthopedic Biomaterials Market, Japan, 2019 74

Figure 3 6: Leading Competitors, Orthopedic Biomaterials Market, Japan, 2019 77

Figure 3 7: SWOT Analysis, Anika Therapeutics (1 of 2) 99

Figure 3 8: SWOT Analysis, Anika Therapeutics (2 of 2) 100

Figure 3 9: SWOT Analysis, Bioventus (1 of 2) 101

Figure 3 10: SWOT Analysis, Bioventus (2 of 2) 102

Figure 3 11: SWOT Analysis, DePuy Synthes 103

Figure 3 12: SWOT Analysis, Ferring Pharmaceuticals 104

Figure 3 13: SWOT Analysis, Fidia Pharmaceuticals 105

Figure 3 14: SWOT Analysis, Genzyme (Sanofi) 106

Figure 3 15: SWOT Analysis, Harvest Technologies 107

Figure 3 16: SWOT Analysis, Integra LifeSciences 108

Figure 3 17: SWOT Analysis, Medtronic 109

Figure 3 18: SWOT Analysis, MTF 110

Figure 3 19: SWOT Analysis, NuVasive 111

Figure 3 20: SWOT Analysis, Orthofix 112

Figure 3 21: SWOT Analysis, RTI Surgical 113

Figure 3 22: SWOT Analysis, Stryker 114

Figure 3 23: SWOT Analysis, Vericel Corporation 115

Figure 3 24: SWOT Analysis, Zimmer Biomet (1 of 2) 116

Figure 3 25: SWOT Analysis, Zimmer Biomet (2 of 2) 117

Figure 4 1: Orthopedic Biomaterials Procedures by Segment, Japan, 2016 – 2026 119

Figure 4 2: Orthopedic Bone Grafting Procedures by Material, Japan, 2016 – 2026 121

Figure 4 3: Units per Procedure by Indication, Bone Graft Substitute Market, Japan, 2016– 2026 123

Figure 4 4: Autograft Orthopedic Procedures by Indication, Japan, 2016 – 2026 (1 of 2) 124

Figure 4 5: Autograft Orthopedic Procedures by Indication, Japan, 2016 – 2026 (2 of 2) 125

Figure 4 6: Synthetic Orthopedic Bone Grafting Procedures by Indication, Japan, 2016 – 2026 (1 of 2) 127

Figure 4 7: Synthetic Orthopedic Bone Grafting Procedures, Japan, 2016 – 2026 (2 of 2) 128

Figure 4 8: Hyaluronic Acid Viscosupplementation Procedures by Injection Cycle, Japan, 2016 – 2026 130

Figure 5 1: Synthetic Bone Graft Substitute Market, Japan, 2016 – 2026 133

Figure 5 2: Synthetic Bone Graft Substitute Market by Indication, Japan, 2016 – 2026 (US$M) 135

Figure 5 3: Spine Synthetic Market, Japan, 2016 – 2026 137

Figure 5 4: Cervical Spine Synthetic Market, Japan, 2016 – 2026 139

Figure 5 5: Thoracolumbar Spine Synthetic Market, Japan, 2016 – 2026 141

Figure 5 6: Trauma Synthetic Market, Japan, 2016 – 2026 143

Figure 5 7: Non-Union Trauma Synthetic Market, Japan, 2016 – 2026 145

Figure 5 8: Fresh Fracture Trauma Synthetic Market, Japan, 2016 – 2026 147

Figure 5 9: Large Joint Reconstruction Synthetic Market, Japan, 2016 – 2026 149

Figure 5 10: Hip Reconstruction Synthetic Market, Japan, 2016 – 2026 151

Figure 5 11: Knee Reconstruction Synthetic Market, Japan, 2016 – 2026 153

Figure 5 12: Foot Reconstruction Synthetic Market, Japan, 2016 – 2026 155

Figure 5 13: Craniomaxillofacial Synthetic Market, Japan, 2016 – 2026 157

Figure 5 14: Oncology Synthetic Market, Japan, 2016 – 2026 159

Figure 5 15: Drivers and Limiters, Orthopedic Bone Graft Substitute Market, Japan, 2019 163

Figure 5 16: Leading Competitors, Orthopedic Bone Graft Substitute Market, Japan, 2019 165

Figure 6 1: Hyaluronic Acid Viscosupplementation Market by Segment, Japan, 2016 – 2026 (US$M) 170

Figure 6 2: Hyaluronic Acid Viscosupplementation Market by Segment, Japan, 2016 – 2026 (JP¥M) 171

Figure 6 3: Total Hyaluronic Acid Viscosupplementation Market, Japan, 2016 – 2026 175

Figure 6 4: Three-Injection Hyaluronic Acid Viscosupplementation Market, Japan, 2016 – 2026 177

Figure 6 5: Five-Injection Hyaluronic Acid Viscosupplementation Market, Japan, 2016 – 2026 179

Figure 6 6: Drivers and Limiters, Hyaluronic Acid Viscosupplementation Market, Japan, 2019 182

Figure 6 7: Leading Competitors, Hyaluronic Acid Viscosupplementation Market, Japan, 2019 185

iData’s 9-Step Research Methodology

Our reports follow an in-depth 9-step methodology which focuses on the following research systems:

- Original primary research that consists of the most up-to-date market data

- Strong foundation of quantitative and qualitative research

- Focused on the needs and strategic challenges of the industry participants

Step 1: Project Initiation & Team Selection During this preliminary investigation, all staff members involved in the industry discusses the topic in detail.

Step 2: Prepare Data Systems and Perform Secondary Research The first task of the research team is to prepare for the data collection process: Filing systems and relational databases are developed as needed.

Step 3: Preparation for Interviews & Questionnaire Design The core of all iData research reports is primary market research. Interviews with industry insiders represent the single most reliable way to obtain accurate, current data about market conditions, trends, threats and opportunities.

Step 4: Performing Primary Research At this stage, interviews are performed using contacts and information acquired in the secondary research phase.

Step 5: Research Analysis: Establishing Baseline Estimates Following the completion of the primary research phase, the collected information must be synthesized into an accurate view of the market status. The most important question is the current state of the market.

Step 6: Market Forecast and Analysis iData Research uses a proprietary method to combine statistical data and opinions of industry experts to forecast future market values.

Step 7: Identify Strategic Opportunities iData analysts identify in broad terms why some companies are gaining or losing share within a given market segment.

Step 8: Final Review and Market Release An integral part of the iData research methodology is a built-in philosophy of quality control and continuing improvement is integral to the iData philosophy.

Step 9: Customer Feedback and Market Monitoring iData philosophy of continuous improvement requires that reports and consulting projects be monitored after release for customer feedback and market accuracy.

Click Here to Read More About Our Methodology