Product Description

Industry Trends

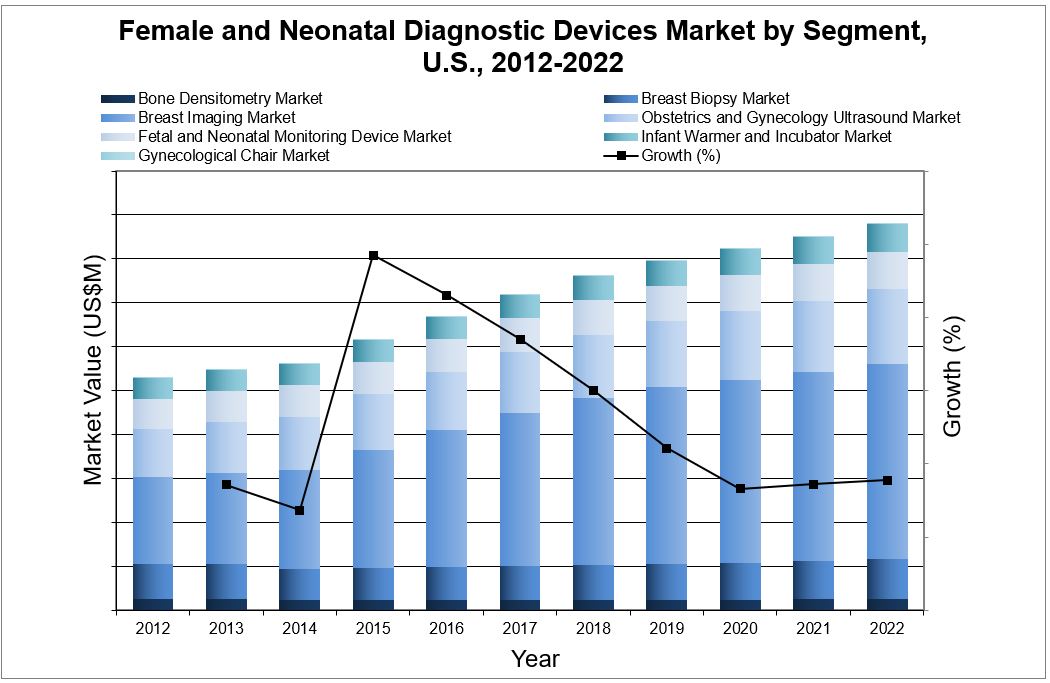

The majority of these U.S. female and neonatal diagnostic devices market segments will see stable growth throughout the forecast period of this report. The largest segment of this market was represented by breast imaging. This is primarily due to the large number of screening procedures performed with these devices, which add to the demand of the devices as well as the introduction of new technologies such as digital breast tomosynthesis (DBT) and automated breast ultrasound (ABUS). As the population ages, the incidence of cancer increases, thus increasing the demand for breast cancer screening. Moreover, there has been a push towards newer and more expensive devices with increased detection capabilities, tissue versatility and lower radiation doses as well as increasing public awareness about the importance of screening.

In the Europe female and neonatal diagnostic devices market, the well-established and mature OB/GYN ultrasound segment will continue to dominate this market throughout the forecast period. This will be followed by the breast imaging segment, representing just over a quarter of the overall market. The markets expected to experience a net growth over the forecast period are the breast biopsy market as well as the infant warmer and incubator market. The increasing average age of the European population as well as technological advances will improve growth in the breast biopsy market.

Report Regional Coverage

Throughout this research series, iData has covered several countries in great detail. Each country may be purchased as a stand-alone report, tailoring the data to your needs. The covered countries are:

- United States

- Europe (15 countries including: Germany, France, U.K., Italy, Spain, Benelux (Belgium, Netherlands and Luxembourg), Scandinavia (Denmark, Finland, Norway and Sweden) Austria, Switzerland and Portugal)

- Asia Pacific

The Only Medical Device Market Research With: |

||||

|---|---|---|---|---|

| ✔ Procedure Volume Analysis ✔ Unit Sales Growth Analysis ✔ Average Selling Prices ✔ Competitor Shares by Segment & Country ✔ SKU-Level Research Methods ✔ The Lowest Acquisition Cost |

||||

Highly Detailed Segmentation

While this report suite contains all applicable market data, each of the markets are also available as stand alone MedCore reports. This allows you to get access to only the specific market segment research that you need. You can view all these included reports and segmentation here:

- Female and Neonatal Diagnostic Devices Market – MedPro

- Female and Neonatal Diagnostic Devices Market – MedCore

- Bone Densitometry Market – MedCore

- Breast Biopsy Market – MedCore

- Breast Imaging Equipment Market – MedCore

- Obstetrics and Gynecology Ultrasound Equipment Market – MedCore

- Female and Neonatal Monitoring Device Market – MedCore

- Infant Warmer and Incubator Market – MedCore

- Gynecological Chair Market – MedCore

Buying all of these reports together in this suite package will provide you with substantial discounts from the separate prices. Request Pricing to Learn More.

Data Types Included

- Unit Sales, Average Selling Prices, Market Value & Growth Trends

- Procedure Volumes

- 10 Year Scope and Forecast range

- Market Drivers & Limiters for Each Segment

- Competitive Analysis with Market Shares for Each Segment

- Recent Mergers & Acquisitions

- Disease Overviews and Demographic Information

- Company Profiles, Product Portfolios and SWOT for Top Competitors

Female and Neonatal Diagnostic Devices Market Share Insights

Hologic was the leading competitor in the U.S. female and neonatal diagnostic device market. This company has a significant presence in the U.S. breast health market and is known for its commitment to women’s health and innovative products. At one time Hologic held sole possession of the DBT market. Although two additional companies now have FDA approval, Hologic’s early establishment in the market has led to its continued dominance.

GE Healthcare was the second leading competitor in the U.S. market for breast imaging. GE Healthcare was also the second leading competitor in both the digital breast tomosynthesis and digital radiography mammography segments. This company has been producing mammography systems for over 50 years and is focused on developing accurate, efficient and patient-friendly breast imaging products.

In the European market, GE and Hologic are major players, but more so in the done densitometry market. However, the downturn in this market has

allowed smaller competitors, such as Cooper Surgical’s Norland

Globally, strong competition is found through top competitors including Philips Healthcare, Siemens Healthcare, Mammotome, C.R. Bard, Laborie, Drager Medical, AFGA Healthcare, Atmos Medical BeamMed, Fujifilm Medical, Fukuda Denshi, Hitachi Aloka Medical America Inc, International Biomedical, Konica Minolta Osteometer Meditech, Samsung Madison, SonoCine, Spacelabs Healthcare, Toshiba America Medical Systems, Zonare Medical Systems and various others.

All Companies Analyzed in this Study |

||||

|---|---|---|---|---|

|

|

|||

Statistics and Procedure Trends

There are over 4.5 million DXA procedures being performed annually in the U.S. Central DXA procedures accounted for a large portion of DXA procedures at 98%. The ratio of Central DXA procedures will remain steady over the forecast period as the market is well developed with few changes. Despite predicted market growth, procedure numbers as reported are predicted to decline. This contradiction can be attributed to two factors; firstly these procedures do not take into account central DXAs being used in the body composition market which is a major driver for potential market growth, and secondly, the procedural data also excludes ultrasonometers which are a larger portion of the peripheral bone densitometry market.

In the U.S. market, there are more than 1.7 million breast biopsy procedures being performed annually. There are over 17 million OB/GYN ultrasounds performed in the U.S. Despite a decrease in birth rate in the U.S., a major shift towards a more mature maternal pregnancy age will help offset any decreases in obstetrics imaging due to reduced birth and pregnancy rates. Moreover, as the population is aging, more gynecological procedures to examine abnormalities in the uterus will be required. The largest driver of this market, however, seems to be consumer choice rather

than medical necessity. With the wide availability and ease of access to ultrasound equipment, many patients are requesting ultrasounds for non-medical reasons such as bonding or scrap booking.