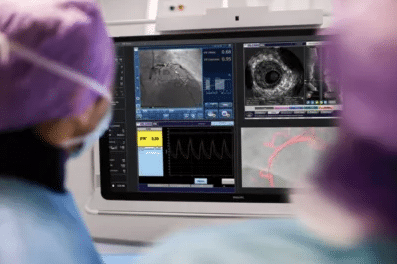

Intravascular ultrasound (IVUS) is an imaging technique that can be used as an alternative in peripheral procedures. IVUS provides the physician with a cross-sectional image of the vessel. Specifically, the technique is used in endovascular aneurysm repair (EVAR), thoracic endovascular aneurysm repair (TEVAR), carotid, subclavian, mesenteric, renal, iliac, superficial femoral artery (SFA), popliteal, inferior vena cava filter, (IVCF), deep venous, superficial venous and AV access procedures. An IVUS system consists of two components: the disposable IVUS catheter and the IVUS console. Some of the most popular peripheral IVUS catheters include Philips’ Visions® Catheter product line and the popular IVUS consoles include Philips’ Core® and Core® Mobile consoles.

Aside from Philips, Boston Scientific is the only other company that offers an IVUS catheter specialized for peripheral interventions (OptiCross® 18). The IVUS market is expected to evolve over the forecast period. Within this progressive market, two main companies are present, Philips and Boston Scientific. Competition between these two industry giants is impossible to avoid and as a result, one will remain superior to the other. If you’re interested in finding out which of the two dominates the U.S. peripheral IVUS catheter market, you’ve come to the right place.

Philips

Philips is a health technology company in which strives on improving people’s health through innovative technology. In 2017, Philips was the leading competitor in the peripheral IVUS catheter market and was able to gain entrance to the market through its acquisition of Volcano Corporation in 2015. Philips’ peripheral IVUS catheter portfolio includes the Visions® PV .018 (20 MHz) Catheter, Visions® PV .035 (10 MHz) Catheter, Visions® PV .014P Catheter and Visions® PV .014P RX. Along with the company’s Eagle Eye Platinum and Eagle Eye Platinum ST IVUS catheters which are used in both coronary and peripheral procedures.

Boston Scientific

Boston Scientific is a U.S. medical device company in which strives on developing innovative medical solutions to benefit its patient’s overall health. In 2017, Boston Scientific was the second-leading competitor in the peripheral IVUS catheter market. The company offers the OptiCross18® peripheral IVUS catheter. The OptiCross18®catheter can be used with the iLab® and POLARIS™ systems. Boston Scientific’s share is particularly strong in PAD indications, due to the company’s robust peripheral portfolio which includes complementary devices such as stents, balloons, etc.

Leading Competitor

Despite the large presence of both companies within the peripheral IVUS catheter market, one is ultimately more successful in comparison to the other. In this case, Philips remains the dominant leader in the U.S. peripheral IVUS catheter market. Currently, Philips is the only company that offers a full portfolio of IVUS catheters and because of this Philips has had an advantage over the competition. In 2017, Philips acquired Spectranetics and was able to increase its presence within the peripheral vascular market. Because of this, Philips has successfully been able to maintain its leading position in the U.S. peripheral IVUS catheter market, leaving Boston Scientific as the second-leading competitor.

Conclusion

The peripheral IVUS catheter market is expected to be the fastest-growing segment of the total peripheral vascular devices market and is projected to appreciate over the forecast period. Growth will be driven by a strong increase in unit sales and limited by slight ASP declines. Unit growth will be driven by the growing number of peripheral interventions performed in the U.S. as well as the rising adoption of the IVUS imaging technique in peripheral procedures.

iData Research was able to conduct a detailed analysis of the IVUS catheter market, the products and segments, to develop insights on prices, units sold, and market shares. The results of this analysis are available through our exclusive MedSKU solutions. Alongside this, an entire collection of reports on the Peripheral Vascular Devices Market, including the IVUS catheter market, is available as a MedSuite.

Click here to find out more about MedSKU

Receive a free synopsis of the U.S. Peripheral Vascular Device Market Report