Register to receive a free Interventional Cardiology Devices Market Report Suite for US 2018-2024 synopsis and brochure

Register to receive a free Interventional Cardiology Devices Market Report Suite for US 2018-2024 synopsis and brochure

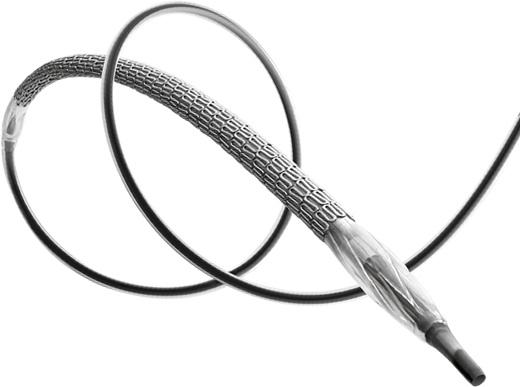

Designed specifically for small vessels, Medtronic announced the U.S. Food and Drug Administration (FDA) approval and U.S. launch of the Resolute Onyx(TM) 2.0 mm Drug-Eluting Stent (DES) – the smallest sized DES on the market. The new stent is intended to help interventional cardiologists treat patients with coronary artery disease (CAD) who have small vessels often untreatable with larger stent technologies during percutaneous coronary intervention (PCI). It is estimated that approximately 65 percent of smaller vessels (<= 2.25 mm) are in critical locations of the heart, making them significant lesions to treat.

“Patients with lesions in small vessels or complex vasculatures can present unique challenges for physicians during PCI procedures,” said Matthew J. Price, M.D., interventional cardiologist at Scripps Clinic in La Jolla, Calif., and national principal investigator of the RESOLUTE ONYX 2.0 mm Clinical Study, which supported the recent FDA approval. “The Resolute Onyx 2.0 mm DES is an extremely deliverable stent that, when needed, can be post-dilated to 3.25 mm to treat lesions in difficult-to-reach areas of the heart.”

The first-and-only 2.0 mm DES size available in the U.S., the newly approved stent joins the unique Resolute Onyx 4.5- and 5.0-mm DES to provide physicians with the broadest DES size matrix available, expanding treatment options for patients with the smallest coronary vessels to the largest, from the simplest of anatomies to the complex. In addition, the stent is engineered with the lowest crossing profile of any DES (less than 1 mm) enabling exceptional deliverability. Once delivered, the Resolute Onyx 2.0 mm DES is engineered to expand from 2.0 mm to the maximum labeled expansion diameter of 3.25 mm.

The Resolute Onyx DES platform is the first-and-only DES to feature Core Wire Technology, an evolution of Continuous Sinusoid Technology (CST). CST is a unique Medtronic method of stent manufacturing, which involves forming a single strand of cobalt alloy wire into a sinusoidal wave to construct a stent. Core Wire Technology enables thinner struts while maintaining structural strength and visibility.

“Furthering our core objective of developing technologies that address unmet patient needs, the introduction of the Resolute Onyx 2.0 mm DES allows physicians to expand treatment options for patients with smaller vessels,” said Dave Moeller, vice president and general manager of the Coronary and Renal Denervation business, which is part of the Cardiac and Vascular Group at Medtronic. “The Resolute Onyx DES is an incredibly deliverable product that incorporates various design enhancements enabling physicians to optimize treatment for a wide range of patients.”

The Resolute Onyx 2.0 mm DES is supported by the RESOLUTE ONYX 2.0 mm Clinical Study, which was presented at the 2017 EuroPCR Annual Meeting and simultaneously published in the Journal of the American College of Cardiology (JACC): Cardiovascular Intervention. In the study, the Resolute Onyx DES met its pre-specified performance goal with low target lesion failure (5 percent), low target lesion revascularization (2 percent), no episodes of stent thrombosis and no cardiac death at 12 months.

The Resolute Onyx DES is available for use in all sizes in the United States, as well as in Europe and other countries that recognize the CE (Conformité Européene) Mark.

In collaboration with leading clinicians, researchers and scientists worldwide, Medtronic offers the broadest range of innovative medical technology for the interventional and surgical treatment of cardiovascular disease and cardiac arrhythmias. The company strives to offer products and services that deliver clinical and economic value to healthcare consumers and providers around the world.

iData Analyst Insights

One of the factors driving overall PCI procedure growth is the increased focus on complex PCI patients as well as the development of specialized devices and treatment techniques for patients that would otherwise be medically managed or treated with coronary artery bypass graft (CABG). Medtronic’s new Resolute Onyx(TM) 2.0 mm Drug-Eluting Stent (DES) is an example of product innovation in the interventional cardiology market in response to this trend. The release of the product will positively contribute to Medtronic’s position in the DES stent market, where it closely competes with Boston Scientific and Abbott for the leading position. Similar to other large competitors in the interventional cardiology market, Medtronic offers a vast selection of devices across both the coronary and peripheral markets, allowing it to strategically bundle products and leverage its position in the competitive landscape.

For Further Information

More on the interventional cardiology market in the U.S. can be found in a series of reports published by iData entitled the U.S. Market Report Suite for Interventional Cardiology Devices. This report covers the following market segments: coronary stent, coronary balloon catheter, balloon-inflation device, interventional coronary catheter, interventional coronary guidewire, coronary embolic protection device, coronary atherectomy device, coronary thrombectomy device, chronic total occlusion system, introducer sheath, coronary vascular closure device, diagnostic coronary catheter and guidewire, intravascular ultrasound (IVUS) and optical coherence tomography (OCT).

The iData series on the market for interventional cardiology covers the U.S., Japan, and 15 countries in Europe including Germany, France, the United Kingdom (U.K.), Italy, Spain, Benelux (Belgium, Netherlands and Luxemburg), Scandinavia (Finland, Denmark, Sweden and Norway), Portugal, Austria and Switzerland. Reports provide a comprehensive analysis including units sold, procedure numbers, market value, forecasts, as well as detailed competitive market shares and analysis of major players’ success strategies in each market and segment. To find out more about interventional cardiology device market data or procedure data, register online or email us at info@idataresearch.net for an U.S. Market Report Suite for Interventional Cardiology Devices brochure and synopsis.

Register to receive a free

Register to receive a free