Product Description

The U.S. and European insulin pump markets include durable pumps and patch pumps, which are further segmented to account for hardware and disposable components. Within both the U.S. and the European insulin pump markets, the largest segment was the durable pump market, which accounted for the majority of the total market value. Durable pumps account for such a large portion of the market because they are significantly more established than patch pumps.

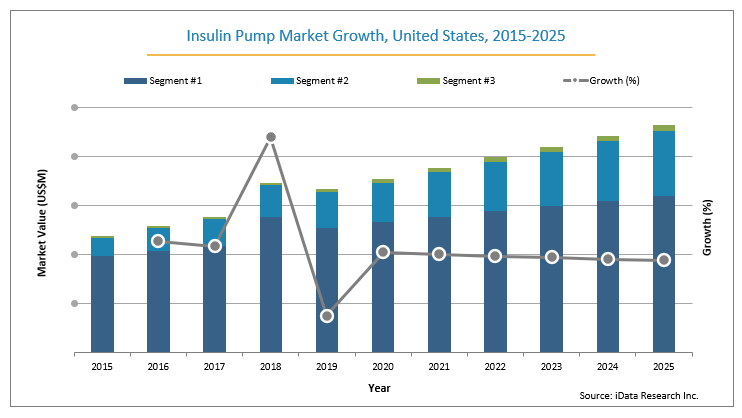

Over the forecast period, the value for both the U.S. and the European insulin pump markets is expected to increase over the forecast period. The U.S. market is expected to reach approximately $2 billion and the European market is expected to reach approximately €1 billion by 2025.

MARKET DATA INCLUDED

- Unit Sales, Average Selling Prices, Market Size & Growth Trends

- Market Drivers & Limiters

- Market Forecasts Until 2025, and Historical Data to 2015

- Company Profiles and Product Portfolios

- Leading Competitors

U.S. INSULIN PUMP MARKET INSIGHTS

Durable pumps account for such a large portion of the market because they are significantly more established than patch pumps and simple pumps, which were launched in the U.S. in 2005 and 2012, respectively. It is expected that durable pumps will maintain their dominance over the forecast period, despite the growing market share of patch pumps and simple pumps. Although Medtronic and Tandem hold a duopoly in the U.S. market as of 2018, SOOIL and other competitors are expected to enter the market over the forecast period.

Durable pumps account for such a large portion of the market because they are significantly more established than patch pumps and simple pumps, which were launched in the U.S. in 2005 and 2012, respectively. It is expected that durable pumps will maintain their dominance over the forecast period, despite the growing market share of patch pumps and simple pumps. Although Medtronic and Tandem hold a duopoly in the U.S. market as of 2018, SOOIL and other competitors are expected to enter the market over the forecast period.

EUROPE’S INSULIN PUMP MARKET INSIGHTS

Durable pumps account for such a large portion of the market because they are significantly more established than patch pumps, which were only launched in Europe in the last decade. It is expected that traditional pumps will maintain their dominance over the forecast period, despite the growing market share of patch pumps. The patch pump market accounted for the remainder of the total market value. Insulet continues to benefit from its monopolistic position in the market.

U.S. AND EUROPEAN INSULIN PUMP MARKET SHARE INSIGHTS

Medtronic, Roche, and Insulet controlled the European insulin pump market, and Medtronic, Insulet, and Tandem controlled the U.S. insulin pump market.

The leading competitor in both the U.S. and European insulin pump markets was Medtronic, which held the vast majority of the total market share. The company held the dominant leading position in the durable insulin pump market, primarily attributed to an established and very large installed base.

REPORT REGIONAL COVERAGE

Throughout this research series, iData has covered several countries in great detail. The covered countries are:

- North America (United States)

- Europe (Germany, France, United Kingdom, Italy, Spain, Benelux (Belgium, Netherlands, and Luxembourg), Scandinavia (Denmark, Finland, Norway, and Sweden), Austria, Switzerland, and Portugal)

FREE Sample Report

TABLE OF CONTENTS

LIST OF FIGURES IVLIST OF CHARTS VIEXECUTIVE SUMMARY 1U.S. DIABETES MONITORING, TREATMENT AND DRUG DELIVERY MARKET OVERVIEW 1COMPETITIVE ANALYSIS 4MARKET TRENDS 7MARKET DEVELOPMENTS 9

PROCEDURE NUMBERS

PROCEDURE CODES INVESTIGATED 10MARKETS INCLUDED 11KEY REPORT UPDATES 13VERSION HISTORY 13

RESEARCH METHODOLOGY

1.1 RESEARCH SCOPE 141.2 IDATA'S 9-STEP METHODOLOGY 14Step 1: Project Initiation & Team Selection 14Step 2: Prepare Data Systems and Perform Secondary Research 16Step 3: Preparation for Interviews & Questionnaire Design 17Step 4: Performing Primary Research 18Step 5: Research Analysis: Establishing Baseline Estimates 20Step 6: Market Forecast and Analysis 21Step 7: Identify Strategic Opportunities 23Step 8: Final Review and Market Release 24Step 9: Customer Feedback and Market Monitoring 25

DISEASE OVERVIEW 26

2.1 INTRODUCTION 262.1.1 Types of Diabetes 262.1.2 Diabetes Complications 282.1.3 Risk Factors Associated with Type 1 and Type 2 Diabetes 302.1.4 Signs and Symptoms 312.1.5 Diabetes Monitoring 332.1.6 Treatment 352.1.7 Drug Delivery Systems 36

INSULIN PUMP MARKET

3.1 INTRODUCTION 383.1.1 Traditional Insulin Pumps 383.1.2 Patch Insulin Pumps 383.1.3 Simple Insulin Pumps 393.2 MARKET OVERVIEW 403.3 MARKET ANALYSIS AND FORECAST 443.3.1 Total Traditional Insulin Pump Market 443.3.1.1 Traditional Pump Market 483.3.1.2 Infusion Set Market 503.3.1.3 Pump Reservoir Market 523.3.2 Total Patch Insulin Pump Market 543.3.2.1 Patch Pump System Market 583.3.2.2 Insulin Pod Market 603.3.3 Simple Insulin Pump Market 623.4 DRIVERS AND LIMITERS 653.4.1 Market Drivers 653.4.2 Market Limiters 673.5 COMPETITIVE MARKET SHARE ANALYSIS 69ABBREVIATIONS 73

Chart 1.1: Diabetes Monitoring, Treatment and Drug Delivery Market by Segment, U.S., 2013 - 2023 3Chart 1.2: Diabetes Monitoring, Treatment and Drug Delivery Market Overview, U.S., 2013- 2023 3Chart 3.1: Insulin Pump Market by Segment, U.S., 2013 - 2023 42Chart 3.2: Insulin Pump Market Breakdown, U.S., 2016 43Chart 3 3: Insulin Pump Market Breakdown, U.S.,2023 43Chart 3.4: Total Traditional Insulin Pump Market by Segment, U.S., 2013 - 2023 46Chart 3.5: Total Traditional Insulin Pump Market Breakdown, U.S., 2016 47Chart 3.6: Total Traditional Insulin Pump Market Breakdown, U.S., 2023 47Chart 3.7: Traditional Pump Market, U.S., 2013 - 2023 49Chart 3.8: Infusion Set Market, U.S., 2013 - 2023 51Chart 3.9: Pump Reservoir Market, U.S., 2013 - 2023 53Chart 3.10: Total Patch Insulin Pump Market by Segment, U.S., 2013 - 2023 56Chart 3.11: Total Patch Insulin Pump Market Breakdown, U.S., 2016 57Chart 3.12: Total Patch Insulin Pump Market Breakdown, U.S.,2023 57Chart 3.13: Patch Pump System Market, U.S., 2013 - 2023 59Chart 3.14: Insulin Pod Market, U.S., 2013 - 2023 61Chart 3.15: Simple Insulin Pump Market, U.S., 2013 - 2023 64Chart 3.16: Leading Competitors, Insulin Pump Market, U.S., 2016 72

Figure 1.1: Diabetes Monitoring, Treatment and Drug Delivery Market Share Ranking by Segment, U.S., 2016 (1 of 2) 4Figure 1.2: Diabetes Monitoring, Treatment and Drug Delivery Market Share Ranking by Segment, U.S., 2016 (2 of 2) 5Figure 1.3: Companies Researched in this Report, U.S., 2016 6Figure 1.4: Factors Impacting the Diabetes Monitoring, Treatment and Drug Delivery Market by Segment, U.S. (1 of 2) 7Figure 1.5: Factors Impacting the Diabetes Monitoring, Treatment and Drug Delivery Market by Segment, U.S. (2 of 2) 8Figure 1.6: Recent Events in the Diabetes Monitoring, Treatment and Drug Delivery Market, U.S., 2013 - 2016 9Figure 1.7: Diabetes Monitoring, Treatment and Drug Delivery Markets Covered, U.S., 2016 10Figure 1.8: Procedure Codes Investigated, U.S., 2016 10Figure 1.9: Diabetes Monitoring, Treatment and Drug Delivery Markets Covered, U.S., 2016 (1 of 2) 11Figure 1.10: Diabetes Monitoring, Treatment and Drug Delivery Markets Covered, U.S., 2016 (2 of 2) 12Figure 1.11: Key Report Updates 13Figure 1.12: Version History 13Figure 2.1: Major Types of Diabetes and Related Pathologies, U.S., 2016 27Figure 2.2: Risk Factors Associated with Type 1 and Type 2 Diabetes, U.S., 2016 31Figure 2.3: Signs and Symptoms Associated with Type 1 and Type 2 Diabetes, U.S., 2016 32Figure 3.1: Insulin Pump Market by Segment, U.S., 2013 - 2023 (US$M) 41Figure 3.2: Total Traditional Insulin Pump Market by Segment, U.S., 2013 - 2023 (US$M) 45Figure 3.3: Traditional Pump Market, U.S., 2013 - 2023 48Figure 3.4: Infusion Set Market, U.S., 2013 - 2023 50Figure 3.5: Pump Reservoir Market, U.S., 2013 - 2023 52Figure 3.6: Total Patch Insulin Pump Market by Segment, U.S., 2013 - 2023 (US$M) 55Figure 3.7: Patch Pump System Market, U.S., 2013 - 2023 58Figure 3.8: Insulin Pod Market, U.S., 2013 - 2023 60Figure 3.9: Simple Insulin Pump Market, U.S., 2013 - 2023 63Figure 3.10: Drivers and Limiters, Insulin Pump Market, U.S., 2016 68Figure 3.11: Leading Competitors, Insulin Pump Market, U.S., 2016 71

iData’s 9-Step Research Methodology

Our reports follow an in-depth 9-step methodology which focuses on the following research systems:

- Original primary research that consists of the most up-to-date market data

- Strong foundation of quantitative and qualitative research

- Focused on the needs and strategic challenges of the industry participants

Step 1: Project Initiation & Team Selection During this preliminary investigation, all staff members involved in the industry discusses the topic in detail.

Step 2: Prepare Data Systems and Perform Secondary Research The first task of the research team is to prepare for the data collection process: Filing systems and relational databases are developed as needed.

Step 3: Preparation for Interviews & Questionnaire Design The core of all iData research reports is primary market research. Interviews with industry insiders represent the single most reliable way to obtain accurate, current data about market conditions, trends, threats and opportunities.

Step 4: Performing Primary Research At this stage, interviews are performed using contacts and information acquired in the secondary research phase.

Step 5: Research Analysis: Establishing Baseline Estimates Following the completion of the primary research phase, the collected information must be synthesized into an accurate view of the market status. The most important question is the current state of the market.

Step 6: Market Forecast and Analysis iData Research uses a proprietary method to combine statistical data and opinions of industry experts to forecast future market values.

Step 7: Identify Strategic Opportunities iData analysts identify in broad terms why some companies are gaining or losing share within a given market segment.

Step 8: Final Review and Market Release An integral part of the iData research methodology is a built-in philosophy of quality control and continuing improvement is integral to the iData philosophy.

Step 9: Customer Feedback and Market Monitoring iData philosophy of continuous improvement requires that reports and consulting projects be monitored after release for customer feedback and market accuracy.

Click Here to Read More About Our Methodology

Durable pumps account for such a large portion of the market because they are significantly more established than patch pumps and simple pumps, which were launched in the U.S. in 2005 and 2012, respectively. It is expected that durable pumps will maintain their dominance over the forecast period, despite the growing market share of patch pumps and simple pumps. Although Medtronic and Tandem hold a duopoly in the U.S. market as of 2018, SOOIL and other competitors are expected to enter the market over the forecast period.

Durable pumps account for such a large portion of the market because they are significantly more established than patch pumps and simple pumps, which were launched in the U.S. in 2005 and 2012, respectively. It is expected that durable pumps will maintain their dominance over the forecast period, despite the growing market share of patch pumps and simple pumps. Although Medtronic and Tandem hold a duopoly in the U.S. market as of 2018, SOOIL and other competitors are expected to enter the market over the forecast period.