Product Description

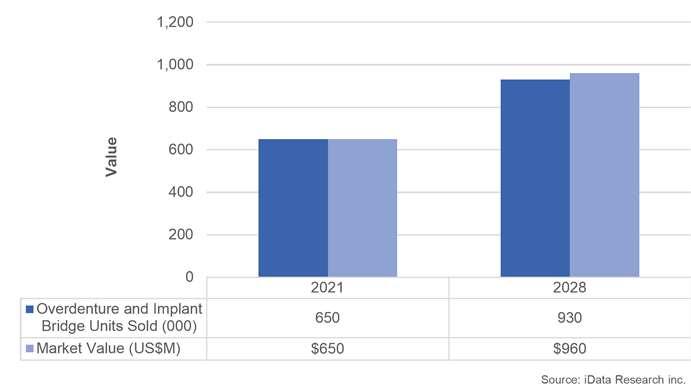

Overall, the U.S. overdentures and implant bridge market was valued at $649 million in 2021. Due to the global COVID-19 pandemic, this was an 18% decrease from the 2020 market value. However, this is expected to increase over the forecast period at a CAGR of 5.7% to reach $958 million by 2028.

Currently, the top competitors within the U.S. overdentures and implant bridge market ith regards to CAD/CAM manufacturers is Nobel Biocare and the attachment market was led by Zest Dental Solutions’ Locator® attachment system.

Throughout this medical market research, we analyzed over 30 overdenture and implant bridge manufacturers/companies in the U.S. and used our comprehensive methodology to understand the market sizes, unit sales, company market shares, procedure volumes, and to create accurate forecasts.

MARKET DATA INCLUDED

- Unit Sales, Average Selling Prices, Market Size & Growth Trends

- COVID-19 Impact Analysis

- Market Drivers & Limiters

- Market Forecasts Until 2028, and Historical Data to 2018

- Recent Mergers & Acquisitions

- Company Profiles and Product Portfolios

- Leading Competitors

U.S. OVERDENTURE AND IMPLANT BRIDGE MARKET INSIGHTS

An ongoing trend within the overdenture market is a shift in patient preferences toward fixed solutions. Patients value that fixed restorations are easier to clean and maintain, which is furthered by their resemblance to natural teeth, due to their permanency. This is especially true for fixed-hybrid overdentures, which as a result, have been seeing significant growth in the overdenture market.

An ongoing trend within the overdenture market is a shift in patient preferences toward fixed solutions. Patients value that fixed restorations are easier to clean and maintain, which is furthered by their resemblance to natural teeth, due to their permanency. This is especially true for fixed-hybrid overdentures, which as a result, have been seeing significant growth in the overdenture market.

U.S. OVERDENTURE AND IMPLANT BRIDGE MARKET SHARE INSIGHTS

The U.S. overdenture and implant bridge market was controlled by Nobel Biocare and Zest Dental Solutions’ Locator® attachment system. In 2021, Nobel Biocare was the leading competitor in the U.S. CAD/CAM milling facilities implant bar market and the Locator® attachment led the total attachment market in 2021, holding the vast majority of the market share. Additionally, in 2021, CAD/CAM manufacturers comprised a significant share of the implant bridge and implant bar markets, respectively. CAD/CAM technology offered by leading competitors, including Nobel Biocare and Dentsply Sirona, continued to lead the way in the market.

In 2021, Nobel Biocare was the leading competitor in the U.S. CAD/CAM milling facilities implant bar market and the Locator® attachment led the total attachment market in 2021, holding the vast majority of the market share. Additionally, in 2021, CAD/CAM manufacturers comprised a significant share of the implant bridge and implant bar markets, respectively. CAD/CAM technology offered by leading competitors, including Nobel Biocare and Dentsply Sirona, continued to lead the way in the market.

MARKET SEGMENTATION SUMMARY

- Overdenture Market – Further Segmented Into:

- implant-supported overdentures, removable implant bar overdentures and fixed-hybrid overdentures.

- Implant Bar Market – Further Segmented Into:

- Traditional Cast Implant Bar Market, Copy Mill Implant Bar Market, and CAD/CAM Implant Bar Market

- Attachment Market – Further Segmented Into:

- Removable Attachment Market, and Fixed Attachment Market

- Implant Bridge Market – Further Segmented Into:

- Cement-Retained Implant Bridge Market, and Screw-Retained Implant Bridge Market

RESEARCH SCOPE SUMMARY

| Report Attribute | Details |

|---|---|

| Region | North America (United States) |

| Base Year | 2021 |

| Forecast | 2022-2028 |

| Historical Data | 2018-2021 |

| Quantitative Coverage | Procedure Numbers, Market Size, Market Shares, Market Forecasts, Market Growth Rates, Units Sold, and Average Selling Prices. |

| Qualitative Coverage | COVID-19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios, Disease Overviews. |

| Data Sources | Primary Interviews with Industry Leaders, Government Physician Data, Regulatory Data, Hospital Private Data, Import & Export Data, iData Research Internal Database. |