Product Description

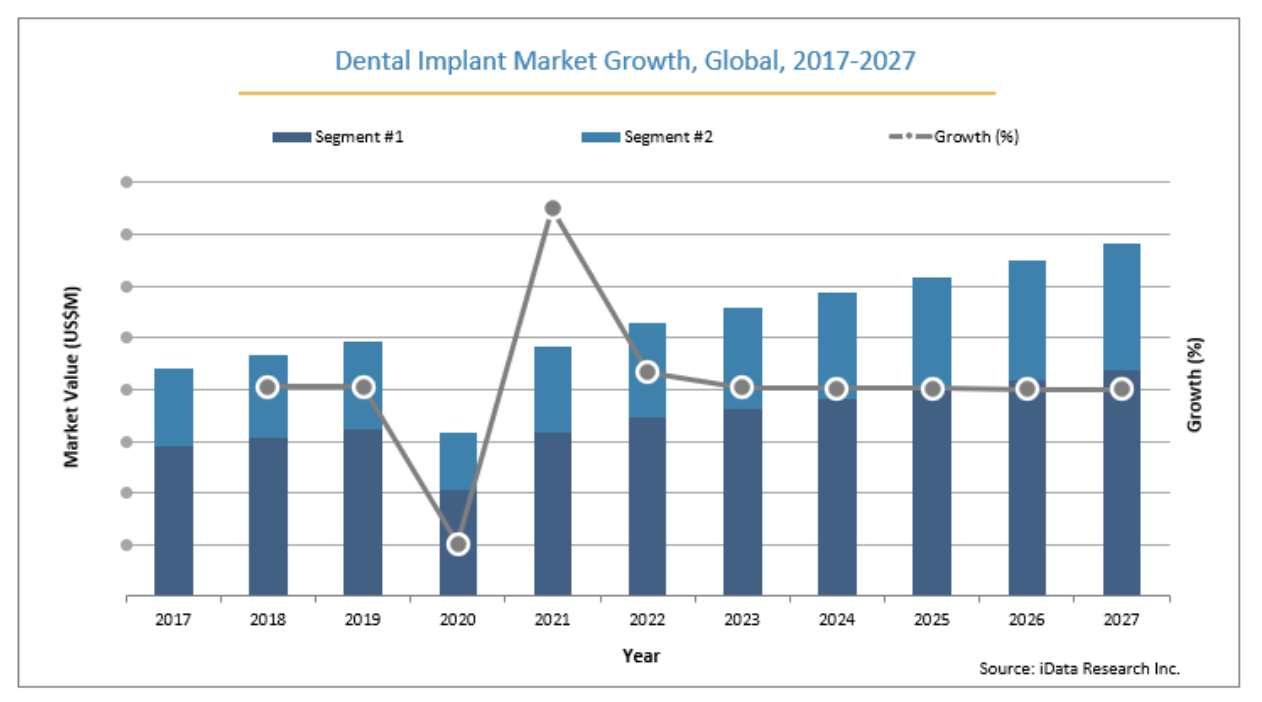

In 2021, the global dental implant and final abutment market size is projected to reach $4.8 billion, with higher demand for dental implants driving the market growth. In spite of COVID-19, the global market size is expected to increase over the forecast period at a CAGR of 11.6% and exceed $6.8 billion in 2027. Currently, the majority of the global market share is controlled by three main companies –Straumann Group, Envista and Dentsply Sirona.

iData’s report on the global market for dental implants includes segments for premium, value and discount implants. The final abutment market includes segments for stock, custom cast and CAD/CAM abutments. Demographic trends are a major driver of the global dental implant and final abutment market. The rising global population generally supports most healthcare markets and, since edentulism rates are highly correlated with age, the dental implant market is no exception. There are many regions around the world with a high growth potential due to increased access to healthcare extending life expectancy. Many of these regions have very low penetration rates of implants and may serve as major growth opportunities within the market.

Demographic trends are a major driver of the global dental implant and final abutment market. The rising global population generally supports most healthcare markets and, since edentulism rates are highly correlated with age, the dental implant market is no exception. There are many regions around the world with a high growth potential due to increased access to healthcare extending life expectancy. Many of these regions have very low penetration rates of implants and may serve as major growth opportunities within the market.

How Did COVID-19 Impact The Global Dental Implant Market?

In 2020, the global market for dental implants and final abutments declined by over 36% when compared to 2019 as a result of the COVID-19 pandemic. However, the global market is expected to recover rapidly and reach the pre-COVID levels by the end of 2022.

COVID-19 severely affected the global dental implant and final abutment market in 2020 and parts of 2021. Many implant procedures are seen as lower priority dental operations. As a result, they were readily postponed once global lockdowns began. However, as vaccines continue to be administered around the globe, the market has continued to recover and is expected to return to pre-pandemic volumes by 2022.

Global Dental Implants Market Share Insights

The global market is dominated by 3 major players – Nobel Biocare (Envista), Straumann, and Dentsply Sirona.

Straumann Group, Envista and Dentsply Sirona were the three strongest competitors in both the global dental implant market and the final abutment market. Sales of implants and abutments are highly correlated, which means that there has historically been significant overlap in the competitive landscapes of the two markets. Furthermore, many competitors also sell implants and abutments bundled together where possible.

Global Dental Implants Market Segmentation Summary

While this global report contains all global dental implants and final abutment market data, each of the market segments is also available as a stand-alone MedCore report. This allows you to get access to only the dental implant market research that you need.

- Dental Implants Market | Global | MedCore – Segmented by:

- Premium, value and discount implant

- Final Abutments Market | Global | MedCore – Segmented by:

- Stock, custom cast and CAD/CAM abutments

Research Scope Summary

| Report Attribute | Details |

|---|

| Regions | North America (Canada, United States)

Latin America (Argentina, Brazil, Chile, Colombia, Mexico, Peru, Venezuela)

Western Europe (Austria, Benelux, France, Germany, Italy, Portugal, Scandinavia, Spain, Switzerland, U.K.)

Central & Eastern Europe (Baltic States, Bulgaria, Croatia, Czech Republic, Greece, Hungary, Kazakhstan, Poland, Romania, Russia, Turkey, Ukraine)

Middle East (Bahrain, Iran, Israel, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates)

Asia Pacific (Australia, Cambodia, China, Hong Kong, India, Indonesia, Japan, Malaysia, Myanmar, New Zealand, Philippines, Singapore, South Korea, Taiwan, Thailand, Vietnam)

Africa (Algeria, Egypt, Ghana, Kenya, Libya, Morocco, Nigeria, South Africa, Sudan, Uganda) |

| Base Year | 2020 |

| Forecast Period | 2021-2027 |

| Historical Data | 2017-2020 |

| Quantitative Data | Market Size, Market Share, Market Growth Rates, Units Sold, Average Selling Prices |

| Qualitative Data | COVID-19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios |

| Data Sources | Primary Interviews with Industry Leaders, Government Physician Data, Regulatory Data, Hospital Private Data, Import & Export Data. Read more about iData’s 9-Step Research Methodology |

FREE Sample Report

For the complete

Table of Contents from any of the Country-Level reports in this Global Series, please navigate to the respective reports:

TABLE OF CONTENTS

TABLE OF CONTENTS I

LIST OF FIGURES VII

LIST OF CHARTS XII

EXECUTIVE SUMMARY 1

GLOBAL DENTAL IMPLANT AND FINAL ABUTMENT MARKET OVERVIEW 1

COMPETITIVE ANALYSIS 3

MARKET TRENDS 5

MARKET DEVELOPMENTS 6

MARKETS INCLUDED 8

REGIONS INCLUDED 9

VERSION HISTORY 10

RESEARCH METHODOLOGY 11

Step 1: Project Initiation & Team Selection 11

Step 2: Prepare Data Systems and Perform Secondary Research 14

Step 3: Preparation for Interviews & Questionnaire Design 16

Step 4: Performing Primary Research 17

Step 5: Research Analysis: Establishing Baseline Estimates 19

Step 6: Market Forecast and Analysis 20

Step 7: Identify Strategic Opportunities 22

Step 8: Final Review and Market Release 23

Step 9: Customer Feedback and Market Monitoring 24

IMPACT OF COVID-19 ON THE GLOBAL DENTAL IMPLANT AND FINAL ABUTMENT MARKET 25

2.1 INTRODUCTION 25

2.2 REGIONAL PROFILES 27

2.3 ANALYSIS BY MARKET SEGMENT 28

2.3.1 Worst Case Scenario 28

2.3.2 Base Case Scenario 29

2.3.3 Best Case Scenario 30

DISEASE OVERVIEW 32

3.1 BASIC ANATOMY 32

3.1.1 Dental Anatomy: Oral Cavity and Intraoral Landmarks 32

3.2 DISEASE PATHOLOGY AND DISORDERS 33

3.2.1 General Diagnostics 33

3.2.2 Indication for Dental Implant 33

3.2.3 Periodontal Disease 34

3.2.4 Dental Implant Procedures 35

3.2.5 Guided Bone Regeneration 36

3.3 PATIENT DEMOGRAPHICS 37

3.3.1 General Dental Statistics 37

3.3.2 Tooth Loss Statistics 38

PRODUCT ASSESSMENT 40

4.1 INTRODUCTION 40

4.2 PRODUCT PORTFOLIOS 40

4.2.1 Dental Implants 40

4.2.1.1 Mini Implants 41

4.2.2 Final Abutments 45

4.2.3 Computer-Guided Surgery 48

4.2.3.1 Treatment Planning Software 48

4.2.3.2 Surgical Guide 50

4.2.4 Dental Instrument Kits 52

4.3 REGULATORY ISSUES AND RECALLS 53

4.3.1.1 ACE Surgical 53

4.3.1.2 Implant Direct 53

4.3.1.3 Nobel Biocare 56

4.3.1.4 Straumann 58

4.3.1.5 Zimmer Biomet 58

4.4 CLINICAL TRIALS 62

4.4.1 Dental Implants 62

GLOBAL DENTAL IMPLANT AND FINAL ABUTMENT DEVICE MARKET OVERVIEW 67

5.1 INTRODUCTION 67

5.1.1 Dental Implants 67

5.1.1.1 Root-Form Dental Implants 67

5.1.1.2 Non-Root-Form Implants 68

5.1.1.3 Mini Implants 68

5.1.1.4 Dental Implant Applications 68

5.1.2 Dental Implant Procedures 69

5.1.3 Final Abutments 69

5.1.3.1 Healing and Transitional Abutments 70

5.1.4 Final Abutment Fabrication Types 70

5.1.4.1 Stock Abutments 70

5.1.4.2 Custom Abutments 71

5.1.4.3 CAD/CAM Abutments 71

5.2 MARKET OVERVIEW & TREND ANALYSIS 72

5.2.1 By Segment 72

5.2.2 By Region 75

5.3 DRIVERS AND LIMITERS 78

5.3.1 Market Drivers 78

5.3.2 Market Limiters 79

5.4 COMPETITIVE MARKET SHARE ANALYSIS 80

5.5 MERGERS AND ACQUISITIONS 86

5.6 COMPANY PROFILES 88

5.6.1 ACE Surgical 88

5.6.2 BioHorizons 89

5.6.3 Dentsply Sirona 90

5.6.4 Envista 91

5.6.5 Osstem Implant 92

5.6.6 MegaGen 93

5.6.7 Straumann Group 94

5.6.8 Zimmer Biomet 95

5.7 SWOT ANALYSIS 96

5.7.1 ACE Surgical 97

5.7.2 BioHorizons 98

5.7.3 Dentsply Sirona 99

5.7.4 Osstem Implant (HIOSSEN) 100

5.7.5 Implant Direct 101

5.7.6 MegaGen 102

5.7.7 MIS Implants 103

5.7.8 Nobel Biocare 104

5.7.9 Straumann Group 105

5.7.10 Zimmer Biomet 106

DENTAL IMPLANT MARKET 107

6.1 EXECUTIVE SUMMARY 107

6.1.1 Global Dental Implant Market Overview 107

6.1.2 Competitive Analysis 110

6.1.3 Markets Included 111

6.1.4 Regions Included 112

6.2 INTRODUCTION 114

6.3 MARKET OVERVIEW 115

6.3.1 By Segment 117

6.3.2 By Region 119

6.4 MARKET ANALYSIS AND FORECAST 121

6.4.1 Total Dental Implant Market 121

6.4.2 Premium Implant Market 126

6.4.3 Value Implant Market 131

6.4.4 Discount Implant Market 136

6.5 UNIT ANALYSIS 141

6.5.1.1 Internal Connection 141

6.5.1.2 External Connection 141

6.5.1.3 One-Piece 141

6.6 DRIVERS AND LIMITERS 146

6.6.1 Market Drivers 146

6.6.2 Market Limiters 147

6.7 COMPETITIVE MARKET SHARE ANALYSIS 150

FINAL ABUTMENT MARKET 159

7.1 EXECUTIVE SUMMARY 159

7.1.1 Global Final Abutment Market Overview 159

7.1.2 Competitive Analysis 161

7.1.3 Markets Included 162

7.1.4 Regions Included 163

7.2 INTRODUCTION 165

7.3 MARKET OVERVIEW 167

7.3.1 By Segment 168

7.3.2 By Region 170

7.4 MARKET ANALYSIS AND FORECAST 172

7.4.1 Total Final Abutment Market 172

7.4.2 Stock Abutment Market 177

7.4.3 Custom Cast Abutment Market 182

7.4.4 CAD/CAM Abutment Market 187

7.5 DRIVERS AND LIMITERS 191

7.5.1 Market Drivers 191

7.5.2 Market Limiters 192

7.6 COMPETITIVE MARKET SHARE ANALYSIS 193

ABBREVIATIONS 201

Chart 1 1: Dental Implant and Final Abutment Market by Segment, Global, 2020 – 2027 2

Chart 1 2: Dental Implant and Final Abutment Units Sold, Global, 2020 2

Chart 2 1: Multi-Scenario Dental Implant and Final Abutment Market Forecast, Global, 2017 – 2027 (US$M) 31

Chart 5 1: Dental Implant and Final Abutment Device Market by Segment, Global, 2017 – 2027 74

Chart 5 2: Dental Implant and Final Abutment Device Market by Region, Global, 2017 – 2027 77

Chart 5 3: Leading Competitors, Dental Implant and Final Abutment Device Market, Global, 2020 85

Chart 6 1: Dental Implant Market, Global, 2017 – 2027 109

Chart 6 2: Dental Implant Units Sold, Global, 2020 109

Chart 6 3: Dental Implant Market by Segment, Global, 2017 – 2027 118

Chart 6 4: Dental Implant Market by Region, Global, 2017 – 2027 120

Chart 6 5: Leading Competitors, Dental Implant Market, Global, 2020 158

Chart 7 1: Final Abutment Market, Global, 2017 – 2027 160

Chart 7 2: Final Abutment Units Sold, Global, 2020 160

Chart 7 3: Final Abutment Market by Segment, Global, 2017 – 2027 169

Chart 7 4: Final Abutment Market by Region, Global, 2017 – 2027 171

Chart 7 5: Leading Competitors, Final Abutment Market, Global, 2020 200

Figure 1 1: Dental Implant and Final Abutment Market Share Ranking by Segment, Global, 2020 3

Figure 1 2: Companies Researched in this Report 4

Figure 1 3: Factors Impacting the Dental Implant and Final Abutment Market by Segment, Global 5

Figure 1 4: Recent Events in the Dental Implant and Final Abutment Market, Global, 2017 – 2021 (1 of 2) 6

Figure 1 5: Recent Events in the Dental Implant and Final Abutment Market, Global, 2017 – 2021 (2 of 2) 7

Figure 1 6: Dental Implant and Final Abutment Markets Covered 8

Figure 1 7: Dental Implant and Final Abutment Regions Covered, Global (1 of 2) 9

Figure 1 8: Dental Implant and Final Abutment Regions Covered, Global (2 of 2) 10

Figure 1 9: Version History 10

Figure 2 1: Dental Implant and Final Abutment Market by Segment, Worst Case Scenario, Global, 2017 – 2027 (US$M) 28

Figure 2 2: Dental Implant and Final Abutment Market by Segment, Base Case Scenario, Global, 2017 – 2027 (US$M) 29

Figure 2 3: Dental Implant and Final Abutment Market by Segment, Best Case Scenario, Global, 2017 – 2027 (US$M) 30

Figure 4 1: Dental Implant Products by Brand (1 of 2) 43

Figure 4 2: Dental Implant Products by Brand (2 of 2) 44

Figure 4 3: Dental Abutment Products by Brand (1 of 2) 46

Figure 4 4: Dental Abutment Products by Brand (2 of 2) 47

Figure 4 5: Treatment Planning Products by Brand 49

Figure 4 6: Surgical Guide Products by Brand 51

Figure 4 7: Dental Instrument Kit Products by Brand 52

Figure 4 8: Class 2 Device Recall INFINITY Internal Hex Healing Abutment 53

Figure 4 9: Class 2 Device Recall SwishPlus Implant 53

Figure 4 10: Class 2 Device Recall SwishTapered Implant 53

Figure 4 11: Class 2 Device Recall ImplantDirect simply InterActive Implant, Part 655010U 54

Figure 4 12: Class 2 Device Recall REPLANT 5.0mmD ABUTMENT, Part number 60505260 54

Figure 4 13: Class 2 Device Recall Implant Direct Legacy Implant 54

Figure 4 14: Class 2 Device Recall ImplantDirect simply RePlant Implant 54

Figure 4 15: Class 2 Device Recall ImplantDirect Legacy 3 Implant 55

Figure 4 16: Class 2 Device Recall Simply InterActive Implant 55

Figure 4 17: Class 2 Device Recall Swiss Plant Dental Implant System 55

Figure 4 18: Class 2 Device Recall Legacy 3 Implant 55

Figure 4 19: Class 2 Device Recall Spectra System Dental Implants 56

Figure 4 20: Class 2 Device Recall Legacy"2 HA Implant 56

Figure 4 21: Class 2 Device Recall 17 MultiUnit Abutment, Conical Connection NP, 2.5mm 56

Figure 4 22: Class 2 Device Recall NobelActive Internal Connection Implant 57

Figure 4 23: Class 2 Device Recall NobelReplace Hexagonal Implant 57

Figure 4 24: Class 2 Device Recall Esthetic Abutment CC RP 1.5 mm 57

Figure 4 25: Class 2 Device Recall NobelParallel Conical Connection 58

Figure 4 26: Class 2 Device Recall Endosseous dental implant abutment 58

Figure 4 27: Class 2 Device Recall Zimmer Dental Tapered SwissPlus & SwissPlus Implant Systems surgical kit 58

Figure 4 28: Class 2 Device Recall LOCATOR Overdenture Implant System 59

Figure 4 29: Class 2 Device Recall LOCATOR Overdenture Implant System 60

Figure 4 30: Class 2 Device Recalls CERTAIN® BELLATEK® TITANIUM ABUTMENT 3.4MM 61

Figure 4 31: Class 2 Device Recall Tapered SwissPlus Implant System 61

Figure 4 32: The Marginal Bone Loss in Dental Implants (BL-Implants) 62

Figure 4 33: A Clinical Study of the Eztetic Dental Implant System (RoseQuartz) 62

Figure 4 34: A 3-YEAR CLINICAL INVESTIGATION ON THE NOBEL ACTIVE® TIULTRA™ IMPLANT AND ON1™ BASE XEAL1™ 63

Figure 4 35: Impact of Laser-modified Abutment Topography on Peri-implant Mucosal Integration (Laser-Lok) 63

Figure 4 36: Evaluation of Different Implant Collar Lengths on Long-term Bone Healing 64

Figure 4 37: Retrospective Evaluation of Clinical Performance of the Astra Tech Implant System EV When Used in Everyday Practice 64

Figure 4 38: A Clinical Study of the T3 Short Dental Implant System (Magnolia) 65

Figure 4 39: Dental Implants with a SLActive® vs. SLA® Surface 65

Figure 4 40: Immediate vs Delayed Placement of Straumann BLX Implants in Molar Extraction Sockets 66

Figure 5 1: Dental Implant and Final Abutment Device Market by Segment, Global, 2017 – 2027 (US$M) 73

Figure 5 2: Dental Implant and Final Abutment Device Market by Region, Global, 2017 – 2027 (US$M) 76

Figure 5 3: Leading Competitors, Dental Implant and Final Abutment Device Market by Segment, Global, 2020 84

Figure 5 4: SWOT Analysis, ACE Surgical 97

Figure 5 5: SWOT Analysis, BioHorizons 98

Figure 5 6: SWOT Analysis, Dentsply Sirona 99

Figure 5 7: SWOT Analysis, Osstem Implant (HIOSSEN) 100

Figure 5 8: SWOT Analysis, Implant Direct 101

Figure 5 9: SWOT Analysis, MegaGen 102

Figure 5 10: SWOT Analysis, MIS Implants 103

Figure 5 11: SWOT Analysis, Nobel Biocare 104

Figure 5 12: SWOT Analysis, Straumann Group 105

Figure 5 13: SWOT Analysis, Zimmer Biomet 106

Figure 6 1: Dental Implant Markets Covered 111

Figure 6 2: Dental Implant Regions Covered, Global (1 of 2) 112

Figure 6 3: Dental Implant Regions Covered, Global (2 of 2) 113

Figure 6 4: Dental Implant Market by Segment, Global, 2017 – 2027 (US$M) 117

Figure 6 5: Dental Implant Market by Region, Global, 2017 – 2027 (US$M) 119

Figure 6 6: Dental Implant Market, Global, 2017 – 2027 122

Figure 6 7: Units Sold by Region, Dental Implant Market, Global, 2017 – 2027 123

Figure 6 8: Average Selling Price by Region, Dental Implant Market, Global, 2017 – 2027 (US$) 124

Figure 6 9: Market Value by Region, Dental Implant Market, Global, 2017 – 2027 (US$M) 125

Figure 6 10: Premium Implant Market, Global, 2017 – 2027 127

Figure 6 11: Units Sold by Region, Premium Implant Market, Global, 2017 – 2027 128

Figure 6 12: Average Selling Price by Region, Premium Implant Market, Global, 2017 – 2027 (US$) 129

Figure 6 13: Market Value by Region, Premium Implant Market, Global, 2017 – 2027 (US$M) 130

Figure 6 14: Value Implant Market, Global, 2017 – 2027 132

Figure 6 15: Units Sold by Region, Value Implant Market, Global, 2017 – 2027 133

Figure 6 16: Average Selling Price by Region, Value Implant Market, Global, 2017 – 2027 (US$) 134

Figure 6 17: Market Value by Region, Value Implant Market, Global, 2017 – 2027 (US$M) 135

Figure 6 18: Discount Implant Market, Global, 2017 – 2027 137

Figure 6 19: Units Sold by Region, Discount Implant Market, Global, 2017 – 2027 138

Figure 6 20: Average Selling Price by Region, Discount Implant Market, Global, 2017 – 2027 (US$) 139

Figure 6 21: Market Value by Region, Discount Implant Market, Global, 2017 – 2027 (US$M) 140

Figure 6 22: Dental Implant Units Sold by Connection Type, Global, 2017 – 2027 142

Figure 6 23: Internal Connection Implant Units Sold by Region, Global, 2017 – 2027 143

Figure 6 24: External Connection Implant Units Sold by Region, Global, 2017 – 2027 (US$) 144

Figure 6 25: One-Piece Units Implant Sold by Region, Global, 2017 – 2027 (US$M) 145

Figure 6 26: Leading Competitors, Dental Implant Market, Global, 2020 156

Figure 6 27: Leading Competitors, Dental Implant Market, Global, 2020 157

Figure 7 1: Final Abutment Markets Covered 162

Figure 7 2: Final Abutment Regions Covered, Global (1 of 2) 163

Figure 7 3: Final Abutment Regions Covered, Global (2 of 2) 164

Figure 7 4: Final Abutment Market by Segment, Global, 2017 – 2027 (US$M) 168

Figure 7 5: Final Abutment Market by Region, Global, 2017 – 2027 (US$M) 170

Figure 7 6: Final Abutment Market, Global, 2017 – 2027 173

Figure 7 7: Units Sold by Region, Final Abutment Market, Global, 2017 – 2027 174

Figure 7 8: Average Selling Price by Region, Final Abutment Market, Global, 2017 – 2027 (US$) 175

Figure 7 9: Market Value by Region, Final Abutment Market, Global, 2017 – 2027 (US$M) 176

Figure 7 10: Stock Abutment Market, Global, 2017 – 2027 178

Figure 7 11: Units Sold by Region, Stock Abutment Market, Global, 2017 – 2027 179

Figure 7 12: Average Selling Price by Region, Stock Abutment Market, Global, 2017 – 2027 (US$) 180

Figure 7 13: Market Value by Region, Stock Abutment Market, Global, 2017 – 2027 (US$M) 181

Figure 7 14: Custom Cast Abutment Market, Global, 2017 – 2027 183

Figure 7 15: Units Sold by Region, Custom Cast Abutment Market, Global, 2017 – 2027 184

Figure 7 16: Average Selling Price by Region, Custom Cast Abutment Market, Global, 2017 – 2027 (US$) 185

Figure 7 17: Market Value by Region, Custom Cast Abutment Market, Global, 2017 – 2027 (US$M) 186

Figure 7 18: CAD/CAM Abutment Market, Global, 2017 – 2027 187

Figure 7 19: Units Sold by Region, CAD/CAM Abutment Market, Global, 2017 – 2027 188

Figure 7 20: Average Selling Price by Region, CAD/CAM Abutment Market, Global, 2017 – 2027 (US$) 189

Figure 7 21: Market Value by Region, CAD/CAM Abutment Market, Global, 2017 – 2027 (US$M) 190

Figure 7 22: Leading Competitors, Final Abutment Market, Global, 2020 199

iData’s 9-Step Research Methodology

Our reports follow an in-depth 9-step methodology which focuses on the following research systems:

- Original primary research that consists of the most up-to-date market data

- Strong foundation of quantitative and qualitative research

- Focused on the needs and strategic challenges of the industry participants

Step 1: Project Initiation & Team Selection During this preliminary investigation, all staff members involved in the industry discusses the topic in detail.

Step 2: Prepare Data Systems and Perform Secondary Research The first task of the research team is to prepare for the data collection process: Filing systems and relational databases are developed as needed.

Step 3: Preparation for Interviews & Questionnaire Design The core of all iData research reports is primary market research. Interviews with industry insiders represent the single most reliable way to obtain accurate, current data about market conditions, trends, threats and opportunities.

Step 4: Performing Primary Research At this stage, interviews are performed using contacts and information acquired in the secondary research phase.

Step 5: Research Analysis: Establishing Baseline Estimates Following the completion of the primary research phase, the collected information must be synthesized into an accurate view of the market status. The most important question is the current state of the market.

Step 6: Market Forecast and Analysis iData Research uses a proprietary method to combine statistical data and opinions of industry experts to forecast future market values.

Step 7: Identify Strategic Opportunities iData analysts identify in broad terms why some companies are gaining or losing share within a given market segment.

Step 8: Final Review and Market Release An integral part of the iData research methodology is a built-in philosophy of quality control and continuing improvement is integral to the iData philosophy.

Step 9: Customer Feedback and Market Monitoring iData philosophy of continuous improvement requires that reports and consulting projects be monitored after release for customer feedback and market accuracy.

Click Here to Read More About Our Methodology

Demographic trends are a major driver of the global dental implant and final abutment market. The rising global population generally supports most healthcare markets and, since edentulism rates are highly correlated with age, the dental implant market is no exception. There are many regions around the world with a high growth potential due to increased access to healthcare extending life expectancy. Many of these regions have very low penetration rates of implants and may serve as major growth opportunities within the market.

Demographic trends are a major driver of the global dental implant and final abutment market. The rising global population generally supports most healthcare markets and, since edentulism rates are highly correlated with age, the dental implant market is no exception. There are many regions around the world with a high growth potential due to increased access to healthcare extending life expectancy. Many of these regions have very low penetration rates of implants and may serve as major growth opportunities within the market.