Product Description

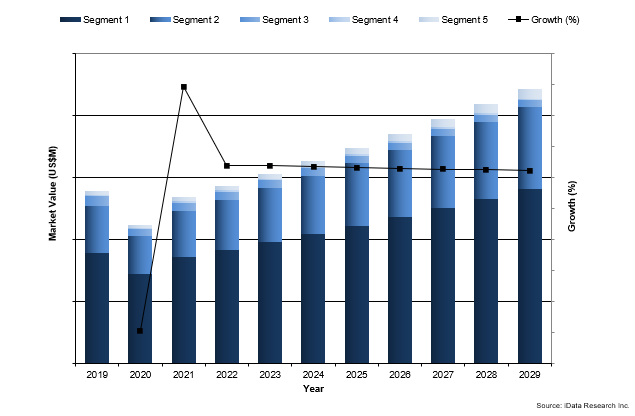

Overall, the U.S. dental implant and final abutment market was valued at $1.4 billion in 2022. This is expected to increase over the forecast period at a CAGR of 6.4% to reach $2.2 billion in 2029.

The full report suite on the U.S. market for dental implants and final abutments includes dental implants, final abutments, instrument kits, treatment planning software and surgical guides.

DATA TYPES INCLUDED IN THIS REPORT

- Unit Sales, Average Selling Prices, Market Value & Growth Trends

- Market Forecasts Until 2029 & Historical Data to 2019

- Competitive Analysis with Market Shares for Each Market Segment

- Market Drivers & Limiters

- Recent Mergers & Acquisitions

- COVID19 Impact on the DI Market in the US

- Disease Overviews & Demographic Information

- Company Profiles, Product Portfolios & SWOT for Top Competitors

U.S. DENTAL IMPLANT MARKET TRENDS

Market growth will be driven by an array of factors, including but not limited to; the continued consolidation of individual dental clinics into group practices and dental service organizations (DSOs), long term cost efficiency of dental implant procedures, continuous dental implant technological improvements, as well as a relatively low penetration rate of dental implants into the U.S. population. All-time highs in efficacy of dental implant procedures in addition to increasing demand for aesthetics and an increasing proportion of general practitioners placing dental implant setup this market to grow in the high-single-digit range between 2022 and 2029.

Market growth will be driven by an array of factors, including but not limited to; the continued consolidation of individual dental clinics into group practices and dental service organizations (DSOs), long term cost efficiency of dental implant procedures, continuous dental implant technological improvements, as well as a relatively low penetration rate of dental implants into the U.S. population. All-time highs in efficacy of dental implant procedures in addition to increasing demand for aesthetics and an increasing proportion of general practitioners placing dental implant setup this market to grow in the high-single-digit range between 2022 and 2029.

U.S. DENTAL IMPLANT MARKET SHARE INSIGHTS

Out of 40+ dental implant companies analyzed, the majority of the U.S. market share was controlled by Straumann Group, Envista, and Dentsply Sirona. Straumann Group was the strongest competitor in the dental implant and final abutment market in 2022. Straumann benefits from its brand name recognition and a proven track record of developing best-in-class dental implants. Historically the company has dominated in the premium implant segment, with success stemming from an entire suite of dental-implant-associated products that provide continued success across a wide range of applications. Straumann’s subsidiary, Neodent, has additionally performed above-average market levels in the value implant segment, which has further solidified Straumann as a clear leader in the dental implant market. Straumann is well positioned to continue performing as a market leader in the dental implant industry.

Straumann Group was the strongest competitor in the dental implant and final abutment market in 2022. Straumann benefits from its brand name recognition and a proven track record of developing best-in-class dental implants. Historically the company has dominated in the premium implant segment, with success stemming from an entire suite of dental-implant-associated products that provide continued success across a wide range of applications. Straumann’s subsidiary, Neodent, has additionally performed above-average market levels in the value implant segment, which has further solidified Straumann as a clear leader in the dental implant market. Straumann is well positioned to continue performing as a market leader in the dental implant industry.

MARKET SEGMENTATION SUMMARY

- U.S. Market Segment for Dental Implants – Includes:

- Premium, value, discount, and mini-implant products.

- U.S. Market Segment for Final Abutments – Includes:

- Stock, custom cast, and CAD/CAM abutments.

- U.S. Market Segment for Dental Implant Instrument Kits – Includes:

- Instrument kits and potential market for instrument kits.

- U.S. Market Segment for Treatment Planning Software – Includes:

- Treatment planning software, and treatment planning software maintenance fee

- U.S. Market Segment for Surgical Guides – Includes:

- Traditional surgical guides, third-party surgical guides, and in-house surgical guides.

Research Scope Summary

| Report Attribute | Details |

|---|---|

| Regions | North America (United States) |

| Base Year | 2022 |

| Forecast Period | 2023-2029 |

| Historical Data | 2019-2022 |

| Quantitative Data | Market Size, Market Share, Market Growth Rates, Units Sold, Average Selling Prices |

| Qualitative Data | COVID-19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios |

| Data Sources | Primary Interviews with Industry Leaders, Government Physician Data, Regulatory Data, Hospital Private Data, Import & Export Data.

Read more about iData’s 9-Step Research Methodology |

WHY CHOOSE IDATA?

- Experts Only – iData has been around for over 17 years and is the trusted source of intelligence, and data-driven insights for key industry players. We are made up of specialists with a sole focus on medical devices, dental devices and pharmaceuticals. Our research and consulting field of endeavor never strays from the medical device industry and, because of this, we are the number one choice for leading companies in this field.

- Global Coverage – iData’s unique methodology, and its expansion to over 70 countries world-wide, has made it one of the most viable sources of intelligence for global companies along with those who plan to expand their portfolio beyond the confines of their own country. Providing procedural data at the country level is another testimony to the trusted global coverage we provide.

- Attention to Detail – It’s our attention to small details, scheduling of timelines, and keen project management that makes us stand out from the rest. We are creative, and our reports include metrics such as procedure numbers, ASPs, and SKU-level insights that are not found elsewhere.

- Pricing – When comparing like-with-like, iData’s prices are not only extremely competitive but also the most cost-effective. We strive for success and want the same for our clients. With the level of detail incorporated into each report alongside the extensive segmentation provided, no other report compares at our price point.