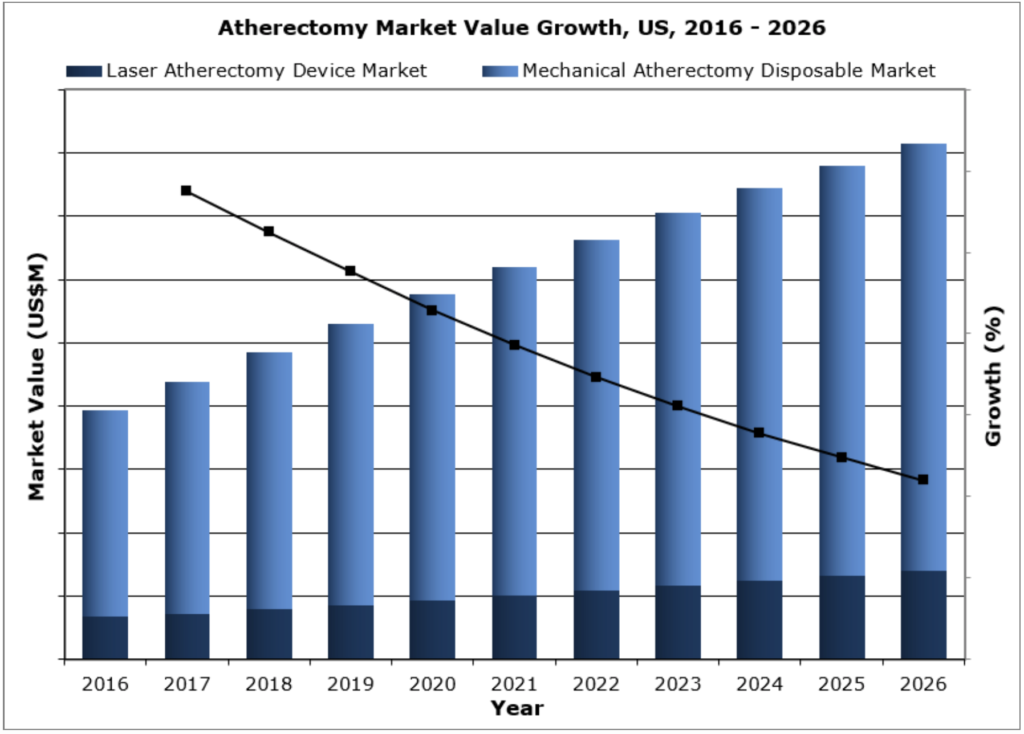

According to the latest market analysis by iData Research, the U.S. atherectomy market is expected to remain as one of the biggest contributors to the growth of the peripheral vascular market.

While often performed in conjunction with other procedures, such as angioplasties, atherectomy procedures have been experiencing double-digit growth rates for the past two years with over 187,000 procedures being performed every year in the United States.

As the atherectomy market continues to expand, iData’s lead market expert provides an in-depth analysis of key factors causing the continued growth.

Key Factors Affecting Atherectomy Market Expansion

- Atherectomy Procedures are Becoming More Widely-Adopted

- Laser Atherectomy Market is Gaining Ground on Mechanical Atherectomy

- Office-Based Labs are the Hot-Bed of Competition

- New Competitors Entering the Laser Atherectomy Market

Atherectomy Procedures are Becoming More Widely-Adopted

Atherectomy procedures are increasingly becoming a routine procedure. In the past few years, complications involving the long-term use of stents, such as angioplasty stents, have become a serious concern as safer treatment options are being developed. For this reason, physicians have started a movement to leave nothing behind in patients they treat by actively trying to limit the occurrence of in-stent restenosis.

Two main treatment techniques have helped accomplish this: drug-coated balloons, and atherectomy catheters. In early 2019, the FDA’s concerns over late mortality signals associated with the use of Paclitaxel devices in peripheral treatments caused a significant negative shock to the drug-coated balloon and drug-eluting stent markets. As these devices recover, the atherectomy procedures continue to become more popular.

The procedural growth in the atherectomy market will be focused in the infra-popliteal arteries, where the placement of a stent comes with additional complications due to the narrow vasculature. However, the atherectomy catheters are also expected to experience strong growth directed towards treatment in the distal regions.

Laser Atherectomy Market is Gaining Ground on Mechanical Atherectomy

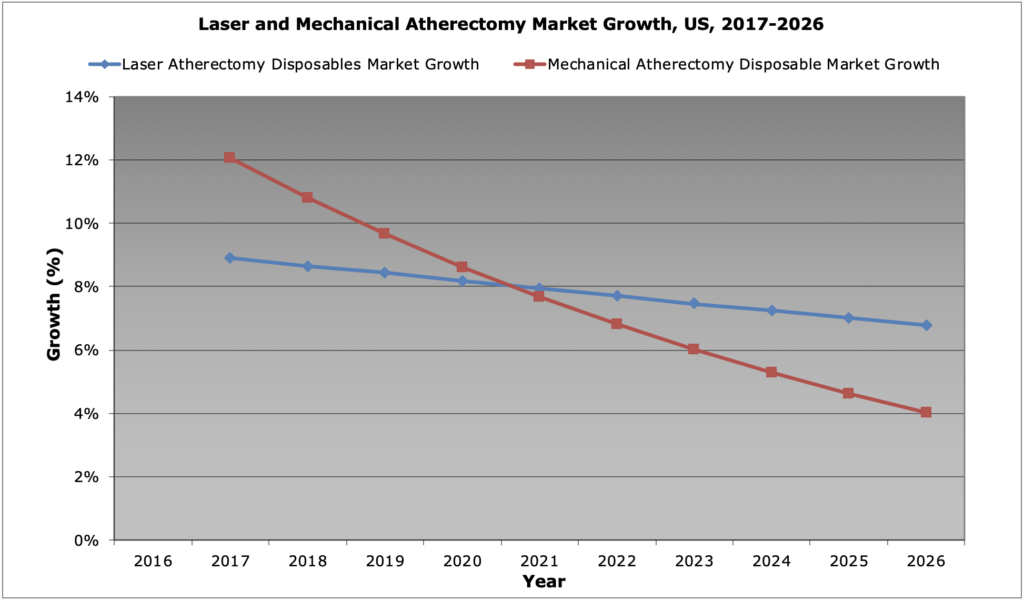

Due to the high reimbursement rate associated with atherectomy procedures, the increasingly prominent office-based labs (OBL’s) are keen to incorporate these procedures. Laser atherectomy is expected to grow at a higher rate than mechanical atherectomy markets within the OBL settings. The laser devices require a separate generator to be connected to the catheter, with a price upwards of $170,000. Due to the price sensitivity of OBL’s, this has historically been a difficult place to gain ground in the market.

However, in spite of this limitation, Philips, the market leader in laser devices, has successfully been able to introduce their devices into OBL’s across the United States. As the mechanical atherectomy device market growth slows to around 4% per year, the laser atherectomy market is expected to experience growth of almost 7% per year until 2026.

As atherectomy procedures become increasingly common, and patients are diagnosed early, the treatment capacity for laser atherectomy devices will expand, and the market will increase in total share. By 2026, it is expected that laser atherectomy procedures will compose 20% of all the atherectomy treatments in the United States.

Office-Based Labs are the Hot-Bed of Competition

The competition in the atherectomy market has been especially strong within OBL’s because of the high reimbursement rates. As one of the primary treatment devices, associated products are typically sold in a complete bundle set. These kits can include any or all of plain-old and specialty balloons, stents, catheters, guidewires, introducer sheaths, and vascular closure devices. Drug-coated balloons and drug-eluting stents are also occasionally used in the procedure but often sold à la carte.

Larger competitors with fuller product portfolios are able to offer discounts across their bundled products, securing the sales of the associated products, and limiting competitors’ ability to compete. Smaller competitors are forced to offer deep discounts in the already price-reduced market, or target the hospital market.

Based on the latest market study, OBL’s are now performing almost 65% of the total atherectomy procedures in the United States, which is expected to reach 80% by 2025. This positive trend is a result of the competition being forced to direct their efforts into OBL’s and respond to the long-run expectations of this market.

New Competitors Entering the Laser Atherectomy Market

Two new competitors entered the laser atherectomy market in the past two years. In May 2017, Ra Medical received FDA approval for their DARBA® laser along with Eximo Medical’s B-Laser® device. Eximo was recently acquired by AngioDynamics which is a strong competitor in both angioplasty and atherectomy device markets.

One of the leaders in the mechanical atherectomy market is Cardiovascular Systems Inc. Already having almost one-third of the total atherectomy market, the company poses a threat to the near-monopoly Philips has had on the laser atherectomy market since the acquisition of Spectranetics.

Currently, Cardiovascular Systems Inc. is developing a laser atherectomy device in association with a leader in dermatological lasers, Aerolase. Should the device be able to successfully develop and obtain FDA clearance, they are also expected to challenge Medtronic for the leading position within the entire atherectomy market.

Conclusion

According to the recent market research, the atherectomy market is rapidly expanding and one of one the major contributing factors is accelerated adoption of the atherectomy procedures. An ongoing trend for the past few years involved physicians moving away from stent placement procedures in order to limit the cases of in-stent restenosis. Because the atherectomy procedure can replace the need for the permanent placement of a device, the number of procedures is expected to witness increased growth in the next few years.

Another factor contributing to the growth of the atherectomy market is the rising popularity of laser atherectomies within office-based labs. In spite of the price sensitivity of OBL’s, Philips, the market leader in the laser device market, was able to successfully introduce their devices into OBL’s in the US. By 2026, it is expected that laser atherectomy procedures will compose 20% of all the atherectomy treatments in the market.

The increasing competition within OBL’s is a third factor contributing to the expansion of the US market. As atherectomy market leaders can offer discounts across their bundled products, they are able to easily secure the sales of their products within OBL’s. For this reason, OBL’s are expected to perform 80% of the total atherectomy procedures in the United States by 2025.

The last factor contributing to the growth of the atherectomy market is the increasing number of competitors in the laser atherectomy space. As new technologies being developed, new competitors, such as Ra Medical and AngioDynamics, are entering the rapidly growing market. Thus, the market share distribution is expected to change radically in the following years.

For more information

For a complete breakdown of the Peripheral Vascular Market in the United States, feel free to request a complimentary summary of our research. In addition to outlining key market trends, the summary covers the competitive landscape for the entire market in addition to providing a procedural forecast until 2026.