| Figure 1‑1: Peripheral Vascular Device Market Share Ranking by Segment, U.S., 2022 (1 of 4) |

| Figure 1‑2: Peripheral Vascular Device Market Share Ranking by Segment, U.S., 2022 (2 of 4) |

| Figure 1‑3: Peripheral Vascular Device Market Share Ranking by Segment, U.S., 2022 (3 of 4) |

| Figure 1‑4: Peripheral Vascular Device Market Share Ranking by Segment, U.S., 2022 (4 of 4) |

| Figure 1‑5: Companies Researched in this Report (1 of 2) |

| Figure 1‑6: Companies Researched in this Report (2 of 2) |

| Figure 1‑7: Factors Impacting the Peripheral Vascular Device Market by Segment, U.S. (1 of 4) |

| Figure 1‑8: Factors Impacting the Peripheral Vascular Device Market by Segment, U.S. (2 of 4) |

| Figure 1‑9: Factors Impacting the Peripheral Vascular Device Market by Segment, U.S. (3 of 4) |

| Figure 1‑10: Factors Impacting the Peripheral Vascular Device Market by Segment, U.S. (4 of 4) |

| Figure 1‑11: Recent Events in the Peripheral Vascular Device Market, U.S., 2019 – 2022 |

| Figure 1‑12: Peripheral Vascular Device Procedures Covered by Indication (1 of 3) |

| Figure 1‑13: Peripheral Vascular Device Procedures Covered by Indication (2 of 3) |

| Figure 1‑14: Peripheral Vascular Device Procedures Covered by Indication (3 of 3) |

| Figure 1‑15: Peripheral Vascular Device Procedures Covered by Device Type (1 of 5) |

| Figure 1‑16: Peripheral Vascular Device Procedures Covered by Device Type (2 of 5) |

| Figure 1‑17: Peripheral Vascular Device Procedures Covered by Device Type (3 of 5) |

| Figure 1‑18: Peripheral Vascular Device Procedures Covered by Device Type (4 of 5) |

| Figure 1‑19: Peripheral Vascular Device Procedures Covered by Device Type (5 of 5) |

| Figure 1‑20: Procedure Codes Investigated |

| Figure 1‑21: Peripheral Vascular Device Markets Covered (1 of 5) |

| Figure 1‑22: Peripheral Vascular Device Markets Covered (2 of 5) |

| Figure 1‑23: Peripheral Vascular Device Markets Covered (3 of 5) |

| Figure 1‑24: Peripheral Vascular Device Markets Covered (4 of 5) |

| Figure 1‑25: Peripheral Vascular Device Markets Covered (5 of 5) |

| Figure 1‑26: Key Report Updates |

| Figure 1‑27: Version History |

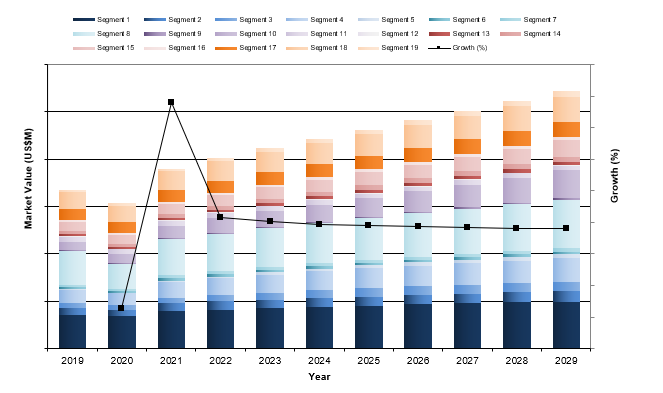

| Figure 2‑1: Peripheral Vascular Device Market by Segment, Worst Case Scenario, U.S., 2019 – 2029 (US$M) (1 of 3) |

| Figure 2‑2: Peripheral Vascular Device Market by Segment, Worst Case Scenario, U.S., 2019 – 2029 (US$M) (2 of 3) |

| Figure 2‑3: Peripheral Vascular Device Market by Segment, Worst Case Scenario, U.S., 2019 – 2029 (US$M) (3 of 3) |

| Figure 2‑4: Peripheral Vascular Device Market by Segment, Base Case Scenario, U.S., 2019 – 2029 (US$M) (1 of 3) |

| Figure 2‑5: Peripheral Vascular Device Market by Segment, Base Case Scenario, U.S., 2019 – 2029 (US$M) (2 of 3) |

| Figure 2‑6: Peripheral Vascular Device Market by Segment, Base Case Scenario, U.S., 2019 – 2029 (US$M) (3 of 3) |

| Figure 2‑7: Peripheral Vascular Device Market by Segment, Best Case Scenario, U.S., 2019 – 2029 (US$M) (1 of 3) |

| Figure 2‑8: Peripheral Vascular Device Market by Segment, Best Case Scenario, U.S., 2019 – 2029 (US$M) (2 of 3) |

| Figure 2‑9: Peripheral Vascular Device Market by Segment, Best Case Scenario, U.S., 2019 – 2029 (US$M) (3 of 3) |

| Figure 4‑1: Peripheral Vascular Stent by Company (1 of 2) |

| Figure 4‑2: Peripheral Vascular Stent by Company (2 of 2) |

| Figure 4‑3: PTA Balloon Catheter by Company (1 of 3) |

| Figure 4‑4: PTA Balloon Catheter by Company (2 of 3) |

| Figure 4‑5: PTA Balloon Catheter by Company (3 of 3) |

| Figure 4‑6: Drug-Coated Balloon by Company |

| Figure 4‑7: Atherectomy Device by Company (1 of 2) |

| Figure 4‑8: Atherectomy Device by Company (2 of 2) |

| Figure 4‑9: Lithotripsy Device by Company |

| Figure 4‑10: Chronic Total Occlusion Device by Company |

| Figure 4‑11: Surgical Graft by Company (1 of 2) |

| Figure 4‑12: Surgical Graft by Company (2 of 2) |

| Figure 4‑13: Stent Graft by Company |

| Figure 4‑14: Embolic Protection Device by Company |

| Figure 4‑15: Peripheral Thrombus Management by Company |

| Figure 4‑16: Inferior Vena Cava Filter & Retrieval Device by Company (1 of 2) |

| Figure 4‑17: Inferior Vena Cava Filter & Retrieval Device by Company (2 of 2) |

| Figure 4‑18: Carotid Shunt by Company |

| Figure 4‑19: Transcarotid Artery Revascularization Device by Company |

| Figure 4‑20: Diagnostic and Interventional Catheters by Company (1 of 2) |

| Figure 4‑21: Diagnostic and Interventional Catheters by Company (2 of 2) |

| Figure 4‑22: Diagnostic and Interventional Guidewire by Company (1 of 3) |

| Figure 4‑23: Diagnostic and Interventional Guidewire by Company (2 of 3) |

| Figure 4‑24: Diagnostic and Interventional Guidewire by Company (3 of 3) |

| Figure 4‑25: Introducer Sheath by Company (1 of 2) |

| Figure 4‑26: Introducer Sheath by Company (2 of 2) |

| Figure 4‑27: Vascular Closure Device by Company |

| Figure 4‑28: Transcatheter Embolization Devices by Company (1 of 2) |

| Figure 4‑29: Transcatheter Embolization Devices by Company (2 of 2) |

| Figure 4‑30: Peripheral IVUS Catheter by Company |

| Figure 4‑31: Class 2 Device Recall VENOVO Venous Stent System |

| Figure 4‑32: Class 1 Device Recall VICI VENOUS STENT System |

| Figure 4‑33: Class 2 Device Recall ELUVIA |

| Figure 4‑34: Class 2 Device Recall PALMAZ GENESIS |

| Figure 4‑35: Class 2 Device Recall S.M.A.R.T. Flex |

| Figure 4‑36: Class 1 Device Recall PRECISE PRO RX CAROTID STENT Implant System |

| Figure 4‑37: Class 2 Device Recall Cordis S.M.A.R.T. CONTROL /S.M.A.R.T. Vascular Stent System |

| Figure 4‑38: Class 2 Device Recall S.M.A.R.T. Nitinol Stent System and the S.M.A.R.T. Control Nitinol Stent System |

| Figure 4‑39: Class 2 Device Recall Cordis Precise Nitinol Stent System |

| Figure 4‑40: Class 2 Device Recall Formula 418 Renal BalloonExpandable Stent |

| Figure 4‑41: Class 2 Device Recall Zilver 635 Biliary Stent |

| Figure 4‑42: Class 2 Device Recall Zilver 518 Biliary Stent |

| Figure 4‑43: Class 1 Device Recall Atrium |

| Figure 4‑44: Class 2 Device Recall Everflex Selfexpanding Peripheral Stent |

| Figure 4‑45: Class 2 Device Recall Medtronic Abre |

| Figure 4‑46: Class 2 Device Recall Medtronic Abre Venous Selfexpanding Sent System |

| Figure 4‑47: Class 2 Device Recall ENROUTE Transcarotid Stent System |

| Figure 4‑48: Class 2 Device Recall GORE VIABAHN VBX, BALLOON EXPANDABLE ENDOPROSTHESIS |

| Figure 4‑49: Class 2 Device Recall Conquest PTA Balloon Dilatation Catheter |

| Figure 4‑50: Class 2 Device Recall Conquest 40 PTA Dilatation Catheter |

| Figure 4‑51: Class 2 Device Recall Cordis SABER PTA Balloon Dilation Catheter |

| Figure 4‑52: Class 2 Device Recall Cordis POWERFLEX P3, PTA Dilation Catheter |

| Figure 4‑53: Class 2 Device Recall Cordis MAXI LD PTA Dilatation Catheter |

| Figure 4‑54: Class 2 Device Recall POWERFLEX PRO Percutaneous Transluminal Angioplasty (PTA) Catheter |

| Figure 4‑55: Class 1 Device Recall ADVANCE ENFORCER 35 FOCAL FORCE PTA BALLOON CATHETER |

| Figure 4‑56: Class 2 Device Recall Medtronic IN.PACT Admiral, Paclitaxelcoated PTA Balloon Catheter |

| Figure 4‑57: Class 2 Device Recall Chameleon PTA Balloon Dilation Catheter |

| Figure 4‑58: Class 2 Device Recall Boston Scientific ROTAPRO |

| Figure 4‑59: Class 2 Device Recall STEALTH 360 GEN2 PERIPHERAL ORBITAL ATHERECTOMY SYSTEM |

| Figure 4‑60: Class 2 Device Recall DIAMONDBACK 360 GEN2 PERIPHERAL ORBITAL ATHERECTOMY SYSTEM |

| Figure 4‑61: Class 1 Device Recall TurboHawk Plus |

| Figure 4‑62: Class 1 Device Recall HawkOne |

| Figure 4‑63: Class 2 Device Recall Shockwave Medical Peripheral Intravascular Lithotripsy (IVL) System |

| Figure 4‑64: Class 2 Device Recall Zurpaz(TM) MEDIUM CURL, ASYMMETRIC CURVE, Steerable Sheath |

| Figure 4‑65: Device Recall AngioJet Ultra 5000 A Console, Boston Scientific |

| Figure 4‑66: Class 1 Device Recall IntraClude IntraAortic Occlusion Device |

| Figure 4‑67: Class 2 Device Recall Intergard Woven Vascular Graft |

| Figure 4‑68: Class 2 Device Recall Interavascular SAS/Getinge |

| Figure 4‑69: Class 2 Device Recall Hemashield Gold Knitted Bifurcated |

| Figure 4‑70: Class 2 Device Recall Atrium ADVANTA VXT Vascular Graft |

| Figure 4‑71: Class 2 Device Recall HEMASHIELD MICROVEL Double Velour Knitted Vascular Grafts |

| Figure 4‑72: Class 2 Device Recall HEMASHIELD PLATINUM WOVEN/MICROVEL DOUBLE VELOUR VASCULAR GRAFTS |

| Figure 4‑73: Class 2 Device Recall HEMASHIELD PLATINUM Woven Double Velour Vascular Graft |

| Figure 4‑74: Class 2 Device Recall VASCUTEK/TERUMO |

| Figure 4‑75: Class 2 Device Recall Gore Propaten Vascular Graft |

| Figure 4‑76: Class 1 Device Recall ENDOLOGIX AFX2 Bifurcated Endograft System |

| Figure 4‑77: Class 1 Device Recall ENDOLOGIX AFX/AFX2, Proximal (Aortic) Extension Endograft |

| Figure 4‑78: Class 1 Device Recall ENDOLOGIX AFX Endovascular AAA System |

| Figure 4‑79: Class 1 Device Recall ENDOLOGIX AFX/AFX2, Limb (Iliac) Extension Endograft |

| Figure 4‑80: Class 2 Device Recall Zenith Alpha Abdominal Endovascular Graft |

| Figure 4‑81: Class 2 Device Recall Zenith Alpha Abdominal Endovascular Graft |

| Figure 4‑82: Class 2 Device Recall Zenith Alpha SpiralZ Endovascular Leg |

| Figure 4‑83: Class 2 Device Recall Zenith Alpha Abdominal Endovascular Graft |

| Figure 4‑84: Class 2 Device Recall Endurant, Endurant II and Endurant IIs Stent Graft Systems |

| Figure 4‑85: Class 2 Device Recall Endurant Stent Graft System |

| Figure 4‑86: Class 2 Device Recall Endurant II Stent Graft System |

| Figure 4‑87: Class 2 Device Recall Endurant II/IIs Stent Graft System |

| Figure 4‑88: Class 2 Device Recall Endurant II/IIs Stent Graft System |

| Figure 4‑89: Class 1 Device Recall Valiant Navion Thoracic Stent Graft System |

| Figure 4‑90: Class 2 Device Recall EKOS |

| Figure 4‑91: Class 2 Device Recall EkoSonic Endovascular Device |

| Figure 4‑92: Class 2 Device Recall EKOS Control System |

| Figure 4‑93: Class 2 Device Recall AngioJet Ultra Consoles Thrombectomy System |

| Figure 4‑94: Class 1 Device Recall ArrowTrerotola PTD |

| Figure 4‑95: Class 1 Device Recall ArrowTrerotola Percutaneous Thrombolytic Device |

| Figure 4‑96: Class 1 Device Recall ArrowTrerotola OverTheWire PTD Kit Percutaneous Thrombolytic Device: 7FR |

| Figure 4‑97: Class 3 Device Recall Cook |

| Figure 4‑98: Class 3 Device Recall Cook Celect Platinum Vena Cava Filter Set |

| Figure 4‑99: Class 2 Device Recall ENROUTE Transcarotid Stent System |

| Figure 4‑100: Class 2 Device Recall SoftVu Omni Flush Angiographic Catheter |

| Figure 4‑101: Class 2 Device Recall SEEKER(R) Crossing Support Catheter |

| Figure 4‑102: Class 1 Device Recall Imager II 5F Angiographic Catheter |

| Figure 4‑103: Class 1 Device Recall SUPER TORQUE MB 5F PIG |

| Figure 4‑104: Class 1 Device Recall CrossCath Support Catheter |

| Figure 4‑105: Class 2 Device Recall Torcon NB Advantage |

| Figure 4‑106: Class 2 Device Recall Amplatz extra Stiff Wire Guide |

| Figure 4‑107: Class 2 Device Recall Bentson Wire Guide |

| Figure 4‑108: Class 2 Device Recall Cope Mandril Wire Guide |

| Figure 4‑109: Class 2 Device Recall Cope Mandril Wire Guide (Nitinol) |

| Figure 4‑110: Class 2 Device Recall Coons Interventional Wire Guide |

| Figure 4‑111: Class 2 Device Recall Lunderquist Ring Torque Wire Guide |

| Figure 4‑112: Class 2 Device Recall Newton Wire Guide |

| Figure 4‑113: Class 2 Device Recall Roadrunner PC Hydrophilic Wire Guide |

| Figure 4‑114: Class 2 Device Recall Roadrunner PC Wire Guide (Nimble Floppy) |

| Figure 4‑115: Class 2 Device Recall Roadrunner PC Wire Guide (The Firm) |

| Figure 4‑116: Class 2 Device Recall Cook Roadrunner UniGlide Hydrophilic Wire Guide |

| Figure 4‑117: Class 2 Device Recall Cook Roadrunner PC Wire Guide |

| Figure 4‑118: Class 2 Device Recall Roadrunner Hydrophilic PC Wire Guide |

| Figure 4‑119: Class 2 Device Recall Ultimum HEMOSTASIS INTRODUCER |

| Figure 4‑120: Class 2 Device Recall FastCath Trio HEMOSTASIS INTRODUCER |

| Figure 4‑121: Class 2 Device Recall FastCath Hemostasis Introducer, HEMOSTASIS INTRODUCER |

| Figure 4‑122: Class 2 Device Recall Avanti Catheter Sheath Introducer |

| Figure 4‑123: Class 2 Device Recall |

| Figure 4‑124: Class 2 Device Recall Flexor CheckFlo Introducer |

| Figure 4‑125: Class 1 Device Recall Flexor CheckFlo Introducer |

| Figure 4‑126: Class 2 Device Recall Hilal Embolization Microcoil |

| Figure 4‑127: Class 2 Device Recall Nester Embolization Microcoil |

| Figure 4‑128: Class 2 Device Recall Tornado Embolization Microcoil |

| Figure 4‑129: Class 2 Device Recall Terumo AZUR Peripheral Coil System, Detachable 18 |

| Figure 4‑130: Class 2 Device Recall Terumo AZUR CX Peripheral Coil System, Detachable 35, CX Coil |

| Figure 4‑131: Class 2 Device Recall Terumo AZUR CX Peripheral Coil System, Detachable 18, CX Coil |

| Figure 4‑132: Class 2 Device Recall OptiCross 35 15 MHz Peripheral Imaging Catheter |

| Figure 4‑133: Peripheral Venous Stent System in the Treatment of Iliac Vein Stenosis or Occlusion |

| Figure 4‑134: Belgian Trial Investigating the LifeStream Stent in Complex TASC C and D Iliac Lesions (BELSTREAM) |

| Figure 4‑135: Paclitaxel-coated Peripheral Stents Used in the Treatment of Femoropopliteal Stenoses (XPEDITE) |

| Figure 4‑136: An All-Comers Observational Study of the MicroStent™ Peripheral Vascular Stent System in Subjects With Peripheral Arterial Disease (HEAL) |

| Figure 4‑137: SOLARIS Peripheral PMCF Trial |

| Figure 4‑138: A Superiority Trial of the SUPERA Peripheral Stent System in Patients With Femoro-popliteal Artery Disease |

| Figure 4‑139: Evaluation of Safety and Efficacy of the S.M.A.R.T. RADIANZ™ Vascular Stent System in the Treatment of Iliac and Femoropopliteal Lesions Via Transradial Access (RADIANCY) |

| Figure 4‑140: Stella Supera Siberia |

| Figure 4‑141: A Real World Evaluation of the ELUVIA Stent in Subjects With Lesions Located in the Femoropopliteal Arteries (REGAL) |

| Figure 4‑142: Zilver® PTX® V Clinical Study |

| Figure 4‑143: In-Stent Restenosis Post-Approval Study |

| Figure 4‑144: BARD® The VENOVO™ Venous Stent Study for Treatment of Iliofemoral Occlusive Disease (VERNACULAR) |

| Figure 4‑145: VIVO Clinical Study |

| Figure 4‑146: ULTRASCORE™ Focused Force PTA Balloon Angioplasty for CLI Patients With Below the Knee Vessel Disease |

| Figure 4‑147: Real World Registry Assessing the Clinical Use of the Bard UltraScore Forced Focus PTA Balloon |

| Figure 4‑148: Ranger™ and Ranger™ SL (OTW) DCB in China |

| Figure 4‑149: The VaSecure BTK Study |

| Figure 4‑150: Comparison of the Ranger™ Paclitaxel-Coated PTA Balloon Catheter and Uncoated PTA Balloons in Femoropopliteal Arteries (RANGER-SFA) |

| Figure 4‑151: A Trial to Evaluate the Safety and Efficacy of the Passeo-18 Lux Drug-coated Balloon of Biotronik in the Treatment of the Femoropopliteal Artery Compared to the Medtronic IN.PACT Admiral Drug-coated Balloon. (BIOPACT-RCT) |

| Figure 4‑152: Safety and Efficacy of the SurVeil™ Drug-Coated Balloon (TRANSCEND) |

| Figure 4‑153: RANGER™ Paclitaxel Coated Balloon vs Standard Balloon Angioplasty (RANGER II SFA) |

| Figure 4‑154: IN.PACT BTK Randomized Study to Assess Safety and Efficacy of IN.PACT 014 vs. PTA |

| Figure 4‑155: Compare I Pilot Study for the Treatment of Subjects With Symptomatic Femoropopliteal Artery Disease |

| Figure 4‑156: ILLUMENATE Below-The-Knee (BTK) Arteries: a Post Market Clinical Study (BTK PMS) |

| Figure 4‑157: IN.PACT Global Clinical Study |

| Figure 4‑158: ILLUMENATE Pivotal Post-Approval Study (PAS) |

| Figure 4‑159: BIOLUX P-III BENELUX All-Comers Registry |

| Figure 4‑160: Real-World Registry Assessing the Clinical Use of the Lutonix 035 Drug Coated Balloon Catheter (SAFE-DCB) |

| Figure 4‑161: Safety and Effectiveness Evaluation of Peripheral Orbital Atherectomy (KAIZEN) |

| Figure 4‑162: Jetstream in Treatment of Occlusive Atherosclerotic Lesions in the SFA and/or PPA |

| Figure 4‑163: Revascularization of Total or Sub-total Occluded Peripheral Arteries With ByCross® Device. Post Market Clinical Follow-up |

| Figure 4‑164: Post-Market Registry of AURYON™ Atherectomy Device in Subjects Affected With Infrainguinal Peripheral Artery Disease (PATHFINDER-I) |

| Figure 4‑165: JET-RANGER Trial - JETStream Atherectomy With Adjunctive Paclitaxel-Coated Balloon Angioplasty vs Plain Old Balloon Angioplasty Followed by Paclitaxel-Coated Balloon |

| Figure 4‑166: Pantheris Atherectomy Treatment of In-Stent Restenosis in Lower Extremity Arteries (INSIGHT) |

| Figure 4‑167: Safety and Effectiveness Study of Eximo's B-Laser™ Atherectomy Device for PAD Treatment |

| Figure 4‑168: Safety and Effectiveness of Jetstream Atherectomy System (J-SUPREME II) |

| Figure 4‑169: DiRectional AthErectomy + Drug CoAted BaLloon to Treat Long, CalcifIed FemoropopliTeal ArterY Lesions (REALITY) |

| Figure 4‑170: Mini S Feasibility Study With Shockwave Medical Mini S Peripheral IVL System |

| Figure 4‑171: SOLUTION Trial in China |

| Figure 4‑172: Disrupt PAD+ Study With the Shockwave Medical M5+ Peripheral IVL System (Disrupt PAD+) |

| Figure 4‑173: Shockwave Medical Peripheral Lithoplasty System Study for PAD (Disrupt PAD III) |

| Figure 4‑174: A Prospective and Retrospective, Multi-Centre, Post-Market, Non-Interventional Study of Terumo Aortic Knitted and Woven Grafts, and Cardiovascular Patches (PANTHER) |

| Figure 4‑175: Retrospective Post-Market Clinical Follow-Up Study of GORE-TEX® Vascular Grafts and GORE® PROPATEN® Vascular Graft in Peripheral Artery Disease, Aortic Aneurysms, and Dialysis Access |

| Figure 4‑176: Ankura™ TAA Stent Graft System Post-Market Clinical Follow-up Study |

| Figure 4‑177: Post-Approval Study of the TREO Abdominal Stent-Graft System (TREO PAS) |

| Figure 4‑178: The Merit WRAPSODY™ Endovascular Stent Graft for Treatment of Iliac Artery Occlusive Disease |

| Figure 4‑179: Zenith Alpha™ Abdominal Endovascular Graft |

| Figure 4‑180: Fenestrated AAA Endovascular Graft Post-Approval Study |

| Figure 4‑181: transShield Embolic Protection System Feasibility Study |

| Figure 4‑182: Study of the Long-Term Safety and Outcomes of Treating Pulmonary Embolism With the Indigo Aspiration System |

| Figure 4‑183: Preservation of Venous Valvular Function After PMT for Acute DVT (PREFER) |

| Figure 4‑184: A Study of Patients With Lower Extremity Acute Limb Ischemia to Remove Thrombus With the Indigo Aspiration System (STRIDE) |

| Figure 4‑185: FlowTriever All-Comer Registry for Patient Safety and Hemodynamics (FLASH) |

| Figure 4‑186: JETi Peripheral Thrombectomy Registry (JETi) |

| Figure 4‑187: Treatment of Low-Risk Submassive Pulmonary Embolism With FlowTriever |

| Figure 4‑188: Forceps vs. Snare IVC Filter Removal |

| Figure 4‑189: Predictors of Attempted Inferior Vena Cava Filters Retrieval |

| Figure 4‑190: Retrievability and Incidence of Complex Retrieval in Celect Versus Denali Filter |

| Figure 4‑191: Cook IVC Filter Study (CIVC) |

| Figure 4‑192: Predicting the Safety and Effectiveness of Inferior Vena Cava Filters (PRESERVE) |

| Figure 4‑193: Post-approval Study of Transcarotid Artery Revascularization in Standard Risk Patients With Significant Carotid Artery Disease |

| Figure 4‑194: The ENROUTE Transcarotid Neuroprotection System (ENROUTE Transcarotid NPS) DW-MRI Evaluation (DW-MRI-US) |

| Figure 4‑195: The ENROUTE Transcarotid Neuroprotection System (ENROUTE Transcarotid NPS) DW-MRI Study (DW-MRI OUS) |

| Figure 4‑196: Evaluation of Safety and Efficacy of the Mynx Control Venous Vascular Closure Device 6F-12F vs Manual Compression (ReliaSeal) |

| Figure 4‑197: AbsorbaSeal (ABS 5.6.7) Vascular Closure Device Trial |

| Figure 4‑198: Vascular Closure Device in Transcatheter Aortic Valve Replacement |

| Figure 4‑199: Manta™ Versus Suture-based Closure After Transcatheter Aortic Valve Implantation Trial (MASH-TAVI) |

| Figure 4‑200: Study to Evaluate the Safety and Effectiveness of MynxGrip Vascular Closure Device (PANDA) |

| Figure 4‑201: (HALT) Embrace Hydrogel Embolic System (HES) Study of Embolization in Peripheral Arterial Bleeds |

| Figure 4‑202: Microvascular Plug (MVP) for the Treatment of Pulmonary ArterioVenous Malformations (PAVMs) |

| Figure 4‑203: Use of Interlocking Detachable Coils System in Embolization of Peripheral Arterial Embolization |

| Figure 4‑204: CATERPILLAR™ Arterial Embolization Device Study (CHRYSALIS) |

| Figure 4‑205: LC Bead LUMI for Prostatic Artery Embolization |

| Figure 5‑1: Peripheral Vascular Device Market by Segment, U.S., 2019 – 2029 (US$M) (1 of 3) |

| Figure 5‑2: Peripheral Vascular Device Market by Segment, U.S., 2019 – 2029 (US$M) (2 of 3) |

| Figure 5‑3: Peripheral Vascular Device Market by Segment, U.S., 2019 – 2029 (US$M) (3 of 3) |

| Figure 5‑4: Leading Competitors, Peripheral Vascular Device Market, U.S., 2022 (1 of 4) |

| Figure 5‑5: Leading Competitors, Peripheral Vascular Device Market, U.S., 2022 (2 of 4) |

| Figure 5‑6: Leading Competitors, Peripheral Vascular Device Market, U.S., 2022 (3 of 4) |

| Figure 5‑7: Leading Competitors, Peripheral Vascular Device Market, U.S., 2022 (4 of 4) |

| Figure 5‑8: SWOT Analysis, Abbott (1 of 2) |

| Figure 5‑9: SWOT Analysis, Abbott (2 of 2) |

| Figure 5‑10: SWOT Analysis, Becton Dickinson (1 of 2) |

| Figure 5‑11: SWOT Analysis, Becton Dickinson (2 of 2) |

| Figure 5‑12: SWOT Analysis, Boston Scientific |

| Figure 5‑13: SWOT Analysis, Cardinal Health |

| Figure 5‑14: SWOT Analysis, Cardiovascular Systems, Inc. |

| Figure 5‑15: SWOT Analysis, Cook Medical |

| Figure 5‑16: SWOT Analysis, Medtronic |

| Figure 5‑17: SWOT Analysis, Penumbra |

| Figure 5‑18: SWOT Analysis, Philips |

| Figure 5‑19: SWOT Analysis, Shockwave Medical |

| Figure 5‑20: SWOT Analysis, Silk Road Medical |

| Figure 5‑21: SWOT Analysis, Terumo (1 of 2) |

| Figure 5‑22: SWOT Analysis, Terumo (2 of 2) |

| Figure 5‑23: SWOT Analysis, W.L. Gore |

| Figure 6‑1: Procedure Codes Investigated, U.S., 2022 |

| Figure 6‑2: Peripheral Vascular Procedures by Segment, U.S., 2019 – 2029 (1 of 3) |

| Figure 6‑3: Peripheral Vascular Procedures by Segment, U.S., 2019 – 2029 (2 of 3) |

| Figure 6‑4: Peripheral Vascular Procedures by Segment, U.S., 2019 – 2029 (3 of 3) |

| Figure 6‑5: Above-the-Knee Procedures by Segment, U.S., 2019 – 2029 (1 of 2) |

| Figure 6‑6: Above-the-Knee Procedures by Segment, U.S., 2019 – 2029 (2 of 2) |

| Figure 6‑7: Above-the-Knee Stent Procedures by Device Type, U.S., 2019 – 2029 |

| Figure 6‑8: Above-the-Knee Stent Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑9: Above-the-Knee POBA Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑10: Above-the-Knee DCB Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑11: Intravascular Lithotripsy Procedures, U.S., 2019 – 2029 |

| Figure 6‑12: Above-the-Knee Atherectomy without Stent Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑13: Above-the-Knee Atherectomy with Stent Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑14: Surgical Graft Procedures, U.S., 2019 – 2029 |

| Figure 6‑15: Below-the-Knee Procedures by Intervention Type, U.S., 2019 – 2029 (1 of 2) |

| Figure 6‑16: Below-the-Knee Procedures by Intervention Type, U.S., 2019 – 2029 (2 of 2) |

| Figure 6‑17: Below-the-Knee Stent Procedures by Device Type, U.S., 2019 – 2029 |

| Figure 6‑18: Below-the-Knee Stent Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑19: Below-the-Knee POBA Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑20: Below-the-Knee DCB Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑21: Intravascular Lithotripsy Procedures, U.S., 2019 – 2029 |

| Figure 6‑22: Below-the-Knee Atherectomy without Stent Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑23: Below-the-Knee Atherectomy with Stent Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑24: Surgical Graft Procedures, U.S., 2019 – 2029 |

| Figure 6‑25: Iliac Procedures by Intervention Type, U.S., 2019 – 2029 |

| Figure 6‑26: Iliac Stent Procedures by Device Type, U.S., 2019 – 2029 |

| Figure 6‑27: Iliac Stent Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑28: Iliac POBA Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑29: AV Access Procedures by Intervention Type, U.S., 2019 – 2029 |

| Figure 6‑30: AV Access Covered Stent Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑31: AV Access POBA Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑32: AV Access DCB Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑33: Renal Procedures by Intervention Type, U.S., 2019 – 2029 |

| Figure 6‑34: Carotid Intervention by Procedure Type, U.S., 2019 – 2029 |

| Figure 6‑35: Peripheral Vascular Stent Procedures by Device Type, U.S., 2019 – 2029 |

| Figure 6‑36: Peripheral Arterial Stent Procedures by Stent Type, U.S., 2019 – 2029 |

| Figure 6‑37: Bare-Metal Stent Procedures by Indication, U.S., 2019 – 2029 |

| Figure 6‑38: Bare-Metal Iliac Stent Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑39: Bare-Metal Fem-Popliteal Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑40: Bare-Metal Infra-Popliteal Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑41: Bare-Metal Stent Procedures by Delivery Method, U.S., 2019 – 2029 |

| Figure 6‑42: Covered Stent Procedures by Indication, U.S., 2019 – 2029 |

| Figure 6‑43: Drug-Eluting Stent Procedures by Indication, U.S., 2019 – 2029 |

| Figure 6‑44: Peripheral Venous Stent, U.S., 2019 – 2029 |

| Figure 6‑45: PTA Balloon Catheter Procedures by Segment, U.S., 2019 – 2029 |

| Figure 6‑46: Drug-Coated Balloon Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑47: Drug-Coated Balloon Procedures by Indication, U.S., 2019 – 2029 |

| Figure 6‑48: Atherectomy Procedures by Device Type, U.S., 2019 – 2029 |

| Figure 6‑49: Atherectomy Procedures by Indication, U.S., 2019 – 2029 (1 of 2) |

| Figure 6‑50: Atherectomy Procedures by Indication, U.S., 2019 – 2029 (2 of 2) |

| Figure 6‑51: Fem-Popliteal Artery Atherectomy Procedures by Type, U.S., 2019 – 2029 |

| Figure 6‑52: Infra-Popliteal Artery Atherectomy Procedures by Type, U.S., 2019 – 2029 |

| Figure 6‑53: Atherectomy Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 6‑54: Intravascular Lithotripsy Procedures by Indication, U.S., 2019 – 2029 |

| Figure 6‑55: CTO Device Procedures by Type, U.S., 2019 – 2029 |

| Figure 6‑56: Surgical Graft Procedures by Graft Material, U.S., 2019 – 2029 |

| Figure 6‑57: Surgical Graft Procedures by Indication, U.S., 2019 – 2029 |

| Figure 6‑58: Lower Limb Surgical Graft Procedures by Anatomy, U.S., 2019 – 2029 |

| Figure 6‑59: Aorta Repair Surgical Graft Procedures by Anatomy, U.S., 2019 – 2029 |

| Figure 6‑60: Endovascular Stent Graft Procedures by Type, U.S., 2019 – 2029 |

| Figure 6‑61: EVAR Procedures by Anatomy, U.S., 2019 – 2029 |

| Figure 6‑62: EVAR Procedures by Device Type, U.S., 2019 – 2029 |

| Figure 6‑63: EVAR Procedures by Complexity, U.S., 2019 – 2029 |

| Figure 6‑64: EVAR Procedures by Fenestration, U.S., 2019 – 2029 |

| Figure 6‑65: EVAR Procedures by Anesthesia Type, U.S., 2019 – 2029 |

| Figure 6‑66: EVAR Procedures by Gender, U.S., 2019 – 2029 |

| Figure 6‑67: TEVAR Procedures by Indication, U.S., 2019 – 2029 |

| Figure 6‑68: TEVAR Procedures by Anesthesia Type, U.S., 2019 – 2029 |

| Figure 6‑69: TEVAR Procedures by Gender, U.S., 2019 – 2029 |

| Figure 6‑70: Embolic Protection Procedures by Type, U.S., 2019 – 2029 |

| Figure 6‑71: Peripheral Thrombus Management Procedures by Procedure Type, U.S., 2019 – 2029 |

| Figure 6‑72: Peripheral Thrombus Management Procedures by Indication, U.S., 2019 – 2029 |

| Figure 6‑73: Inferior Vena Cava Filter Procedures by Procedure Type, U.S., 2019 – 2029 |

| Figure 6‑74: IVCF Placement Procedures by Device Type, U.S., 2019 – 2029 |

| Figure 6‑75: Carotid Intervention Procedures by Procedure Type, U.S., 2019 – 2029 |

| Figure 6‑76: Vascular Closure Device Procedures by Device Type, U.S., 2019 – 2029 |

| Figure 6‑77: Invasive Vascular Closure Procedures by Device Size, U.S., 2019 – 2029 |

| Figure 6‑78: Vascular Closure Procedures by Approach, U.S., 2019 – 2029 |

| Figure 6‑79: Transcatheter Embolization Procedures by Device Type, U.S., 2019 – 2029 |

| Figure 6‑80: Transcatheter Particle Embolization Procedures by Device Type, U.S., 2019 – 2029 |

| Figure 6‑81: Transcatheter Coil Embolization Procedures by Device Type, U.S., 2019 – 2029 |

| Figure 6‑82: Peripheral IVUS Procedures by Indication, U.S., 2019 – 2029 |

| Figure 6‑83: Peripheral IVUS Procedures by Care Setting, U.S., 2019 – 2029 |

| Figure 7‑1: Peripheral Vascular Stent Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 7‑2: Peripheral Arterial Stent Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 7‑3: Total Peripheral Arterial Stent Market, U.S., 2019 – 2029 |

| Figure 7‑4: Total Bare-Metal Peripheral Arterial Stent Market, U.S., 2019 – 2029 |

| Figure 7‑5: Bare-Metal Peripheral Arterial Stent Market by Indication, U.S., 2019 – 2029 |

| Figure 7‑6: Bare-Metal Carotid Stent Market, U.S., 2019 – 2029 |

| Figure 7‑7: Bare-Metal Iliac Stent Market, U.S., 2019 – 2029 |

| Figure 7‑8: Bare-Metal Renal Stent Market, U.S., 2019 – 2029 |

| Figure 7‑9: Bare-Metal Fem-Popliteal Stent Market, U.S., 2019 – 2029 |

| Figure 7‑10: Bare-Metal Infra-Popliteal Stent Market, U.S., 2019 – 2029 |

| Figure 7‑11: Bare-Metal Stent Market by Delivery Platform, U.S., 2019 – 2029 |

| Figure 7‑12: Self-Expanding Bare-Metal Stent Market, U.S., 2019 – 2029 |

| Figure 7‑13: Balloon Expanding Bare-Metal Stent Market, U.S., 2019 – 2029 |

| Figure 7‑14: Covered Stent Market by Segment, U.S., 2019 – 2029 |

| Figure 7‑15: Total Covered Stent Market, U.S., 2019 – 2029 |

| Figure 7‑16: Iliac Covered Stent Market, U.S., 2019 – 2029 |

| Figure 7‑17: Fem-Popliteal Covered Stent Market, U.S., 2019 – 2029 |

| Figure 7‑18: AV Access Covered Stent Market, U.S., 2019 – 2029 |

| Figure 7‑19: Drug-Eluting Stent Market by Segment, U.S., 2019 – 2029 |

| Figure 7‑20: Total Drug-Eluting Stent Market, U.S., 2019 – 2029 |

| Figure 7‑21: SFA Drug-Eluting Stent Market, U.S., 2019 – 2029 |

| Figure 7‑22: Infra-Popliteal Drug-Eluting Stent Market, U.S., 2019 – 2029 |

| Figure 7‑23: Venous Stent Market, U.S., 2019 – 2029 |

| Figure 7‑24: Units Sold by Stent Length, Bare-Metal Carotid Stent Market, U.S., 2019 – 2029 |

| Figure 7‑25: Units Sold by Stent Length, Bare-Metal Renal Stent Market, U.S., 2019 – 2029 |

| Figure 7‑26: Units Sold by Stent Length, Bare-Metal Iliac Stent Market, U.S., 2019 – 2029 |

| Figure 7‑27: Units Sold by Stent Length, Bare-Metal Fem-Popliteal Stent Market, U.S., 2019 – 2029 |

| Figure 7‑28: Leading Competitors, Peripheral Vascular Stent Market, U.S., 2022 |

| Figure 7‑29: Leading Competitors, Bare-Metal Arterial Peripheral Vascular Stent Market, U.S., 2022 |

| Figure 7‑30: Leading Competitors, Drug-Eluting Peripheral Vascular Stent Market, U.S., 2022 |

| Figure 8‑1: PTA Balloon Catheter Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 8‑2: Total PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑3: Standard PTA Balloon Catheter Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 8‑4: Total Standard PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑5: Hospital Standard PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑6: Office-Based Lab Standard PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑7: High-Pressure PTA Balloon Catheter Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 8‑8: Total High-Pressure PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑9: Hospital High-Pressure PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑10: Office-Based Lab High-Pressure PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑11: Large PTA Balloon Catheter Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 8‑12: Total Large PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑13: Hospital Large PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑14: Office-Based Lab Large PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑15: Total Small PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑16: 0.014” Small PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑17: 0.018” Small PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑18: Hospital Small PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑19: Office-Based Lab Small PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑20: Specialty PTA Balloon Catheter Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 8‑21: Total Specialty PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑22: Hospital Specialty PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑23: Office-Based Lab Specialty PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑24: Units Sold by Application, PTA Balloon Catheter Market, U.S., 2019 – 2029 |

| Figure 8‑25: Leading Competitors, PTA Balloon Catheter Market, U.S., 2022 |

| Figure 9‑1: Drug-Coated Balloon Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 9‑2: Total Drug-Coated Balloon Market, U.S., 2019 – 2029 |

| Figure 9‑3: SFA DCB Market, U.S., 2019 – 2029 |

| Figure 9‑4: BTK DCB Market, U.S., 2019 – 2029 |

| Figure 9‑5: AV Access DCB Market, U.S., 2019 – 2029 |

| Figure 9‑6: Units Sold by Care Setting, Drug-Coated Balloon Market, U.S., 2019 – 2029 |

| Figure 9‑7: Leading Competitors, Drug-Coated Balloon Market, U.S., 2022 |

| Figure 10‑1: Atherectomy Device Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 10‑2: Total Laser Atherectomy Device Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 10‑3: Laser Atherectomy Disposable Market, U.S., 2019 – 2029 |

| Figure 10‑4: Laser Atherectomy Console Market, U.S., 2019 – 2029 (1 of 2) |

| Figure 10‑5: Laser Atherectomy Console Market, U.S., 2019 – 2029 (2 of 2) |

| Figure 10‑6: Mechanical Atherectomy Disposable Market, U.S., 2019 – 2029 |

| Figure 10‑7: Atherectomy Disposable Market by Care Setting, U.S., 2019 – 2029 (US$M) |

| Figure 10‑8: Hospital Atherectomy Disposable Market, U.S., 2019 – 2029 |

| Figure 10‑9: Office-Based Lab Atherectomy Disposable Market, U.S., 2019 – 2029 |

| Figure 10‑10: Leading Competitors, Atherectomy Device Market, U.S., 2022 |

| Figure 11‑1: Intravascular Lithotripsy Market by Care Setting, U.S., 2019 – 2029 (US$M) |

| Figure 11‑2: Hospital Intravascular Lithotripsy Market, U.S., 2019 – 2029 |

| Figure 11‑3: Office-Based Lab Intravascular Lithotripsy Market, U.S., 2019 – 2029 |

| Figure 11‑4: Leading Competitors, Intravascular Lithotripsy Market, U.S., 2022 |

| Figure 12‑1: CTO Device Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 12‑2: Total CTO Device Market, U.S., 2019 – 2029 |

| Figure 12‑3: Re-Entry Device Market, U.S., 2019 – 2029 |

| Figure 12‑4: Re-Canalization Device Market, U.S., 2019 – 2029 |

| Figure 12‑5: Leading Competitors, CTO Device Market, U.S., 2022 |

| Figure 13‑1: Surgical Graft Market by Indication, U.S., 2019 – 2029 (US$M) |

| Figure 13‑2: Surgical Graft Market by Material, U.S., 2019 – 2029 (US$M) |

| Figure 13‑3: Total Surgical Graft Market, U.S., 2019 – 2029 |

| Figure 13‑4: Lower Limb Surgical Graft Market, U.S., 2019 – 2029 (US$M) |

| Figure 13‑5: Total Lower Limb Surgical Graft Market, U.S., 2019 – 2029 |

| Figure 13‑6: Above-the-Knee Surgical Graft Market, U.S., 2019 – 2029 |

| Figure 13‑7: Below-the-Knee Surgical Graft Market, U.S., 2019 – 2029 |

| Figure 13‑8: Aorta Repair Surgical Graft Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 13‑9: Total Aorta Repair Surgical Graft Market, U.S., 2019 – 2029 |

| Figure 13‑10: Abdominal Aortic Aneurysm Surgical Graft Market, U.S., 2019 – 2029 |

| Figure 13‑11: Thoracic Aortic Aneurysm Surgical Graft Market, U.S., 2019 – 2029 |

| Figure 13‑12: Extra-Anatomical Bypass Surgical Graft Market, U.S., 2019 – 2029 |

| Figure 13‑13: Polyester Surgical Graft Market, U.S., 2019 – 2029 |

| Figure 13‑14: ePTFE Surgical Graft Market, U.S., 2019 – 2029 |

| Figure 13‑15: Leading Competitors, Surgical Graft Market, U.S., 2022 |

| Figure 14‑1: Stent Graft Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 14‑2: Total Stent Graft Market, U.S., 2019 – 2029 |

| Figure 14‑3: AAA Stent Graft Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 14‑4: Total AAA Stent Graft Market, U.S., 2019 – 2029 |

| Figure 14‑5: Bifurcated Main Body Graft Market, U.S., 2019 – 2029 |

| Figure 14‑6: Contralateral/Ipsilateral Iliac Leg/Limb Market, U.S., 2019 – 2029 |

| Figure 14‑7: Aorto-uni-iliac (AUI) Stent Graft Market, U.S., 2019 – 2029 |

| Figure 14‑8: Iliac Extension Market, U.S., 2019 – 2029 |

| Figure 14‑9: Aortic Extension Market, U.S., 2019 – 2029 |

| Figure 14‑10: FAA Stent Graft Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 14‑11: Total FAA Stent Graft Market, U.S., 2019 – 2029 |

| Figure 14‑12: Fenestrated Distal Bifurcated Graft Market, U.S., 2019 – 2029 |

| Figure 14‑13: Fenestrated Proximal Body Graft Market, U.S., 2019 – 2029 |

| Figure 14‑14: TAA Stent Graft Market, U.S., 2019 – 2029 |

| Figure 14‑15: Leading Competitors, Stent Graft Market, U.S., 2022 |

| Figure 14‑16: Leading Competitors, AAA Stent Graft Market, U.S., 2022 |

| Figure 15‑1: Embolic Protection Device Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 15‑2: Total Embolic Protection Device Market, U.S., 2019 – 2029 |

| Figure 15‑3: Carotid EPD Market, U.S., 2019 – 2029 |

| Figure 15‑4: Alternative EPD Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 15‑5: Total Alternative EPD Market, U.S., 2019 – 2029 |

| Figure 15‑6: Renal EPD Market, U.S., 2019 – 2029 |

| Figure 15‑7: Lower Limb EPD Market, U.S., 2019 – 2029 |

| Figure 15‑8: Leading Competitors, Embolic Protection Device Market, U.S., 2022 |

| Figure 16‑1: Peripheral Thrombus Management Market Overview by Device Type, U.S., 2019 – 2029 (US$M) |

| Figure 16‑2: Peripheral Thrombus Management Market Overview by Indication, U.S., 2019 – 2029 (US$M) |

| Figure 16‑3: Total Peripheral Thrombus Management Market, U.S., 2019 – 2029 |

| Figure 16‑4: Traditional Thrombectomy Market, U.S., 2019 – 2029 |

| Figure 16‑5: Pharmacomechanical Thrombectomy Market, U.S., 2019 – 2029 |

| Figure 16‑6: Catheter Directed Thrombolysis Market, U.S., 2019 – 2029 |

| Figure 16‑7: AV Access Thrombectomy Device Market, U.S., 2019 – 2029 |

| Figure 16‑8: Arterial Thrombectomy Device Market, U.S., 2019 – 2029 |

| Figure 16‑9: Venous Thrombectomy Device Market, U.S., 2019 – 2029 |

| Figure 16‑10: Leading Competitors, Peripheral Thrombus Management Market, U.S., 2022 |

| Figure 17‑1: Inferior Vena Cava Filter & Retrieval Device Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 17‑2: Retrievable IVCF Market, U.S., 2019 – 2029 |

| Figure 17‑3: Permanent IVCF Market, U.S., 2019 – 2029 |

| Figure 17‑4: IVCF Retrieval Device Market, U.S., 2019 – 2029 |

| Figure 17‑5: Leading Competitors, Inferior Vena Cava Filter & Retrieval Device Market, U.S., 2022 |

| Figure 18‑1: Carotid Shunt Market, U.S., 2019 – 2029 |

| Figure 18‑2: Leading Competitors, Carotid Shunt Market, U.S., 2022 |

| Figure 19‑1: Transcarotid Artery Revascularization Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 19‑2: Transcarotid Bare-Metal Stent Market, U.S., 2019 – 2029 |

| Figure 19‑3: TCAR Neuroprotection System Market, U.S., 2019 – 2029 |

| Figure 19‑4: Leading Competitors, Transcarotid Artery Revascularization Market, U.S., 2022 |

| Figure 20‑1: Diagnostic & Interventional Catheter Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 20‑2: Total Diagnostic & Interventional Catheter Market, U.S., 2019 – 2029 |

| Figure 20‑3: Diagnostic Catheter Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 20‑4: Total Diagnostic Catheter Market, U.S., 2019 – 2029 |

| Figure 20‑5: Standard Diagnostic Catheter Market, U.S., 2019 – 2029 |

| Figure 20‑6: Hydrophilic Diagnostic Catheter Market, U.S., 2019 – 2029 |

| Figure 20‑7: Support Catheter Market, U.S., 2019 – 2029 |

| Figure 20‑8: Leading Competitors, Diagnostic & Interventional Catheter Market, U.S., 2022 |

| Figure 21‑1: Diagnostic & Interventional Guidewire Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 21‑2: Total Diagnostic & Interventional Guidewire Market, U.S., 2019 – 2029 |

| Figure 21‑3: Standard Guidewire Market, U.S., 2019 – 2029 |

| Figure 21‑4: Hydrophilic Guidewire Market, U.S., 2019 – 2029 |

| Figure 21‑5: Leading Competitors, Diagnostic & Interventional Guidewire Market, U.S., 2022 |

| Figure 22‑1: Introducer Sheath Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 22‑2: Total Introducer Sheath Market, U.S., 2019 – 2029 |

| Figure 22‑3: Standard Introducer Sheath Market, U.S., 2019 – 2029 |

| Figure 22‑4: Guiding Introducer Sheath Market, U.S., 2019 – 2029 |

| Figure 22‑5: Leading Competitors, Introducer Sheath Market, U.S., 2022 |

| Figure 23‑1: Vascular Closure Device Market by Device Type, U.S., 2019 – 2029 (US$M) |

| Figure 23‑2: Vascular Closure Device Market by Approach, U.S., 2019 – 2029 (US$M) |

| Figure 23‑3: Total Vascular Closure Device Market, U.S., 2019 – 2029 |

| Figure 23‑4: Non-Invasive VCD Market, U.S., 2019 – 2029 |

| Figure 23‑5: Invasive Vascular Closure Device Market by Application, U.S., 2019 – 2029 (US$M) |

| Figure 23‑6: Total Invasive Vascular Closure Device Market, U.S., 2019 – 2029 |

| Figure 23‑7: Small-Bore Invasive VCD Market, U.S., 2019 – 2029 |

| Figure 23‑8: Large-Bore Invasive VCD Market, U.S., 2019 – 2029 |

| Figure 23‑9: Radial VCD Market, U.S., 2019 – 2029 |

| Figure 23‑10: Femoral VCD Market, U.S., 2019 – 2029 |

| Figure 23‑11: Leading Competitors by Device Type, Vascular Closure Device Market, U.S., 2022 |

| Figure 23‑12: Leading Competitors, Invasive Vascular Closure Device Market, U.S., 2022 |

| Figure 23‑13: Leading Competitors by Approach, Vascular Closure Device Market, U.S., 2022 |

| Figure 24‑1: Transcatheter Embolization Device Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 24‑2: Total Transcatheter Embolization Device Market, U.S., 2019 – 2029 |

| Figure 24‑3: Embolization Particle Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 24‑4: Total Embolization Particle Market, U.S., 2019 – 2029 |

| Figure 24‑5: PVA Embolization Particle Market, U.S., 2019 – 2029 |

| Figure 24‑6: Microsphere Embolization Particle Market, U.S., 2019 – 2029 |

| Figure 24‑7: Drug-Eluting Embolization Particle Market, U.S., 2019 – 2029 |

| Figure 24‑8: Radioactive Embolization Particle Market, U.S., 2019 – 2029 |

| Figure 24‑9: Embolization Coil Market by Segment, U.S., 2019 – 2029 (US$M) |

| Figure 24‑10: Total Embolization Coil Market, U.S., 2019 – 2029 |

| Figure 24‑11: Pushable Coil Market, U.S., 2019 – 2029 |

| Figure 24‑12: Detachable Coil Market, U.S., 2019 – 2029 |

| Figure 24‑13: Embolization Liquid Market, U.S., 2019 – 2029 |

| Figure 24‑14: Embolization Plug Market, U.S., 2019 – 2029 |

| Figure 24‑15: Leading Competitors, Transcatheter Embolization Device Market, U.S., 2022 |

| Figure 24‑16: Leading Competitors, Embolization Particle Market, U.S., 2022 |

| Figure 24‑17: Leading Competitors, Embolization Coil Market, U.S., 2022 |

| Figure 25‑1: Peripheral IVUS Catheter Market, U.S., 2019 – 2029 |

| Figure 25‑2: Leading Competitors, Peripheral IVUS Catheter Market, U.S., 2022 |

One of the greatest limitations in this market is the pricing pressure that is occurring within the office-based lab (OBL) setting. Although these clinics have led to a significant increase in efficiency, reducing the average time for patients to be within a hospital, these settings are also incredibly price sensitive. It is typical that there is a 30% discount on devices sold to an OBL, relative to a hospital. As more OBLs continue to be developed, and more procedures continue to be shifted towards this setting, pricing pressure is expected on PTA balloons, stents, atherectomy devices and associated products for performing routine procedures.

One of the greatest limitations in this market is the pricing pressure that is occurring within the office-based lab (OBL) setting. Although these clinics have led to a significant increase in efficiency, reducing the average time for patients to be within a hospital, these settings are also incredibly price sensitive. It is typical that there is a 30% discount on devices sold to an OBL, relative to a hospital. As more OBLs continue to be developed, and more procedures continue to be shifted towards this setting, pricing pressure is expected on PTA balloons, stents, atherectomy devices and associated products for performing routine procedures. Medtronic was the leading competitor in the total peripheral vascular devices market in 2022. The company derives the majority of its revenue from its strong showing in the high value stent graft, DCB and atherectomy market segments. Medtronic led the U.S. DCB market in 2022. The addition of a DCB to Medtronic’s portfolio has buoyed the company’s share of adjacent market segments, including bare-metal stents, standard PTA balloons and more. The company’s broad market share has also afforded it tremendous competitive success within the OBL setting. Medtronic’s atherectomy portfolio especially has generated significant growth for the company within this setting, and is the second-largest revenue generator, overtaking the stent market.

Medtronic was the leading competitor in the total peripheral vascular devices market in 2022. The company derives the majority of its revenue from its strong showing in the high value stent graft, DCB and atherectomy market segments. Medtronic led the U.S. DCB market in 2022. The addition of a DCB to Medtronic’s portfolio has buoyed the company’s share of adjacent market segments, including bare-metal stents, standard PTA balloons and more. The company’s broad market share has also afforded it tremendous competitive success within the OBL setting. Medtronic’s atherectomy portfolio especially has generated significant growth for the company within this setting, and is the second-largest revenue generator, overtaking the stent market.