Product Description

Industry Trends

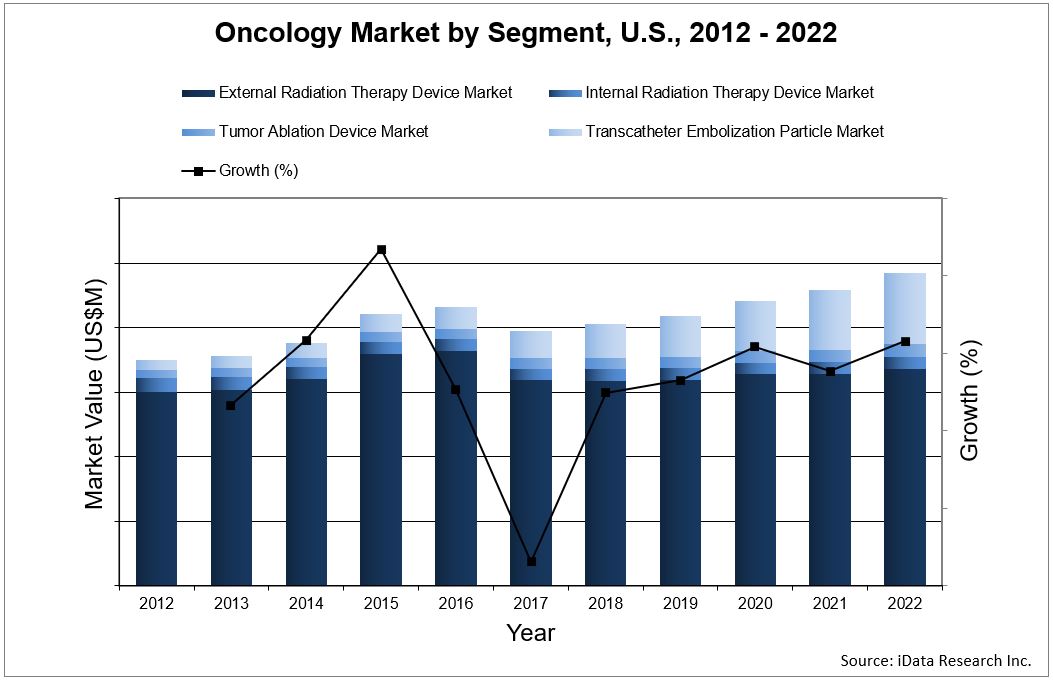

The oncology market encompasses many different types of methodical approaches to the treatment of cancer. As the cancer epidemic continues to flourish in the U.S., so too do a vast variety of treatment options all designed to increase patient survival, comfort and affordability. Despite multiple challenges such as declining ASPs and expensive capital investment, growth is expected for the overall market as the patient demographics in the U.S. maintain a steady demand for cancer treatments. The transcatheter embolization particle segment will be the fastest growing in the market, and will be continually driven by novel and emerging technologies. Similarly, the tumor ablation device segment is expected to exhibit market growth due to an ongoing shift towards newer and more expensive modalities.

Although declining in value, the external and internal radiation therapy device segments will be experiencing rising procedure volumes. Market decline in the external radiation therapy segment will be driven by fluctuations in the number of new system installations on an annual basis. Meanwhile, the market decline in the internal radiation therapy segment will be primarily driven by falling prices.

Competition amongst the different modalities will continue to limit the market. Many of the product segments discussed and analyzed as part of the interventional oncology device market can be considered direct substitutes or alternatives to another. As such, growth in procedural volumes for one area often leads to cannibalization of another.

This report also includes an analysis of other factors and trends that have positively and negatively impacted the market.

The Only Medical Device Market Research With: |

||||

|---|---|---|---|---|

| ✔ Procedure Volume Data & Trends ✔ Unit Sales Growth Analysis ✔ Average Selling Prices ✔ Competitor Shares by Segment & Country ✔ SKU-Level Research Methods ✔ The Lowest Acquisition Cost |

||||

Highly Detailed Segmentation

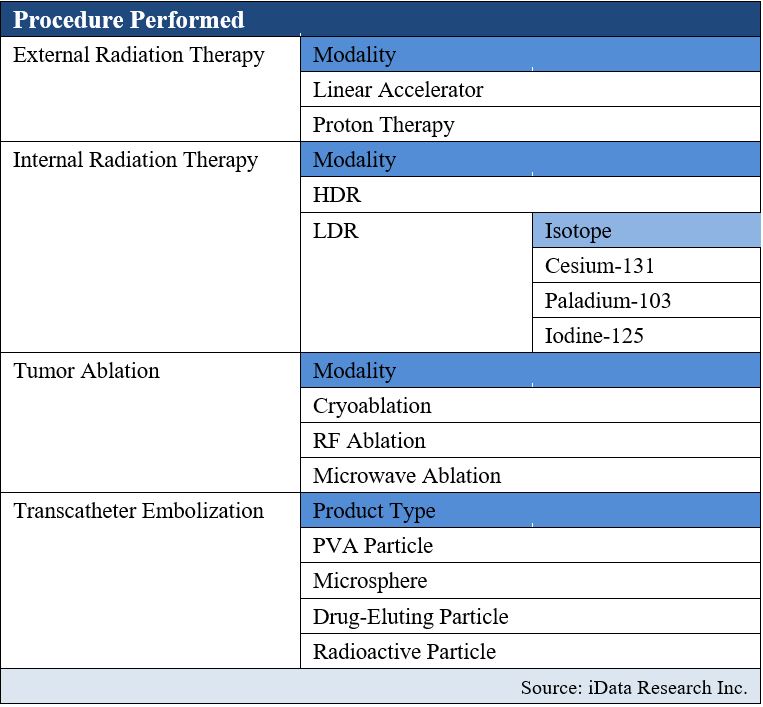

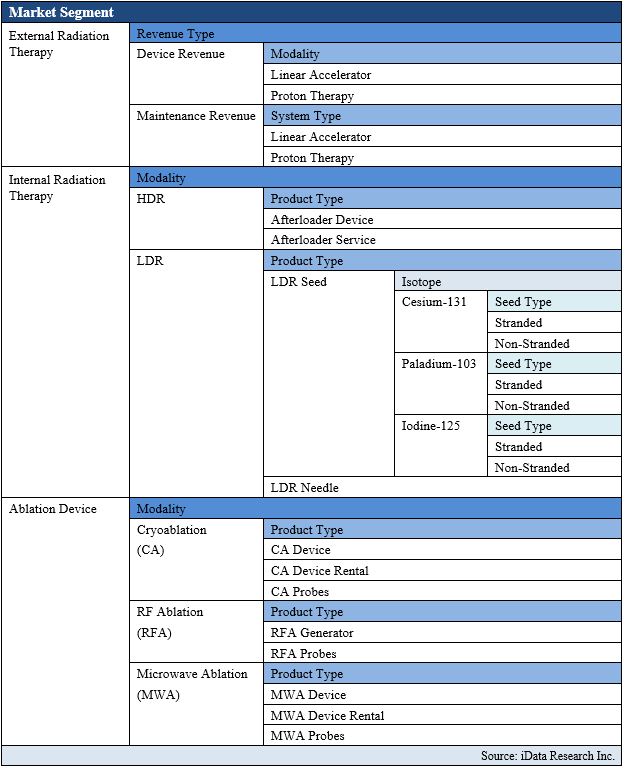

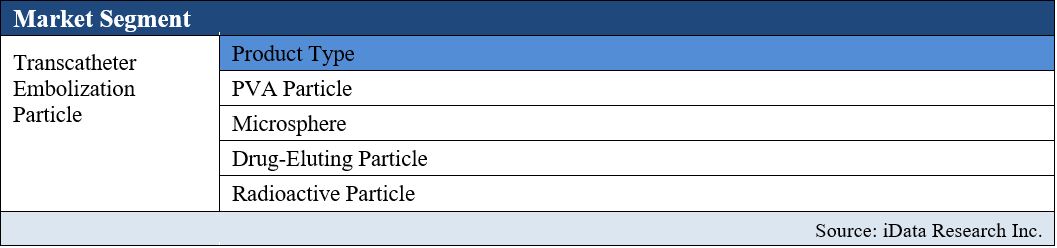

While this report suite contains all applicable United States oncology market data, each of the market segments are also available as stand alone MedCore reports. This allows you to get access to only the oncology market research that you need. You can view all these included reports and segmentation here:

- Procedure Numbers for Oncology – MedPro

- External Radiation Therapy Market – MedCore

- Internal Radiation Therapy Market – MedCore

- Tumor Ablation Device Market – MedCore

- Transcatheter Embolization Particle Market – MedCore

Buying all of these reports together in this suite package will provide you with substantial discounts from the separate prices. Request Pricing to Learn More

Full Segmentation Map for the United States

Data Types Included

-

- Unit Sales, Average Selling Prices, Market Value & Growth Trends

- Procedure Volume Analysis and Trends

- 10 Year Scope and Forecast Range

- Market Drivers & Limiters for Each Segment

- Competitive Analysis with Market Shares for Each Segment

- Recent Mergers & Acquisitions

- Disease Overviews and Demographic Information

- Company Profiles, Product Portfolios and SWOT for Top Competitors

Oncology Market Share Insights

Varian leads the overall oncology market. This is primarily due to the company’s commanding position in the external radiation therapy device segment, which accounts for a large majority of the overall market. In addition to the external radiation therapy device segment, the company is also a leading player in the internal radiation therapy device market.

Elekta holds the second-leading position in the overall oncology market. This is primarily due to the company’s large share of the external radiation therapy device segment, which accounts for a large majority of the overall market. In addition, the company also holds the commanding position in the internal radiation therapy device segment. Similar to Varian, Elekta has a strong global presence in the overall radiation therapy market space.

All Companies Analyzed in this Study |

||||

|---|---|---|---|---|

|

|

|||

Oncology Statistics and Procedure Trends

This report investigates the number of interventional oncology procedures performed via the following treatment types: external radiation therapy, internal radiation therapy, tumor ablation and transcatheter embolization particles. These treatments type are further broken down by modality or product type. Despite rapid growth in cancer incidence rates and potential patient base, growth in procedural volumes will remain low throughout the forecast period. This will primarily be due to the availability of alternative treatments and limitations in the number of patients who can be treated.

It is estimated that over 20 million oncology procedures are performed annually in the United States. External radiation therapy procedures make up the vast majority of the total market procedures.