Product Description

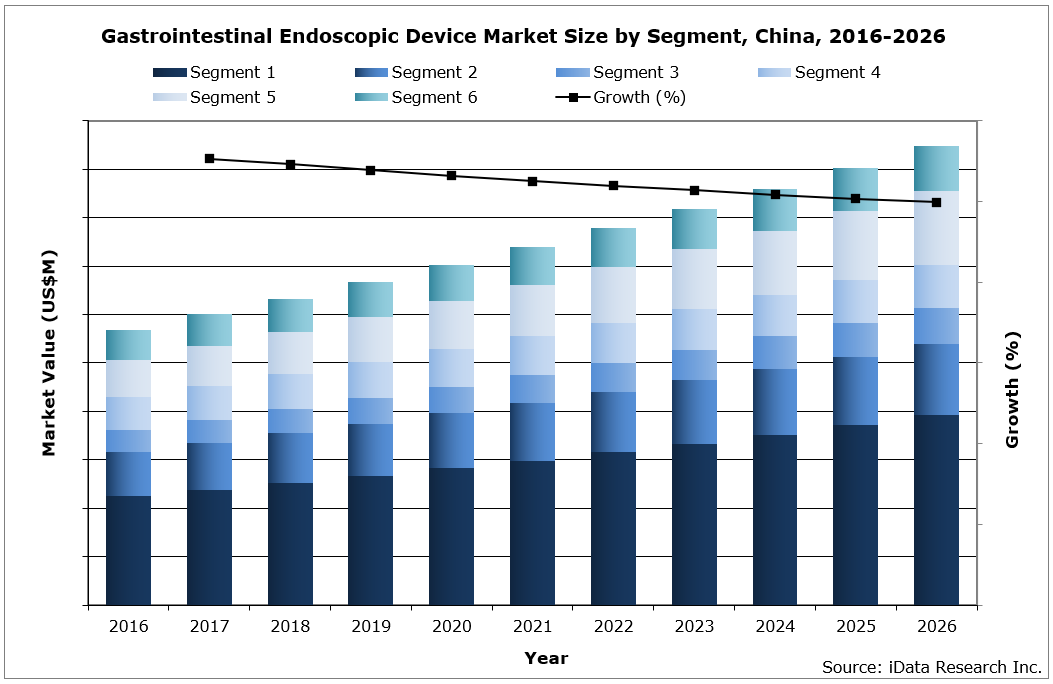

In 2020, the Chinese gastrointestinal endoscopic device market size was valued at approximately $1.3 billion, with over 12.5 million colonoscopy procedures performed every year. The market value is expected to increase at a compound annual growth rate (CAGR) of 5.1% to approach $1.9 billion in 2026.

Throughout this medical market research, we analyzed 43 endoscopic device companies across China and used our comprehensive methodology to understand the market sizes, unit sales, company market shares, and to create accurate forecasts.

While this MedSuite report contains all the Chinese Gastrointestinal Endoscopic Devices market data and analysis, each of the market segments is also available as stand-alone MedCore reports. This allows you to get access to only the market research that you need.

DATA TYPES INCLUDED

- Unit Sales, Average Selling Prices, Market Value & Growth Trends

- Forecasts Until 2026, and Historical Data to 2016

- Market Drivers & Limiters for Each Gastrointestinal Endoscopic Device market

- Competitive Analysis with Market Shares for Each Segment

- Recent Mergers & Acquisitions

- Gastrointestinal Endoscopy Procedure Volumes

- Disease Overviews and Demographic Information

- Company Profiles, Product Portfolios and SWOT for Top Competitors

- Related Press Releases from Top Competitors

Market Value and Industry Trends

The growth of the Chinese gastrointestinal endoscopic device market will likely be limited by the prevalence of government hospitals. Since government hospitals dominate the GI treatment space, their purchasing decisions have large impact on ASPs. Government hospitals tend to buy in bulk, which is often associated with discounted deals, depressing ASPs in the GI space. On top of that, the government has started purchasing GI devices from local manufacturers, rather than premium, international companies.

As endoscopy represents a major segment of the Chinese market, technological improvements to these devices will propel the growth of the total GI market moving forward. The HD format, and now HD+, along with advanced magnification capabilities, which penetrated the GI endoscope market only recently, resulted in a greater detection rate for polyps.

Unlike the system in the United States, Chinese government hospitals operate on a rebate system. After purchasing a GI device, a hospital may then receive a discount through a partial reimbursement strategy. The percentage of this discount varies according to the hospital, product purchased, size of the order, and the manufacturer involved.

Competitive Analysis

By 2020, Olympus was the leading competitor in the GI endoscopic device market and held market positions across all segments of the market. The company has an extensive network of distributors and a far-reaching sales force. Olympus is known for the high quality of its products and the technological innovation that it introduces to the market.

By 2020, Olympus was the leading competitor in the GI endoscopic device market and held market positions across all segments of the market. The company has an extensive network of distributors and a far-reaching sales force. Olympus is known for the high quality of its products and the technological innovation that it introduces to the market.

Boston Scientific was the second leading competitor in the Chinese market. The company has experienced significant growth in the biliary and pancreatic stent market since launching the AXIOS™ lumen-apposing covered-metal stent in 2016. The lumen-apposing covered-metal stent market is one of the latest innovations in the ERCP space, indicated for transgastric or transduodenal endoscopic drainage of symptomatic pancreatic pseudocysts and walled-off necrosis under EUS imaging guidance.

The third-leading competitor in the Chinese gastrointestinal endoscopic device market was Mirco-Tech. The company’s strong position in the market is attributed mainly to its leading position in the hemostasis device market, and specifically, its dominance in the ligation clip market. The company represented more than half of the revenue generated by ligation clips in China.

Segments Covered

Feel free to click on each title to view detailed segmentation.

- Gastrointestinal Endoscopy Procedure Volumes – MedPro – The in-depth analysis of gastrointestinal endoscopy procedures performed in China, including Gastrointestinal Endoscopy, Endoscopic Retrograde Cholangiopancreatography, Stenting & Dilation, Tissue Sampling, and Hemostasis procedures.

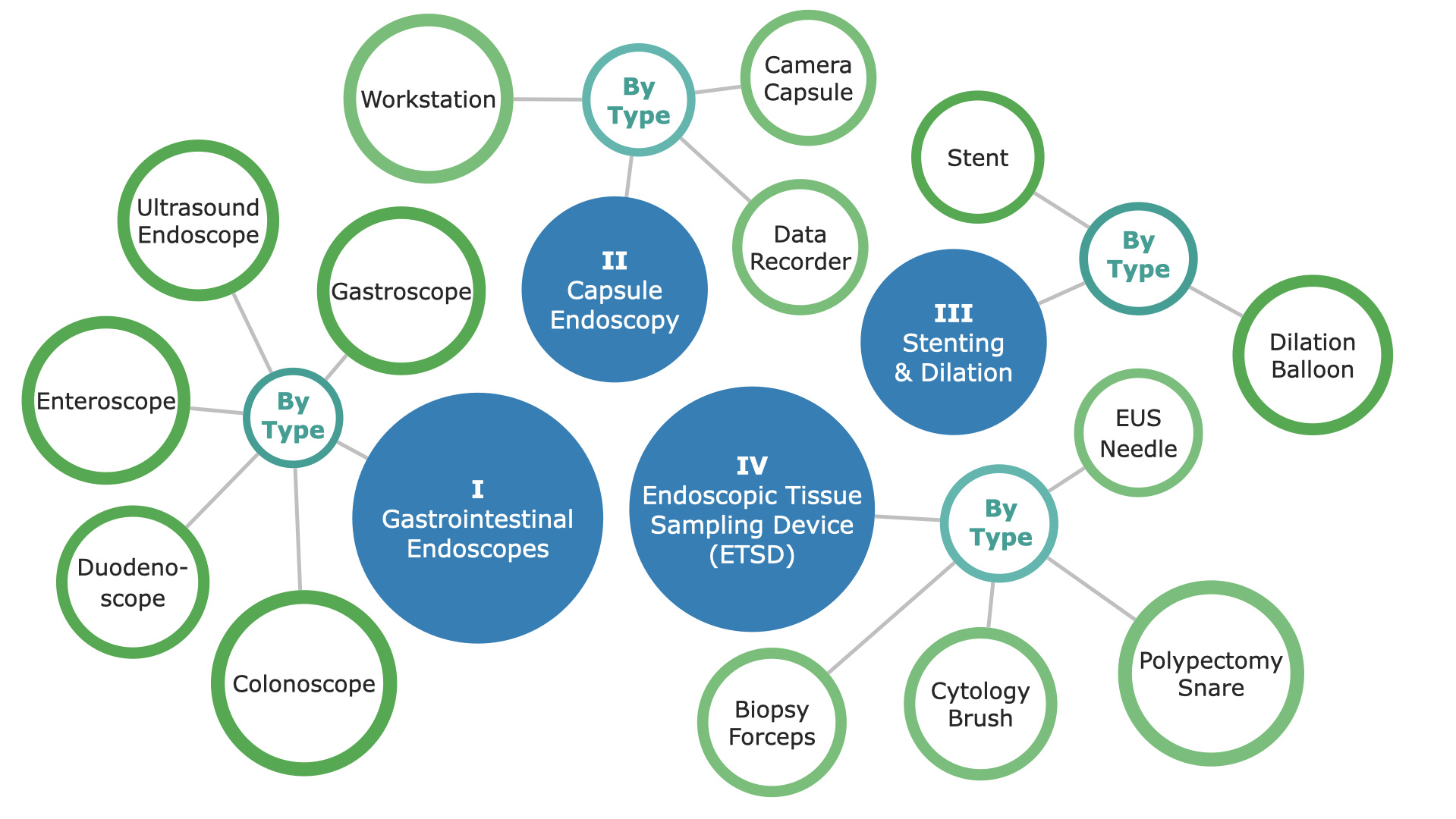

- Gastrointestinal Endoscope Market – MedCore – The market is further broken down by Device Type into the Colonoscope, Duodenoscope, Enteroscope, Ultrasound Endoscope, and Gastroscope markets.

- Capsule Endoscopy Market – MedCore – The market is also further segmented into the Camera Capsule, Workstation, and Data Recorder markets.

- Stenting & Dilation Market – MedCore – The market consists of the segments for Stents and Dilation Balloons.

- Endoscopic Retrograde Cholangiopancreatography (ERCP) Market – MedCore – The market further broken down by Device Type into the Sphincterotome, Biliary Stone Removal Balloon, Biliary Stone Removal Basket, Biliary Dilation Balloon, Biliary Lithotripter, ERCP Guidewire, and ERCP Cannula markets.

- Endoscopic Tissue Sampling Device (ETSD) Market – MedCore – The market consists of the segments, such as Biopsy Forceps, Cytology Brush, Polypectomy Snare, and EUS Needle market segments.

- Hemostasis Device Market – MedCore – The market is broken down into segments by Device Type, such as Hemostasis Probe, Ligation Device, and Sclerotherapy Needle markets.

DETAILED MARKET SEGMENTATION

DON’T SEE THE SEGMENT OR DATA YOU NEED?

Feel free to contact us or send a request by pressing one of the buttons below.